Market scorecard

US stocks dipped just before the close on Monday, giving back some of Friday's Jackson Hole-inspired gains. Futures are now pricing in an 85% chance of a Fed rate cut next month, up from 73% before Powell's remarks. We shall see what happens. Amongst our favourite stocks, Nvidia, Google, and Tesla moved higher. Eli Lilly went backwards.

In company news, Elon Musk has filed a lawsuit against Apple and OpenAI, claiming they are giving unfair preference to OpenAI's chatbot on iPhones and squeezing out rivals. Meanwhile, Keurig Dr Pepper is buying JDE Peet's, the owner of Peet's Coffee, in an $18 billion deal, with plans to later spin off its coffee business into a standalone listed company. Finally, railroad operators sank after Warren Buffett said Berkshire Hathaway won't buy another one.

At the close, the JSE All-share was 0.25% higher, the S&P 500 dropped by 0.43%, and the Nasdaq sagged by 0.22%. Just another day.

Our 10c worth

One thing, from Paul

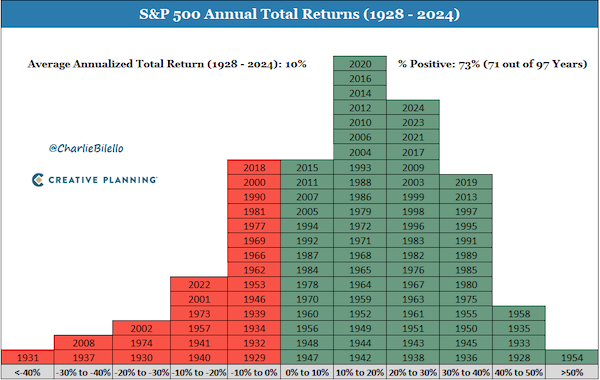

Here's an interesting observation about US equity market returns, and a nice graphic, from Byron's favourite chart maker, Charlie Bilello.

The US stock market's average total return is around 10% per year, but it comes in lumpy, unpredictable bursts.

Charlie notes that over the last 97 years, returns were within 2% of that 10% average just 4 times. It's a bit of a random walk, from year to year.

You have to be invested for a good amount of time, say a decade at least, to be fairly sure of getting the average return. Then you'll end up with positive, compounding gains.

If you are unlucky and invest just before a bad patch, just stay calm and carry on.

Bright's banter

The defining sound of summer 2025 isn't Taylor Swift, isn't Drake, and isn't even a song. It's a cheery British voice declaring, over a decade-old pop track: "Nothing beats a Jet2 holiday."

That single line, lifted from a TV advert by a package holiday operator few Americans had ever heard of, has taken on a life of its own. On TikTok, more than 2.2 million videos now use the clip - mostly with a dose of irony. Think grainy hotel balconies with "sea views" that point directly onto a car park, or fishing trips that end with more injuries than Instagram likes.

As the meme spread, Americans started asking: what on earth is Jet2? Google searches for the airline spiked more than five-fold in the US this summer. Celebrities piled in, and even the White House managed to stir controversy by leaning into the joke. Suddenly, Jet2 was no longer just a discount regional airline; it was an internet buzzword.

But is going viral actually good for business? For Jet2, it seems the answer (so far) is yes. The company is already the UK's third-largest airline, flying nearly 20 million passengers last year, an 11% increase, and generating GBP7.2 billion in revenue, up 15% year-on-year. Investors have noticed too: the stock popped in April after Jet2 reaffirmed guidance, announced a GBP250 million buyback, and cleverly launched the #Jet2Challenge on TikTok, offering cash prizes for the best meme entries.

The viral spotlight may fade as quickly as it arrived, but Jet2 has shown that when the internet hands you a cultural moment, leaning in can turn a joke at your expense into a surprisingly effective form of marketing.

Linkfest, lap it up

AI can do some weird things. If you try hard enough, you can conjure up almost anything - Life with chatbots will certainly be different.

The pursuit of protein explains a lot of human history. JM Coetzee argued in 1995 that it's eccentric not to eat meat- Carnivore country.

Signing off

Asian equities are mostly in the red this morning, tracking Wall Street's weak lead. Benchmarks slipped across the region, with losses seen in Australia, China, Hong Kong, India, Japan, Singapore, South Korea, Malaysia, Taiwan, and Indonesia.

In local company news, Italtile jumped 6% after posting results that were better than feared: turnover slipped 2% but headline earnings per share still rose 2%, helped by cost discipline and stronger performance in East Africa. A special dividend sweetened the release.

US equity futures are marginally lower pre-market, but it's still early. The Rand is trading at around R17.60 to the US Dollar, which is no great shakes.

Yesterday we said that Nvidia's earnings report will be out on Thursday evening, but that was incorrect. They will be out on Wednesday, after the closing bell. CrowdStrike will also report that evening. Now you know.

Adios amigos.