Market scorecard

US stocks slipped on Monday, ahead of a key monthly inflation report. Tariff mania continued, with gold declining after Trump saying out of the blue that there would be no levies on that metal. Later in the day, he backed off on taxes on goods imported from China by offering another 90-day reprieve.

In company news, Trump (who else?) signalled he's open to letting Nvidia sell a toned-down version of Blackwell chips, its most advanced, to China. Both Nvidia and AMD have also agreed to fork over 15% of their Chinese AI chip sales revenue to the US government. This is bizarre, as export taxes are prohibited by the US Constitution. Elsewhere, Intel shares jumped 4% after its CEO visited the White House, days after the President publicly criticised his China links and urged his removal.

At the close, the JSE All-share closed down 0.22%, the S&P 500 fell 0.25%, and the Nasdaq was 0.30% lower.

Our 10c worth

Bright's banter

Amgen just reported its second-quarter results, and they were strong. Revenue for the quarter came in at $9.2 billion, up 9% year-on-year. Adjusted earnings showed a healthy 21% jump. That beat expectations and points to a business still firing, even as some legacy brands begin to fade into the background. Volumes were up 13% across the board.

We own this stock because it has a range of biotech drugs, and there's no shortage of standout performers in their brand portfolio. Repatha grew 31% to $696 million, in line with increasing cardiovascular awareness globally. Evenity came in hot with $518 million (+32%), as more physicians get comfortable with it as a front-line bone therapy.

Tezspire is a newer entrant in the asthma space, its sales surged 46% to $342 million. Then there's Imdelltra, Amgen's lung cancer therapy, up a remarkable 65% from the first quarter to $134 million, showing serious early traction. Even biosimilars, usually a sleepy category, contributed $661 million, a 40% leap year-on-year.

Otezla, one of Amgen's big autoimmune bets, rose 14% to $618 million, due to favourable rebates and modest volume gains. But not everything was up and to the right: Prolia and Xgeva both declined 4% to 5%, facing a mix of pricing pressure and volume softness as they've entered biosimilar territory, with US patents already expired and European ones set to fall in November. Three biosimilars for Prolia have already hit the US market, so expect sharper erosion in the second half.

Amgen is leaning in heavily on its obesity pipeline, particularly on MariTide, with R&D spend up 18% to $1.42 billion. There's a clear trade-off here: build for the next wave or coast on what's already working. Amgen's chosen the former, according to CEO Robert Bradway (pictured below).

MariTide is Amgen's GLP-1 obesity drug candidate, and the horse they're backing hard, with good reason. It's not just another weekly jab like Novo Nordisk's Ozempic, this one is a once-a-month injection, which could offer real differentiation.

In trials, MariTide has shown up to 20% weight loss over 52 weeks, with no apparent plateau and improvement in cardio-metabolic health markers. Phase 3 trials are now fully enrolled, including studies on cardiovascular outcomes, heart failure, and one kicking off soon in sleep apnoea. Phase 2 data for obesity in diabetics and non-diabetics is expected by the end of 2025.

Despite all the positives, Amgen's share price dipped slightly after the results. Likely a combination of short-term concerns around biosimilar erosion and the long wait for obesity trial results. Still, Amgen's share price is up over 11% year-to-date, well ahead of its peers in biotech.

One thing, from Paul

Here's an old point, well made this time by Mike Bird, the Wall Street editor for The Economist. That's him in the picture.

"A lot of people dedicate way too much time to marginally optimising their investment strategy, relative to the amount of time they spend working out how to make more money to invest in the first place."

Byron's beats

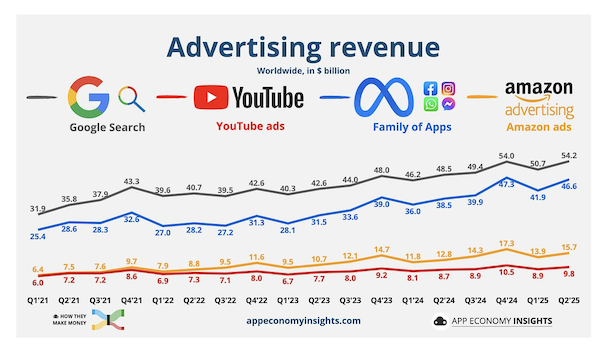

Online advertising is a massive revenue driver for many big tech stocks that also happen to be Vestact holdings. I like to keep tabs on how they are all doing after each earnings season.

Google search still has the lion's share with $54 billion in revenue last quarter. Meta is next with $46 billion, then Amazon with $15.7 billion and lastly YouTube (owned by Google) with $9.8 billion.

Amazon advertising has been the real success story, coming from nearly nothing a decade ago. Sales grew 33% from a year ago, which is fantastic. Amazon Prime has also entered into a streaming partnership with Roku which has 80 million subscribers. The product will be ad-supported and will give Amazon even more clout in that high-margin business.

Michael's musings

We are living through the early evolution of AI, with providers still figuring out the best ways to package and sell their services. It is exciting to see how a new version of the leading models is released every couple of months, with new tools and even more power.

It reminds me of the early days of Twitter or Instagram - there were a lot fewer users, no algorithms and the only content that you saw was generated by someone you followed. Fast-forward a decade, and social media has completely changed as the industry has matured.

AI adoption is moving incredibly quickly, and service providers can't build the infrastructure fast enough. It's an arms race, and the company/country with the most firepower will be the winner. Management consulting firm McKinsey estimates that data centre outlay needs to reach $6.7 trillion to meet demand for computing power globally by 2030. This is why Nvidia is worth a cool $4 trillion.

On Monday, Bloomberg announced that Meta has partnered with Pimco and Blue Owl to help provide capital for a $29 billion data centre in Louisiana - this is only one of many Meta data centre projects. Given the scale of Meta's investment over the coming years, it makes sense for them to partner with some heavy-hitting Wall Street firms. This sounds like a win for all involved.

Linkfest, lap it up

What is the best way to make bacon? These guys tested seven different methods, and there was one clear winner - The science of curing pork bellies.

Some parts of the US still use dial-up internet. At its peak, AOL had 18 million clients and was worth $350 billion - AOL to discontinue its old-fashioned service.

Signing off

Asian markets opened higher this morning, powered by a surge in tech stocks, after Trump hinted that US companies could resume some top-end chip sales to China and extended the trade truce until November. MSCI's Asia Pacific index climbed, with semiconductor names like Advantest jumping 7.5%.

In local company news, Pepkor's R1.9 billion deal to acquire Legit has been approved by the Competition Commission. The acquisition encompasses a portfolio of brands, including Legit, Style, Swagga, Beaver Canoe, and Boardmans, which collectively generated approximately R2.4 billion in revenue during the 2024 financial year from 462 stores.

US equity futures are up nicely pre-market. The Rand has strengthened to around R17.74 to the US Dollar.

The US inflation data out today is expected to show a slight uptick as retailers quietly nudge prices higher on goods facing steeper import tariffs. Let's see how the market feels about that.

Over and out.