Market scorecard

US markets enjoyed an exuberant Friday, rollicking to new highs. Tech stocks rose again after a week of excellent earnings reports, mostly ignoring tariff setbacks and inflation fears. The S&P 500 is now up 28% from its early April lows. Thanks for coming.

In company news, advertising automation company Trade Desk was the biggest loser in the S&P 500, tumbling 38.6% after issuing lacklustre revenue guidance. Elsewhere, sports gear-maker Under Armour shares plunged 18.1% on tepid sales forecasts. Finally, Monster Beverage climbed 6.4% after reporting record sales of caffeinated sugar water.

In summary, on Friday, the JSE All-share closed up 0.21%, the S&P 500 rose 0.78%, and the Nasdaq was 0.98% higher. All right then.

Our 10c worth

Michael's musings

Last week, Stryker delivered market-beating numbers. This medical device company has been a Vestact-recommended stock since January 2014. Revenue came in at $6 billion, up 11.1% year-on-year, and earnings per share was $3.13, up 11.4%. Forward guidance was boosted higher, demonstrating positive momentum of the business, which is encouraging.

The management team mentioned that new tariffs are expected to cost the company $175 million this year. A small amount in the grand scheme of things, but still money that could have been added to shareholder pockets.

We have 852 clients who hold Stryker shares, but out of all our stocks it is probably the least talked about by customers. That's not a bad thing, as it steadily ticks higher, consistently delivering double-digit growth. The overall return in the last five years is 99%, which is excellent.

Onwards and upwards.

One thing, from Paul

Ben Carlson (pictured here) wrote an amusing post about the types of clients who are hard for a financial advisor to manage. He works at Ritholtz Wealth Management, and has a great blog called 'A wealth of common sense.'

We love our clients here at Vestact, and are grateful that they have placed their savings with us, but they are not all easy to deal with. Can you see yourself in any of the profiles that he sets out below?

The performance chaser. Why am I not beating the S&P 500? Why is my portfolio down this year? Why am I only up 23% when my golf buddy is up 27%?!

The recency freak. Why don't I own that thing that just did really well? You should've put my portfolio into that, instead of that junky thing that underperformed. Stocks are down this year. Get me out!

The hindsight client. Why didn't we go all in on Nvidia?! Why didn't you buy Bitcoin for me? We should've had all of my money in tech stocks. [In a bull market] We should be all in equities and dial up the risk. [In a bear market] I think we took too much risk in stocks. We should dial it down.

The macro worrier. Government debt is too high. The system is going under. Oh no, rates are rising! Oh no, rates are falling! This politician is going to crash the market! Did you hear about the Strait of Hormuz this week?

The waffler. I can't make a decision. What if this happens? But what if that happens? If I take too much risk, I could lose money. If I don't take enough risk, I'll never make any money.

The irrational requester. Just pick the best stocks for me. I want 12% guaranteed every single year, and I don't like volatility. Just rotate into the best-performing asset classes each year and avoid the duds.

The market timer. I just want to get out for a little while until the dust settles. I swear I'll get back in. Let's wait until after the election. [Market hits new high] I think now is the time to double down and go all-in.

Byron's beats

Some people are constantly worried about the next bear market. They are so anxious that they aren't able to invest their money in stocks. Either the market is too high and about to crash, or it is falling and will certainly fall more.

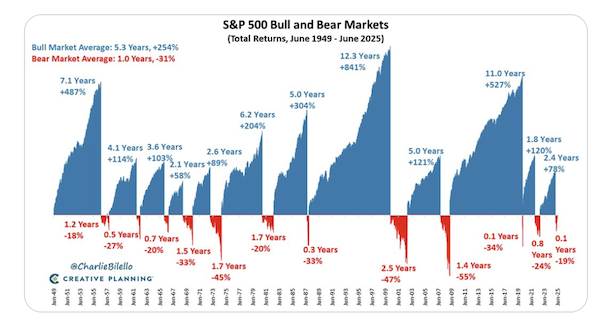

If you fall in that category, hopefully this graph will change your mind. The blue represents the bull markets going back to 1949. It also shows the length and the total returns delivered during those periods of growth. The red sections show the bear markets.

It's quite obvious that bull markets completely dominate the direction of the market. The little blips of red pale in comparison, both in returns and duration. Bear markets should not be the reason you don't buy shares. In fact, those drops are an important part of the process.

Bright's banter

Last week, Palantir posted a blockbuster quarter, and the CEO was not shy about rubbing it in. CEO Alex Karp said, "We're sorry that our haters are disappointed." One imagines he said it with a smug grin and a sip of artisanal kombucha.

Palantir's revenue surged 48% to hit $1 billion, its first time crossing that milestone, topping Wall Street's expectations of $939 million. Net income soared 144% to $327 million.

Palantir is a big data and analytics company that does a lot of work for the US government. Revenue from that one client jumped 53% year-on-year to $426 million, while US commercial sales nearly doubled to $306 million. This momentum is likely to continue, thanks to a new $10 billion decade-long contract with the US Department of Defense.

Palantir now boasts a market cap of $443 billion, putting it ahead of Salesforce, IBM, and Cisco. That is rather large for a company with only $4 billion in sales. Shares have more than doubled year-to-date (up 148%).

This company is known for scaring civil liberties groups, because it works on shadowy government surveillance projects using artificial intelligence and facial recognition software. To be fair, it now has a wider customer base, all around the world.

Linkfest, lap it up

Happy Gilmore 2 is killing it on Netflix. It secured the most-watched debut weekend with 46.7 million views in just three days - Comedy is not dead.

Mark Zuckerberg and his company are shaping our society. Every few years, he writes a manifesto, with the latest focusing on AI - Meta's superintelligence memo.

Signing off

Asian markets opened mostly higher this morning, taking their lead from Wall Street's upbeat finish on Friday. Trading in Japan was paused for the Mountain Day holiday.

In local company news, the Fourways Mall owner, Accelerate Property Fund, reported a 5.7% decline in rental income to R824 million, while net property income fell 8.3% to R494.7 million. The company's after-tax loss deepened to R1.27 billion, nearly double last year's R624.7 million shortfall.

US equity futures are slightly lower in pre-market trade. The Rand has strengthened to around R17.72 to the US Dollar.

The seasons are changing. Here in Joburg, winter is on its way out, but spring has not yet sprung. Have a pleasant week.