Market scorecard

US equities edged lower again yesterday as traders stayed cautious ahead of Fed Chair Jerome Powell's speech at Jackson Hole. The S&P 500 notched its fifth straight decline, which sounds rough, but it has actually only lost 1.5% over that stretch. Markets will be watching closely today for any policy cues that could reignite momentum.

In company news, Walmart fell 4.5% after the retail giant missed profit expectations. Elsewhere, Boeing shares found support on reports that the company is moving closer to sealing a deal with China for up to 500 aircraft. Lastly, US car safety regulators are investigating Tesla over delays in reporting crashes tied to its driver-assistance technology.

At the closing bell, the JSE All-share closed up 0.69%, the S&P 500 fell 0.40%, and the Nasdaq was 0.34% lower.

Our 10c worth

One thing, from Paul

Ian Leslie (pictured here) is a British writer best known for his book about the Beatles, called "John & Paul: A Love Story in Songs".

I liked this quote from him about staying fit.

"All our biological processes, healing wounds, fighting infection, repairing cellular damage, maintaining homeostasis, are essentially the body attempting to beat the system. I sometimes hear people criticise fitness fanatics by saying they're trying to deny mortality. Well, no shit, that's the whole game. We're cheating entropy from the moment we're born. Every organism, including the one which is you, is a revolt, an organised rebellion, against the universe's fundamental drive towards disorder. When you're up against an enemy this implacable, I say it's OK to cheat. In fact it's heroic. The universe wants us to be dust and will eventually get the job done. Staying vital for as long as we can is a magnificently perverse act of resistance."

Byron's beats

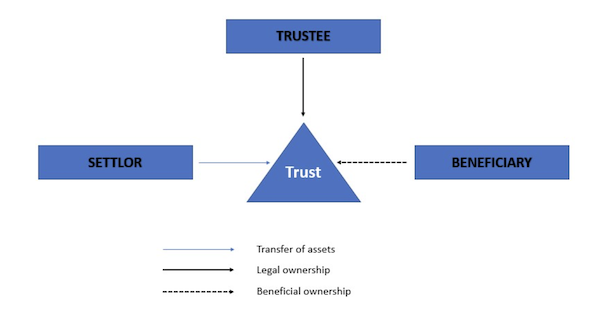

We often get asked by clients if they should invest within an offshore trust structure. The benefits of an offshore trust based in a tax haven is that they are usually exempt from capital gains tax and estate duties. The downside is that they are admin-intensive and costly.

I ran some maths the other day on ChatGPT to see at what value, an offshore trust makes sense. Let's say you have the trust for a period of 10 years. The annual cost is $7000, which is pretty standard. The structure has therefore cost you $70 000 over 10 years.

For the trust to make sense, it should have saved you at least that amount in taxes. Assuming you are in the top income bracket, 18% of your capital gains are taxed. This means you would have required a gain of $390 000 in your portfolio to break even.

Working backwards, in order to have capital gains of $400k after 10 years, taking into account the trust fees and the management fees, and you achieve a 10% per annum return, you will need to start with at least $370 000. And that is just to cover costs.

Our general advice is to start considering an offshore trust if you have $700k or more.

Bright's banter

Alphabet remains a compelling investment because it continues to dominate digital advertising, search, and AI, while expanding into high-growth areas such as cloud computing. Despite regulatory challenges, Google's core business remains incredibly strong, with Search processing over 8.5 billion queries daily and YouTube's ad revenue on track to exceed $10 billion annually.

Even with increasing pressure from retail media and Apple's growing ad business, Google still controls more than 50% of US search ad spending and accounts for nearly 28% of global digital ad revenue. This is an incredible money machine!

Businesses within the Alphabet stable, such as Gemini and Cloud, are a sideshow for now. While Alphabet faces ongoing antitrust scrutiny, its recent decision to abandon the phase out of third-party cookies in Chrome, ensures its ad business remains intact. The company is also taking a pragmatic approach by settling lawsuits rather than risking prolonged legal battles.

Overall, Alphabet's ability to leverage AI, expand cloud services, and maintain its dominance in digital advertising makes it a resilient long-term investment, despite regulatory headwinds.

Linkfest, lap it up

Taylor Swift went podcasting last week. The video has over 20 million views and counting - Swift breaks YouTube's concurrent viewership record.

We like billionaires here. It's always interesting to see where they're from - Richest person by country.

Signing off

Asian equities are trading mostly higher this morning. In Japan, core CPI rose 3.1% year-on-year in July, easing slightly from June's 3.3%, but still above expectations of 3% and the Bank of Japan's 2% target. The print has revived speculation of a rate hike later this year, though the local market is trading in positive territory regardless.

In local company news, Exxaro rallied 7.9% after reporting half-year results. Revenue climbed 8% year-on-year to R20.6 billion, while profit rose 11% to R4.1 billion, supported by stronger local and export sales.

US equity futures are unchanged pre-market. The Rand is trading at around R17.72 to the US Dollar.

TGIF! Enjoy the weekend and hopefully a Bokke revival.