Market scorecard

US markets ended in the green yesterday, continuing an impressive run this week. The S&P 500 has now rallied about 18% from its lowest closing level this year, and is now in the green for the year. Given all the drama we've been through, that's a remarkable outcome.

In company news, chipmakers were standouts once again. Nvidia rose 4.2% and AMD jumped 4.7%, as President Trump's tour of the Middle East sparked a wave of AI-related agreements involving American tech firms. The US also scrapped a Biden-era rule that restricted the export of certain AI technologies. Elsewhere, online trading firm eToro surged 29% on its first day after it's upsized IPO.

Izolo, the JSE All-share closed down 0.18%, but the S&P 500 rose 0.10%, and the Nasdaq was 0.72% higher. Thank you very much.

Our 10c worth

One thing, from Paul

Here's another market-related meme for you to consider. I'm sharing images this week and keeping my words to a minimum.

It makes the point that dummies and gurus often arrive at the same simple conclusions, while those who overthink things lose out.

Byron's beats

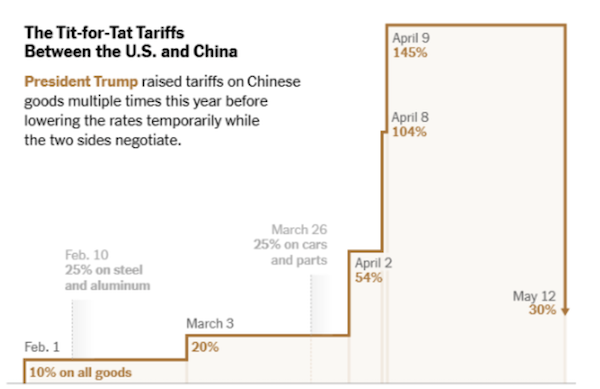

Recency bias is real. The tariff trade war with China is a good example. Three days ago it was announced that tariffs on Chinese goods would come down from 145% to 30%. That sounds like a huge win.

But it's not, actually, if you look a little further back to February when tariffs were at 10%. At 30%, they have tripled. The Chinese retaliation has also resulted in 10% levies on all US goods, many of which were not tariffed before.

Our preference is for lower tariffs everywhere. We support the free movement of goods and capital, worldwide.

Michael's musings

One of the advantages of having a Vestact portfolio is that you can track its performance in real time. There are many opaque products out there that only give value updates once a day or worse.

In volatile times, this advantage can be a problem. Seeing how much money you are 'losing' can cause people to panic. You might start thinking about all the things that you could have done with that money.

To our clients' credit, very few of them sold in April. Well done for holding the line.

We are patient investors, which means our focus is on the long-term value of a company, not its daily share price fluctuations. Even though I can check in on my portfolio at any time, I try to only review it carefully once a month. I have a ballpark figure in my head of what it is worth. I don't need to see every tick higher or lower. For me, that would be a waste of headspace.

Bright's banter

I often compare Sea Limited to Amazon, both run sprawling digital ecosystems combining e-commerce, digital payments, and gaming. That makes Sea an attractive proxy for Southeast Asia's growing digital economy.

Sea Limited surged over 8% on Tuesday after reporting stronger-than-expected Q1 earnings, marking a continued turnaround for the Singapore-based tech group. The company posted sales of $4.84 billion, up almost 30%, driven by a 28.7% jump in e-commerce (Shopee) sales and a 57.6% increase in digital financial services revenue.

Sea's stock is now up 52% year-to-date and 141% from 12 months ago, although still trading below its 2021 highs. A key factor in the rebound is Shopee's improving profitability, despite growing competition from TikTok Shop and Temu. The company's decision to step up spending in late 2023 now appears vindicated.

Notably, Sea has avoided major disruption from trade war headwinds. "We are very much a local marketplace," said President Chris Feng, explaining that cross-border business remains a relatively small part of overall operations.

Linkfest, lap it up

Qatar wants to give Trump a jumbo jet. This ndizamshini is a proper hotel in the sky - It's inappropriate and makes America look silly.

Do you spend too much time online? There's life beyond the infinite scroll - 50 ways to unplug and feel human again.

Signing off

Asian stocks slipped on Thursday, breaking a four-day winning streak, despite Tencent delivering a solid earnings beat (13% year-on-year rise in revenue and a 14% jump in net profit for the first quarter). Its core gaming business advanced with hits like Honor of Kings and Peacekeeper Elite.

In local company news, Bytes Technology reported a 16.5% rise in headline earnings per share, and its board declared a special dividend.

US equity futures are slightly lower pre-market, although it's still the middle of the night in New York. The Rand is at around R18.22 to the US Dollar.

Stay optimistic.