Market scorecard

Tariffs are rising, so US stocks dropped yesterday. Trump told the leaders of South Korea and Japan that their exports to the US will face 25% tariffs starting on 1 August. South Africa also got a special mention, and a 30% tariff, but it is unclear if that includes the extra 10% for being part of BRICs. Amusingly, in Trump's letter to Ramaphosa, he says that the US's trade deficit with South Africa is a threat to their economy and national security.

In company news, Uber closed 3% higher due to a stock upgrade from Wells Fargo, which expects good ridership growth. Tesla was a big loser yesterday, dropping 7% because Elon Musk appeared to be launching a new political party. The market is worried that his focus will shift away from managing Tesla, again, and that there could be retaliation from the Republican establishment.

In summary, the JSE All-share closed up 0.19%, but the S&P 500 fell 0.79%, and the Nasdaq ended 0.92% lower. Not too bad.

Our 10c worth

One thing, from Paul

I read this interesting insight in a blog post by Marc Rubinstein.

"The history of American finance is rooted in the history of railroads. When the first inter-city railway in the world was laid from Liverpool to Manchester in 1830, it was financed via a private placing: local merchants and mill owners subscribed to 4 000 shares at £100 each. America took the idea and made it bigger."

Between 1815 and 1860 the total amount of money spent on US railroads was more than $1.1 billion. It was impossible to raise this amount of capital by tapping the traditional resources of friends and family, so the New York Stock Exchange became a hub.

Rubinstein notes that railroads still accounted for 60% of publicly-issued stock in 1898 and 40% in 1914. Today, they make up a mere 0.5% of the S&P 500 index.

Over decades, the dominant sector in an economy and the market will change. The trick is to be positioned in the right stuff, and not be too quick to move off.

Byron's beats

I have been sceptical of cryptocurrencies since their inception and remain so. Their supposed utility does not make enough sense to me and I cannot bring myself to buy something where its value is unexplainable. I know Bitcoin has done incredibly well over the last decade but so have many other assets. In fact, Bitcoin's volatility is one of the main reasons I believe it will never replace fiat currency. You simply cannot do business with something so uncertain.

Stand up Stablecoins. These are tokens designed to maintain a stable value, typically pegged to a fiat currency like the US dollar or other assets, minimising volatility compared to other cryptocurrencies. Now that makes a lot more sense to me.

If Stablecoins get fully integrated into the retail environment, some worry that a company like Visa could be under threat. As usual, Visa are two steps ahead. They already have a seven-day-a-week stablecoin settlement system to help banks issue and manage them. They have also teamed up with fintechs to offer stablecoin-linked cards and make cross-border payments faster and smoother using USDC on blockchains like Solana and Ethereum.

The crypto space is finally getting useful.

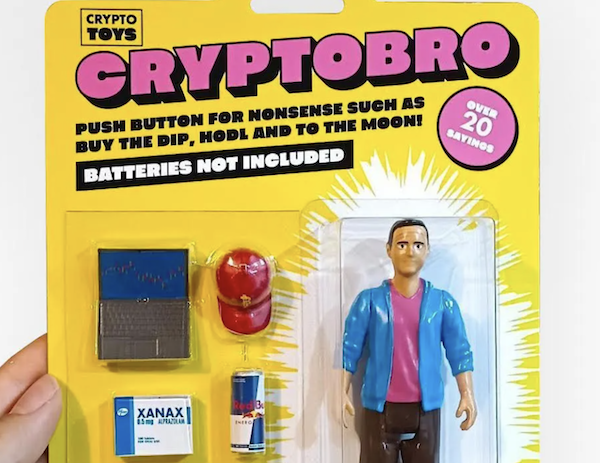

Disclaimer to the cryptobros: I have absolutely zero Bitcoin fomo, so don't come at me with your "have fun staying poor" rubbish.

Michael's musings

The market is near all-time highs even though politicians are misbehaving. When markets make new highs, we find ourselves spending more time encouraging clients to stay invested or to add fresh funds.

No one likes to buy assets that are at record highs, especially when they were 20% cheaper a few months ago. Remember though, a market setting new highs is a bullish sign, not something to be afraid of.

A client recently said to Paul, "no one became poor by taking profits". Paul's very direct reply was, "I'm afraid that you are dead wrong about how to approach long-term investing".

The simple truth is that no one became rich either by taking profits. Imagine if you had sold Nvidia after it had doubled in price, just in the name of harvesting profits. You would have left an absolute fortune on the table. Traders (not investors) take short-term profits because their strategy is to jump in and out of the market, using debt to magnify their returns. Almost all retail traders lose money.

If you are a long-term investor, which our clients are, then you shouldn't be overly concerned about the market's value today. Far more important is that you own companies that have strong moats and will continue to enjoy significant revenue growth. Markets are emotional in the short term, but over the long term, companies creating real value are the winners.

Linkfest, lap it up

Honda is known for making cars. They recently hit a significant milestone in another field - Honda's successful launch and landing of its own reusable rocket.

Apple AI can now detect nudity on FaceTime calls. It then pauses or ends the call - New parental safety feature.

Signing off

Asian markets are higher this morning as Trump has left the door open to further negotiations with nations in that region, before the 1 August deadline.

In local news, South32 announced the sale of its Cerro Matoso ferronickel operations in northern Colombia. In doing so, they are taking a $130 million impairment loss, reflecting a price collapse of nickel due to increasing global supply. That's the problem with commodity companies, they can have the best operations around, but they can't control the price of what they sell.

US futures are very marginally higher. The Rand is now at $/R17.82, unfortunately it's getting weaker on increased tariff worries.

That's it from us. Have a good day.