Market scorecard

US markets ended higher yesterday, with major indices wiping out their 2025 losses. Trade tensions are easing, and sentiment was further boosted by cooler-than-expected inflation data. The consumer price index (CPI) rose just 2.3% year-on-year in April, the slowest pace since early 2021.

In company news, US chip stocks rallied after Nvidia and AMD announced they'll supply semiconductors for a $10 billion AI data center project in Saudi Arabia. Elsewhere, UnitedHealth shocked investors by replacing its CEO and pulling its earnings guidance, a move that's raised eyebrows over how a former Wall Street darling got its cost forecasts so wrong. Meanwhile, Google has just dropped its biggest Android update in years, stealing a bit of the spotlight ahead of Apple's upcoming software reveal.

In summary, the JSE All-share closed up 0.51%, the S&P 500 rose 0.72%, and the Nasdaq was 1.61% higher. Super stuff.

Our 10c worth

One thing, from Paul

My "images only" week continues. Today's contribution is the re-publication of a meme I spotted online. Punchy!

Byron's beats

I have written about Starlink a few times. I'm a big fan, especially after using it while travelling to remote places in Southern Africa. You may be surprised by what I am going to say next, but hear me out. I do not blame our government for preventing Starlink from operating in South Africa without jumping through a few hoops.

MTN and Vodacom have been forced to deal with many regulatory hurdles to operate mobile data networks in this country. They have also ploughed in billions of Rands, building infrastructure, creating jobs, and connecting most of our country to the internet. Sometimes they have been forced to provide a signal in remote areas, even if it didn't make financial sense. But they did it to please the regulators.

I have no doubt that these companies are lobbying hard to prevent the entry of Starlink and for good reason. It would be unfair to let these guys in without similar treatment. If you disagree, let me know why?

Michael's musings

My approach to clothes shopping is to have fewer items of good quality, that I can wear for many years. This is one of the reasons why I haven't done any shopping on Shein; the quality levels generally aren't great. For years, my default sock brand has been Falke - easy to find and they are local.

While doing some reading on Falke's history, I learnt that they have expanded into the US, Australia, and New Zealand. It is great to hear of a local company doing well internationally.

Last year, I decided to try something different and to buy some sports socks from two large international sporting brands. Frustratingly, the quality has been disappointing, and all of them have lost their elasticity. My Falke socks from five years ago are still going strong. I suppose the moral of the story is, if it isn't broken, don't change it.

Bright's banter

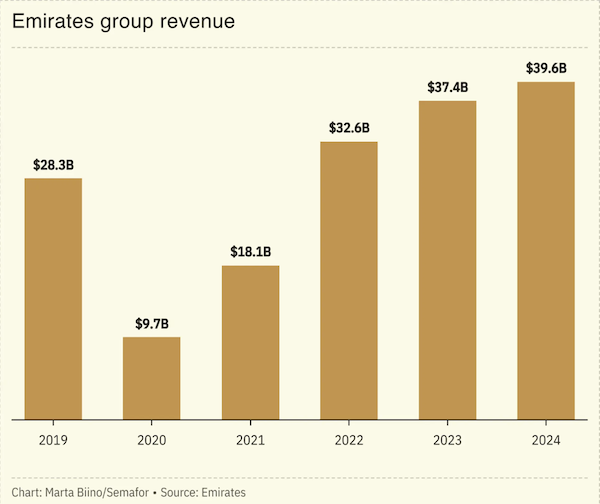

Dubai's Emirates airline just posted its biggest ever profit, clocking in at $5.8 billion pre-tax for the year ended March. That also makes it the most profitable airline in the world right now.

While some carriers are experiencing turbulence due to softer US travel demand and geopolitical worries, Emirates is cruising nicely, with passengers splurging on upgrades and international travel nearing pre-Covid levels.

Its aviation services arm, dnata, also delivered its best performance ever. The group will pay a $1.6 billion dividend to its shareholder, the Investment Corporation of Dubai.

Linkfest, lap it up

Covid screwed up the whole world. Some nations bounced back stronger, others haven't - Post-pandemic growth by region.

The World Video Game Hall of Fame welcomed new members. If you are a millennial, these games formed part of your childhood - Tamagotchi and Quake honoured.

Signing off

Asian markets climbed this morning, led by gains in the tech sector, as investors positioned ahead of key earnings reports from Chinese IT giants. Tencent reports today, with Alibaba set to follow tomorrow.

In local company news, Altron says full-year earnings from continuing operations could be up as much as 75%, thanks to a strong performance from its vehicle tracking unit, Netstar, which recently crossed the 2-million subscriber mark.

US equity futures are narrowly in the green pre-market. The Rand is at around R18.32 to the greenback.

Cisco has results out this evening. As usual, the world media is focused on one man: The Donald. Let's see what he gets up to today.

Go well.