Market scorecard

US markets slowed slightly on Tuesday, in the absence of any major catalysts. We aren't complaining though, after a steamy rally that has lifted the S&P 500 nearly 20% off its April lows. Alphabet and Amazon each slipped over 1% by the close, but Tesla rose after Elon Musk pledged to steer the EV maker for at least another five years.

In company news, Google is rolling out "AI mode" in search for all US users. Not to be outdone, Apple is opening the doors for third-party developers to tap into its AI models, to speed up app innovation. Lastly, Home Depot dipped 0.6% after missing profit expectations for the quarter. The DIY giant says it will simply drop items from its shelves that are badly affected by high import tariffs. That's one way of dealing with the problem.

In short, the JSE All-share closed up 0.29%, but the S&P 500 fell 0.39%, and the Nasdaq was 0.38% lower. Let's try again today.

Our 10c worth

One thing, from Paul

Earlier this month, Bloomberg's Joe Weisenthal wrote:

"What the market does tomorrow is almost certainly irrelevant, and in the long term it will probably go up. What's interesting is what happens in the medium term. In economic life, tomorrow will probably look like today. The long term is largely unknowable. What's interesting to talk about is how the medium term looks."

This is also a useful way to think about your equity investments. Forget about today's price changes, what counts is how the companies that you own will do, operationally, in the medium term. I'd define that as the next three years.

I spend as much time as possible reading about company products, and their impact in the real world. Company websites, trade journals, business news feeds and blogs can be helpful. I try to find out what the companies' customers are saying. Social media feeds are quite useful for that.

We focus on trends in company sales and profit margins. We look at the numbers. All this comes to a head every quarter, when we get their updated results. That's why my favourite season isn't spring or summer. It's earnings season.

Byron's beats

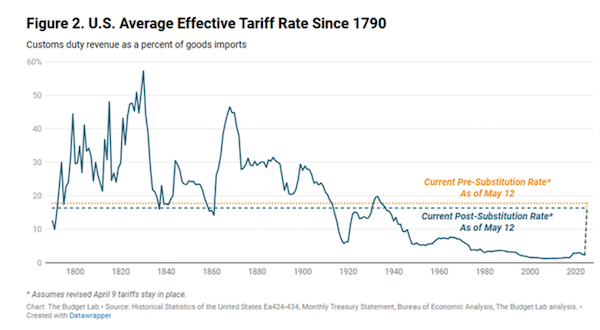

I know that bleating about tariffs is getting a bit stale, but I saw this graph and had to share. It shows the average effective tariff rate on goods imported to the US since 1790. Clearly the trend is downwards over the ages, a sign of human progress, I would think?

For perspective, I asked AI for some facts about America in 1790. Slavery was still legal in many states, with 700 000 people still in bondage. The largest city was New York with a population of 33 000. The US had no official currency yet. The entire population of the country was 4 million and the main driver of the economy was agriculture.

I would say they have progressed somewhat from then. What made sense back then, does not now.

Michael's musings

The US has a population of around 340 million people, who are comparably rich by global standards.If you are a business, having access to so many people with money to spend is a huge advantage. For example, you could be a very basic business, targeting only 0.3% of the population (1 million people) and only making $1 per customer. In that scenario, you still make a million dollars a year.

According to the Fed, the average wealth in the US is now $1 million per family. In absolute numbers, there are around 22 million millionaire households, roughly one in six. If you exclude someone's primary residence from the calculation, the number of millionaires drops to 15 million, which is still a significant number.

Here is an interesting article from the Hustle about where all the wealth came from - The insane growth of America's millionaire class.

South Africa's population, by comparison, is only 63 million people, many of whom are unemployed. It makes it very difficult to start a new company when there aren't enough potential customers to allow the business to scale. We desperately need decent economic growth, for everyone in this country.

Bright's banter

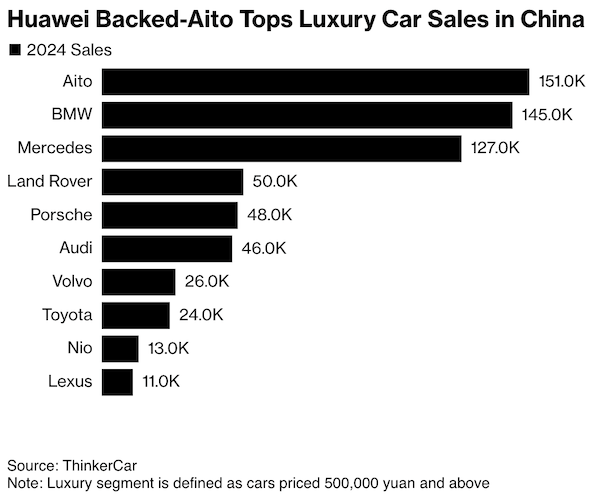

I just read a very interesting article on Chinese luxury cars. In just four years, Seres Group, a former budget 'kombi' maker, has rocketed up China's luxury car rankings thanks to its Aito brand, built in partnership with Huawei.

The Aito M9 SUV (which looks like the Mercedes GLS) features HarmonyOS, a triple-screen dashboard, and even a fridge. It has become China's top-selling luxury car above Yuan 500 000 in 2024, despite only launching in December 2023.

Sales tripled since 2021 to 427 000 cars, and Seres shares have surged 120%. This challenges the assumption that legacy names like BMW and Mercedes were untouchable in China's high-end segment.

Linkfest, lap it up

Mark Cuban is leaving Shark Tank. He's making a $750 million comeback into sports investment - Another private equity sports fund.

Vaccine safety is a talking point again. The team from Our World in Data put together some key research findings - How effective are measles vaccines?

Signing off

Asian markets are mostly in the green this morning, with gains across Sydney, Mumbai, Shanghai, Seoul, and Taipei. Tokyo lagged a little, but the broader MSCI Asia-Pacific index is heading for another solid close. Not a bad way to start the day.

In local company news, Alexander Forbes says headline earnings per share for the year to March will be up to 15% higher, thanks to continued growth in AUM and operating income. Elsewhere, Renergen shares shot up 38.8% after receiving a R14.22 per share all-stock buyout offer from ASP Isotopes. The helium and energy player has been under pressure, so this surprise move gave investors an exit.

US equity futures are slightly lower pre-market.

The Rand is at R17.90 to the US Dollar, ahead of an Oval Office encounter between Trump and Ramaphosa. That will be interesting to watch.

It's cold and windy in Joburg, but at least the sun is shining. Have a solid day.