Market scorecard

US markets went sideways yesterday, but tech stocks were weak. Another spat between Trump and Musk provided some distraction, and the Senate passed its version of the US budget.

In company news, Tesla dropped 5% after The Donald insinuated that Elon might be deported. To where, Pretoria? Meanwhile, one-time meme stock AMC Entertainment tumbled 9% due to announcing a new debt restructuring plan. Elsewhere, Amgen was up 4% thanks to encouraging data for a new stomach cancer drug called bemarituzumab. Lastly, Ford popped 4.6% after reporting an impressive 14% increase in car sales last quarter.

In summary, the JSE All-share closed up 0.50%, but the S&P 500 slipped by 0.11%, and the Nasdaq faceplanted by 0.82%. We can take the rough with the smooth.

Our 10c worth

One thing, from Paul

I just read about something called the "sapient paradox". Basically, it asks why prehistoric humans waited for millennia before starting civilisation.

Scientists know that early people were genetically and intellectually equivalent to modern humans. They already had the brainpower required for history's major societal and technological advancements from as early as 60 000 years ago.

As our ancestors began migrating out of Africa, instead of settling down, building cities and doing useful work, they just wandered around for 50 000 years, surviving as hunter-gatherers. This went on for thousands of generations.

From about 10 000 years ago things finally got moving, including the agricultural, scientific, industrial, and digital revolutions that define modern life. Along with religion, democracy, money and the nation-state system.

Now we have global stock market investing, smartphones, streaming media, intercontinental air travel, AI and self-driving cars. More good things are still to come.

In my view, this stuff is all cumulative. Humans were just taking a while to work out how to behave and how to best organise ourselves. We are definitely not fully evolved.

To paraphrase (and repurpose) something once said by Winston Churchill, humans can always be trusted to do the right thing, once all other possibilities have been exhausted.

Byron's beats

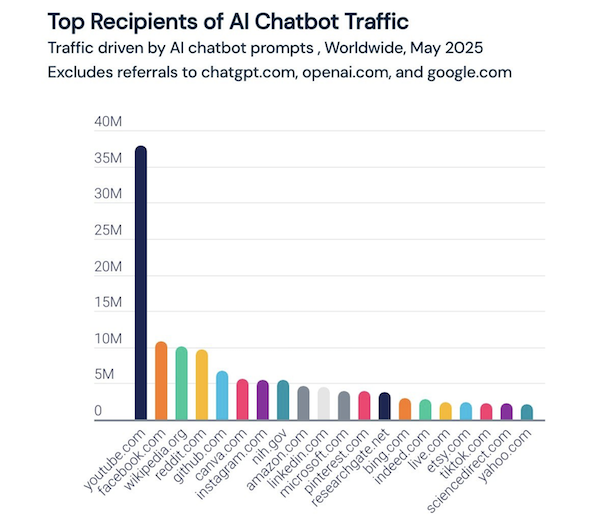

Some analysts are worried that AI chatbots are going to have a negative impact on Google's search business. Instead of asking questions on Google search, people are now using AI chatbots.

The major loss for Google in these cases is its ability to steer traffic and charge for clicks. But as it turns out, YouTube (owned by Google) has been the biggest recipient of traffic driven by AI chat prompts.

Take a look at the image below supplied by Visual Capitalist. YouTube absolutely dominates in this field. For example, you ask Copilot how to make bread and to suggest a video. The video link will almost always be YouTube, so Google wins anyway.

Google is at the forefront of AI innovation, I am not concerned about the impact on the search business. In fact, AI is making search more useful and will benefit Google in many other areas.

Michael's musings

Meta is on a spending spree to stay at the forefront of AI technology. AI will arguably be bigger than the creation of the internet, so it makes sense to be a leader in the industry.

The company just bought Scale AI for $14 billion and is expected to spend a further $70 billion on building new data centres. On top of that, there are rumours that Meta offered some top AI talent $100 million packages to move across to the company. If Cristiano Ronaldo can get $700 million to play football in Saudi for two years, $100 million for someone at the top of AI sounds cheap.

I think it's great that Meta is taking a big bet on the future of AI. Mark Zuckerberg's leadership is key to Meta's ability to spend this much, so quickly, on one industry. Only a controlling founder can avoid corporate bureaucracy, pivot fast and pursue exciting opportunities with such vigour.

Linkfest, lap it up

AI system is better than doctors. Diagnosing complex health conditions is tricky - Microsoft's new tool is highly methodical.

Fathers play a huge role in their kids' lives. Dads prepare youngsters for the outside world - Different models of parenting.

Signing off

Asian stocks are mixed this morning. On the one hand, Trump has reemphasised his 9 July trade talk deadline, saying there is unlikely to be a deal with Japan before then. On the other hand, casino stocks are having a good day after Macau gambling revenues soared 19% in June.

In local news, Hyprop is selling a 50% stake in Hyde Park Corner for R805m to Millennium Equity Partners, with the option to sell the other 50% in the next two years. Things are coming full circle, Hyprop got its name from the Hyde Park shopping centre.

US futures are pointing towards another green day, and the Rand is at $/R17.62.

It's Wednesday already. Stay young.