Market scorecard

US markets were muted yesterday and closed slightly lower, but there was plenty of excitement after hours. A federal trade court ruled that President Trump overstepped his authority by slapping tariffs on nearly every country, and scrapped his global levies that had fuelled a trade war. The White House immediately appealed the ruling, but now they are on the back foot. Futures rose.

In company news, Nvidia shares popped up 4.9% in post-market trade thanks to market-beating numbers. The AI investment theme is alive and well, and other tech titans have also risen. Elsewhere, ski-resort operator Vail Resorts soared 8.8% on the news that it's bringing back former CEO Rob Katz.

At the end of the day, the JSE All-share closed up 0.11%, the S&P 500 fell 0.56%, and the Nasdaq was 0.51% lower. Today looks more promising.

Our 10c worth

Michael's musings

Last night, Nvidia reported quarterly revenue of $44 billion, up 69%, and profits of $20 billion. These spectacular numbers would have been even stronger if they hadn't taken a $4.5 billion loss on chips designed for the Chinese market, now blocked by the US government. That inventory will have to be destroyed.

For the next quarter, Nvidia expects sales of $45 billion, which includes an $8 billion headwind due to lost Chinese sales.

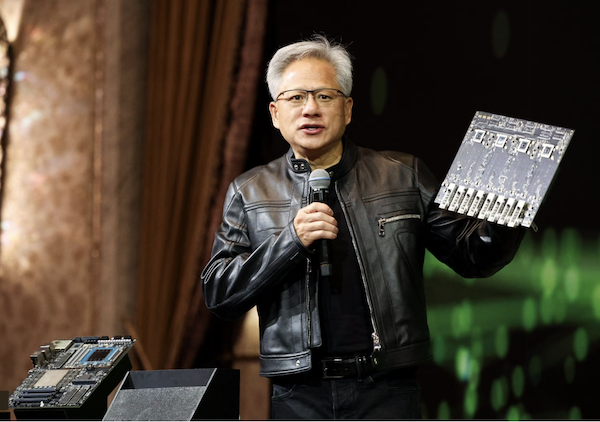

Jensen Huang, Nvidia's CEO, told shareholders last night that he expects China to become a $50 billion a year AI-accelerator market, which, if Nvidia isn't allowed to participate, will allow other companies to fill the gap. 'Giving' all the business to competitors would be bad for Nvidia and detract from the US's lead in AI technology and capabilities.

Nvidia is more than just a GPU producer, they also make the infrastructure to connect all the chips. They just unveiled NVLink Spine, which can handle 130TB of data per second, more data than the internet. These NVLink Spines go into data centres to enable banks of Nvidia GPUs to talk to each other. There is no use having a very fast GPU if it can't effectively work together with other GPUs. Thanks to the ecosystem, Nvidia has an impressive moat against competitors.

This fiscal year, the company will approach $200 billion in annual sales, up from $27 billion just two years ago. The growth isn't expected to slow now that countries are racing to build their own sovereign AI capabilities.

We are happy holders of this stock in our client portfolios, obviously.

One thing, from Paul

It's been a difficult few months for those of us invested in US-listed equities, because the market has been very volatile. The Trump-related news flow has been wild.

We've stuck to our guns and not done much, and our model portfolio is down by just 1.08% so far in 2025. For the record, the S&P 500 is up 0.68% in the same period, and the Nasdaq is down 0.58%. No fireworks there either.

There are some financial firms that are loving these conditions. Ken Griffin's Citadel Securities, a high-speed trading outfit, just reported that its profits jumped nearly 70% in the first quarter to $1.7 billion. They love it when a new executive order from the White House hits the wires and traders go crazy.

The Miami-based giant provides market-making services to many hedge funds and most retail stock trading platforms. They now handle one in four of all US equity trades, grabbing market share from the banks.

When markets get sloppy, self-motivated retail traders can't help themselves. Most of them lose money, and Ken Griffin (pictured here) gets a little richer. Come on, just stop it. He's already worth $45 billion.

Bright's banter

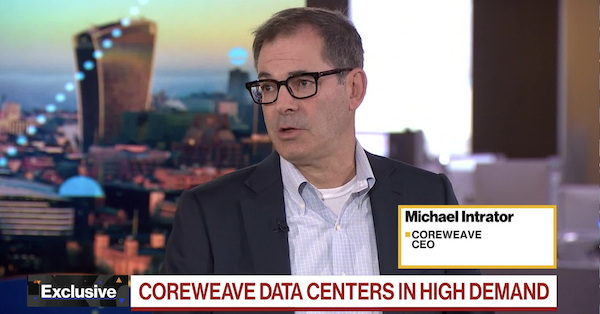

CoreWeave is having its day in the sun, its shares surged 29% in the past week after smashing expectations in its first quarterly results as a public company. Revenue hit $982 million, up 420% year-on-year, and a new $4 billion deal with OpenAI added to an already massive $12 billion contract.

CoreWeave is an AI-first cloud infrastructure firm. Think of it as a specialist landlord, renting out access to over 250 000 high-end Nvidia GPUs, tailored for AI workloads like training large language models. Even giants like Microsoft, Nvidia, and OpenAI rely on them when internal data center capacity runs thin.

A close partnership with Nvidia (which now owns a $2 billion stake) helped seal the company's position at the heart of the AI compute gold rush. CoreWeave is heavily reliant on Nvidia (100% of its chips) and Microsoft (62% of revenue).

It's carrying $8 billion in debt and expects to spend over $20 billion in capex this year. The assets backing that debt, namely, servers and chips, could depreciate quickly in this fast-moving space. Yet the CEO says bookings already exceed $29 billion, enough to cover debt and future investment. High risk, high reward.

Linkfest, lap it up

Gents like to pump iron. There's plenty of research on the benefits of building some muscle - Why women should lift weights.

Building powerful AI models requires vast amounts of data. Some say it's wrong for them to access copyrighted content - Creatives vs AI.

Signing off

Asian markets opened higher, thanks to that legal decision reversing the stupid "reciprocal" tariffs. Japan's Nikkei rose 1.2%, South Korea's Kospi climbed 1.1%, and Australia's ASX 200 nudged 0.3% higher.

In local company news, Tiger Brands roared back to life with a 34% jump in headline earnings per share from continuing operations in its half-year results, strong enough to justify a special dividend for shareholders. They still have that nasty listeriosis problem.

The SARB concludes its monetary policy committee (MPC) meeting this afternoon. The odds are that we will see a 25 basis point cut in local interest rates. That will be nice. The Rand is holding steady at around R17.95 to the US Dollar.

US equity futures are deeply green pre-market. One might say they are verdant, or forest green, or olive green? This is good.

Kind regards.