Market scorecard

US markets were closed on Friday last week when Congress finally approved the new tax legislation and sent it off to Trump's desk for signing. The bill comes with juicy tax incentives, particularly for large companies spending billions on infrastructure like data centres.

Last week marked 50 days after the 'Liberation Day' market lows. Since then, the S&P 500 has bounced 19.8%. Looking back in history, the last eight times the market rallied that hard in such a short time, it was even higher one year later (on average another 16.4% gain). The lesson is this: don't let a strong market scare you from getting invested.

On Friday, the JSE All-share closed up 0.25%, and the US was closed for Independence Day.

Our 10c worth

One thing, from Paul

One of the things I like most about markets is how judgemental they are. Whether it's markets for loans, bonds or equities, capital is fungible, and it flows to where it will be safest, and best rewarded. It doesn't care about your feelings, or your political preferences.

Capital requires a return - investors want to get their money back, plus something. The higher the risk, the higher the return required.

It's considered politically incorrect to be disparaging about a country, its people or its politicians, but the market doesn't give a damn. Bonds issued by Mozambique won't sell, other than at high rates or with a guarantee issued by a multilateral agency. Pension funds want to place most of their money in bonds issued by low-risk countries, in stable currencies.

US treasuries are still the global gold standard, but their effective yields have stayed at around 4.35%, despite falling inflation, because of US fiscal ill-discipline.

Company share prices also vary a lot, in response to news developments. Good news, good management, and solid earnings growth, all lead to a higher rating. The reverse is also true though. Mess up and you'll get punished. This means that clever stock picking is rewarded.

Byron's beats

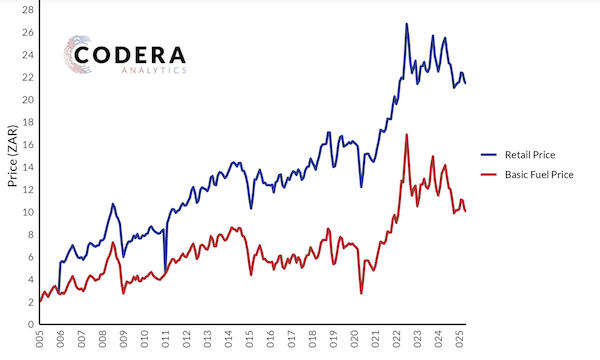

As you may have realised by now, I like charts. I love how they show us trends from the past to the present. If a picture says a thousand words, then a chart says a thousand insights. I made that up (with a little help from Grok).

There's a cool South African site which I discovered via Daily Maverick called Codera. They have put together some interesting data sets, often presented in charts. It's a great source for everything from dam levels to monetary policy forecasts.

For example, the graph below shows the South African retail fuel price versus the basic fuel price. The reason for the gap opening up over time is due to extra taxes, the Road Accident Fund, higher margins for resellers, and transport costs.

Michael's musings

Obesity in children is rising. The 2017 South African income dynamics survey found 16% of children aged five to nine, and 22% of those aged 10 to 14, were overweight or obese. Almost ten years later those numbers are certainly higher.

The SA Medical Research Council analysed the data of 430 children between 2012 and 2022 and found that many children showed health conditions usually associated with middle-aged people. For example, 46% of the children had high blood pressure, 30% had abnormal cholesterol levels and 5% were either pre-diabetic or already had type 2 diabetes.

This isn't only a South African problem. The CDC in the US estimates that 20% of US children are obese. If someone is overweight as a child, they will most likely be overweight as an adult, and suffer from a host of medical conditions like increased prevalence of heart attacks, strokes and kidney problems.

Genetic factors play a part, but the biggest influencers are the usual culprits - too much sugar, not enough exercise and excessive screentime. Obesity will continue to be an issue until there are some major shifts in societal norms.

Linkfest, lap it up

Peruvian plumbers just made an amazing archaeological discovery. While working on pipes in Lima, they found a really old mummy - The tomb of a 1 000-year-old pre-Hispanic human.

AI knows nearly everything. Let's ask it questions about spiritual issues - Bible Chat app has more downloads than Instagram and WhatsApp.

Signing off

Asian markets are mostly lower this morning as further US trade deal uncertainty comes to the fore this week. Trump has also said that those aligning with the BRICS group of nations will face an additional 10% levy - not good news for China or South Africa.

The biggest local news is that Vodacom and Remgro pushed out the long-stop date, which they do every couple of weeks, for the merger of their fibre assets. The deal was first announced in November 2021, but has been held up the Competition Commission. The case will only be heard by the Competition Appeal Court at the end of July.

US futures are pointing to a weaker open this afternoon (down around a third of one percent). The Rand is also on the back foot this morning, now trading at $/R17.78. The risk of extra tariffs on SA goods has dented our currency.

It's a new week, keep moving forwards.