Market scorecard

Wall Street flinched on Friday, going backwards after Donald Trump revived his tariff threats, this time taking aim at the European Union. The US Dollar buckled, reaching its weakest level since December 2023. Over the weekend he changed his mind, delaying a 50% tariff until July 9, after having a "very nice call" with European Commission President Ursula von der Leyen.

In company news, Apple dropped 3% on Friday after Trump repeated the mad idea that iPhones must be made in America. Elsewhere, Oracle is gearing up to spend $40 billion on Nvidia chips to support OpenAI's massive new data centre in Texas. Finally, Salesforce is kicking the tyres on Informatica again, reviving takeover talks that fizzled out last year.

On Friday, the JSE All-share closed up 0.42%, but the S&P 500 fell 0.67%, and the Nasdaq was 1.00% lower. Yuk.

Our 10c worth

One thing, from Paul

What drives stock returns? It depends on the time frame. Here's a guideline, parts of which I saw online, and then I made some adjustments.

1 Day - Automated trading systems deployed by hedge funds and market makers.

1 Week - Geopolitical developments and macro-economic data updates.

1 Quarter - Changes in reported company earnings and profit margins.

1 to 3 Years - Top-line revenue trends (up, down, or sideways).

3 to 5 Years - Valuation shifts, reflected in increasing or decreasing price-to-earnings ratios.

20 Years - Changes in lifestyles, societal values and consumer demand.

Byron's beats

Every action produces a reaction, and leads to unintended consequences. When these actions are taken by interfering governments, the outcomes are usually negative. The recent situation involving Nvidia and China is a good example.

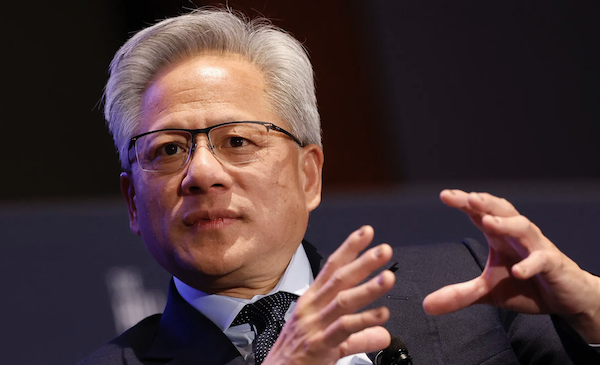

Nvidia boss Jensen Huang came out blazing in public last week, saying that the ban on US chips sales in China have been a colossal failure. They were meant to slow down Chinese progress in AI development, but have resulted in the exact opposite.

Nvidia's market share in China has fallen from 95% to 50%. The ban gave Chinese rival Huawei the perfect opportunity to fill the gaps, and it seems they have done just that. Huang points out that the quality of their technology has also improved drastically.

Of course Nvidia would say all this because it's bad for their business, and I do understand the security concerns. The US do not want China building high tech war weapons using US-made technology. But then again, it was inevitable that China would just do it themselves.

Bright's banter

Cloud-based messaging app Telegram just posted its first annual profit, a cool $540 million, from $1.4 billion in revenue for 2024. Not bad for a platform that lost $173 million the year before. The service, now used by one billion people, has turned a corner financially, thanks to premium subscriptions, ad revenue, and extra features like AI chat.

Telegram is wholly-owned by Pavel Durov (now worth $30 billion), the elusive, hoodie-wearing billionaire often dubbed the "Mark Zuckerberg of Russia." Durov now lives in Dubai but grew up in St. Petersburg, and took part in Italian math competitions before founding (and being forced out of) Russia's largest social network VK. He embraced a digital nomad lifestyle and coded Telegram from Paris to Singapore.

Since its creation in 2013, Telegram has endeavoured to keep conversations private and government-proof. They have weathered pressure from authorities worldwide, including an ongoing criminal case in France, where Durov is accused of enabling illegal activity on the platform. He's currently facing up to 10 years in prison if convicted.

Linkfest, lap it up

Shein and Temu are focusing on the EU now. Due to rising tariffs in the US, Chinese garment sellers are going elsewhere - The pivot to the old world.

Experts unsealed a 2 000-year-old sarcophagus. The Tomb of Cerberus in Giugliano, Naples is one of a kind - A mind-blowing mummy discovery.

Signing off

Japanese markets enjoyed a strong session, with the Topix and Nikkei 225 both ticking higher. The boost came after Donald Trump backed Nippon Steel's bid for US Steel, a move that sent its shares up over 7%.

In local company news, Quantum Foods has delivered an absolute sizzler for the six months to March. Headline earnings per share soared 244%, while revenue rose 20% to R3.6 billion.

US equity futures have edged higher pre-market, on the news of the EU tariff stand down. This is the "Taco Trade" at work. Taco stands for Trump always chickens out.

The Rand is holding steady at around R17.82 to the weakened US Dollar.

There is no trading in New York tonight, because it's Memorial Day. It's also a bank holiday in the UK, so the news flow will be slow.

Have a top day.