Market scorecard

US markets snapped back to winning ways yesterday, erasing Friday's losses. Perhaps last week's very weak bad jobs report will induce the Fed to cut interest rates in September. Strong company earnings are still rolling in, so there is no cause for negativity, just yet.

In company news, Tesla closed 2.2% higher after awarding Elon Musk a new incentive package of 96 million shares, worth around $30 billion. Elsewhere, Spotify shares rose 5.0% after it hiked subscription prices, locking in loyal listeners. Finally, American Eagle Outfitters rose 23.6% thanks to more hype about Sydney Sweeney's jeans.

In summary, the JSE All-share closed up 1.60%, the S&P 500 rose 1.47%, and the Nasdaq marched 1.95% higher. That will do nicely, thank you.

Our 10c worth

One thing, from Paul

Amazon had quarterly results out last week, and despite a very handsome beat on revenue and profits, its stock price fell sharply on the day (-8.3%). What gives, and should we be concerned?

Let's go back a step. We've owned Amazon shares in client portfolios since early 2011. We were attracted to its online sales platform, which was in the process of expanding massively, building many more distribution centres in North America, and going global. They were the leading e-commerce business back then, and they still are today.

Somewhere along the line they added a web hosting business, Amazon Web Services (AWS), selling spare server capacity to third parties. Unlike the retail operation, which has low margins, AWS has very fat margins. For the last decade, AWS has been the market leader, towering over Microsoft's Azure business and Google's Cloud unit.

For perspective, AWS generates $30.6 billion in quarterly revenue compared to Azure's $22.9 billion and Google Cloud's $12.5 billion, but has slower growth, for the moment. Microsoft's exclusive partnership with OpenAI has changed Azure from an "also ran" into the likely choice for AI startups.

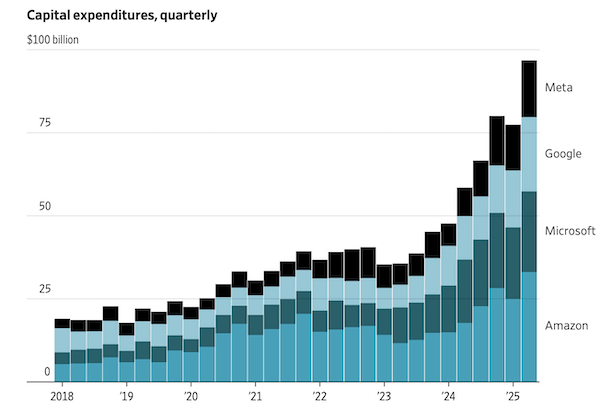

The Amazon management team has responded by jacking up capital spending to $120 billion in 2025, up from about $105 billion previously. That means more Trainium 2 chips (their in-house creation), more multi-gigawatt data centres, and agentic AI offerings across their hosting business.

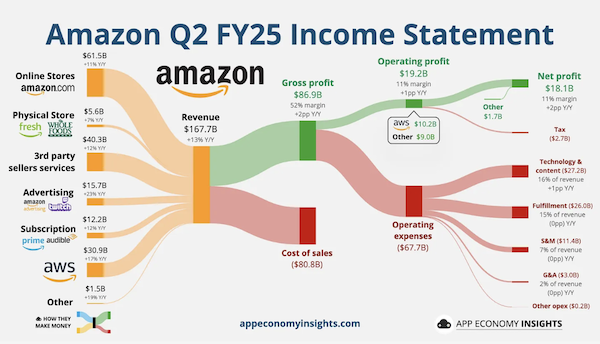

While we wait to see how that turns out, the rest of their business is doing brilliantly. The retail operation grew sales by 11%, the fastest rate since 2021. Prime Day set new records. Fulfilment and shipping for third parties also boomed. Advertising grew by 23%. Amazon Prime subscription revenue also stepped up by 12%. See the chart below, from App Economy Insights.

As ever, we are steady holders and buyers of quality companies. Amazon is most certainly in that category.

Byron's beats

According to the Wall Street Journal, Amazon, Microsoft, Google and Meta are expected to spend up to $100 billion per quarter on capex for the next year. That will equate to $400 billion of investments from just 4 companies in a year. That's huge!

As we saw from Microsoft's recent results, they cannot build AI capacity fast enough. The demand is higher than the supply. As it stands, the capital spent on building these data centres is generating great returns. In time, spending will slow, when it no longer makes financial sense.

When will that be? No-one knows. I think that we are still far away from that point. A famous Winston Churchill quote comes to mind. "Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning".

Michael's musings

Last week, it seemed that my dreams had come true. Reserve Bank governor Lesetja Kganyago announced that the SARB's new interpretation of its 3-6% inflation target is to aim at 3%, instead of 4.5%. Unfortunately it didn't take the National Treasury long to announce that although the new target has been set, they weren't going to change policy to make it officially 3%.

As things stand, the stars have aligned for an almost painless adjustment to our inflation target. An opportunity like this doesn't come along every day. I would go so far as calling it a once-in-a-generation opportunity. It is very rare for inflation to be low when there is not an economic crisis.

I'm not sure if our leaders are cowards or they just don't grasp what is happening. There isn't time for politicians to have meetings, about planning another meeting about thinking about an even bigger meeting, to maybe discuss changing the target.

If you think about it, 3-6% is super vague and is actually useless. A decade ago, the market and the SARB took that target to mean 6%. In 2017, Kganyago announced that the midpoint of 4.5% would be used because that gave us more policy certainty. Then last week, he said that we should lock in the hard-fought gains (getting inflation below 3% isn't easy) and now aim for 3%.

What makes this announcement great, is that Kganyago is still operating 100% within his mandate from Treasury, which is "keep inflation between 3-6%". Well done to him for having the stones to make a decision while this opportunity is available to us.

Linkfest, lap it up

We are still discovering new creatures in the deepest parts of the ocean. It is not easy to get 9km below the surface - Extreme life forms seen for the first time.

A healthy society creates new wealth. Over-regulation stifles innovation and competition - Self-made wealth is better than inheritances.

Signing off

Asian markets followed the lead of US stocks, marching higher today. India is under pressure due to its continued buying of oil from Russia, so markets there are down around 0.35%.

Locally, Gold Fields announced that they expected profits to rise by up to 181%, thanks to increased volumes mined and a strong gold price. The share popped 8.7%.

US futures are fractionally higher. Companies reporting today include AMD, Caterpillar, Pfizer and Amgen.

The Rand is looking a bit better this morning at $/R17.93. The price of oil has been sliding for three days after OPEC announced that it would increase global crude supply.

Have a top day.