Market scorecard

Markets roared higher yesterday after the US and China struck a deal to scale down the Trump-induced tariff war. The tech-heavy Nasdaq jumped 4.3%, closing more than 20% above its April low, the technical definition of a bull market. We stayed long and strong through this drama, so we are feeling vindicated. Let's see how long it takes before we are back at all-time market highs.

In company news, reports surfaced that Apple might hike iPhone prices and its stock rallied 6.3% on the day. Companies with complicated multi-country operations rallied hard - Amazon jumped 8.1%, Nike sprinted 7.3% higher, and Tesla revved up 6.8%. Metals and mining stocks fell as gold declined: AngloGold Ashanti dropped 10.3% and Gold Fields Limited sank 10.5%. Sorry chaps.

At the close, the JSE All-share closed up 0.34%, the S&P 500 screamed 3.26% higher, and the Nasdaq exploded by 4.35%. Wow, what a day!

Our 10c worth

One thing, from Paul

Stryker is a global leader in medical technologies with innovative products and services in surgical equipment, neurotechnology, and orthopaedics. They have been a Vestact-recommended stock since January 2014.

It's my turn to write about their recent quarterly results, which were very good, but I had promised an "images only" week, so I will confine myself to one line, and then post the image below.

Stryker has steadily increased its cash dividend every year since the last century - they even did so during Covid in 2020 and 2021, when elective surgeries fell off sharply.

Byron's beats

We are coming to the end of the first quarter of US earnings season, and it has been a solid showing. As it stands, earnings are set to be 12.5% higher than the first quarter of 2024 with over 75% of stocks beating estimates. The big tech stocks lead the charge again, with AI-related spending still powering ahead.

We should note that the first quarter ended before the tariff mess that started on 2nd April. It does seem that sense has prevailed and deals are being struck quickly enough to avoid long-term effects.

Again, it shows that selling in the middle of a crisis is the worst way to react. This market selloff felt horrible and "different" but the required response was the same - hold the line. Market volatility will never end, but the US market has survived yet another challenge.

Michael's musings

We weren't fans of "Liberation Day". These so-called retaliatory tariffs led to a market rout, with our portfolio of stocks dropping by up to 20%. Thankfully, most of those losses have been reversed.

One thing that hasn't recovered is oil, which dropped over 20% and is still down around 16%. A trade war means less trade, and less trade means decreased manufacturing and fewer global shipments. In April, Chinese exports to the US dropped 21%!

A lower oil price is great news because it's a significant driver of inflation. In the US, tariffs are already pushing prices higher, so lower fuel prices may act as a cushion. The market is still expecting three interest rate cuts from the Fed this year.

Here at home, petrol prices have fallen and inflation is finally below 3%, so we should also start to see interest rate cuts soon. Good news for anyone with home loans and debt.

Bright's banter

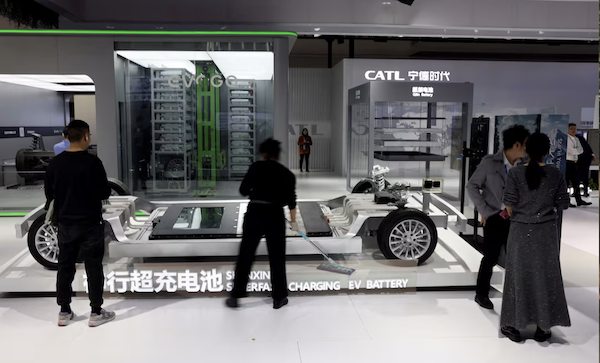

Chinese battery giant CATL is kicking off its highly-anticipated Hong Kong listing towards the end of May. They aim to raise at least $4 billion at a modest 5% discount to its Shenzhen-listed shares. At 248.27 yuan, CATL's domestic shares provide a rough benchmark, and the smaller discount suggests strong investor appetite despite ongoing US-China trade tensions.

The company has become a dominant force in the energy storage and electric vehicle ecosystem, supplying industry giants like Tesla and BMW. Founded in 2011, CATL rode China's early push into electric mobility and now commands over a third of the global EV battery market.

Cornerstone investors have already committed about $2.6 billion. The Kuwait Investment Authority and Sinopec are each in for $500 million, while Hillhouse Investment is contributing $200 million. This is a vote of confidence from Western investors.

Linkfest, lap it up

People are having fun online with Google Maps. Users vote every 10 seconds on where to drive a car next - This takes back-seat driving to the next level

It's time to take stock of your experiences, achievements, and overall well-being. Self-reflection is important - Gain clarity and identify areas of growth.

Signing off

Asian markets are in the green, taking their cue from Wall Street's upbeat finish. Japanese shares led the charge, with the Topix notching up its 13th consecutive gain, its longest winning streak in over a decade. Australia and Taiwan also saw solid moves higher. China lifted a ban on Boeing deliveries.

In local company news, Boxer's first full-year results as a listed company were a bit of a mixed bag. Headline earnings per share dropped 11.8% due to issue of new shares and other listing costs. On the plus side, turnover climbed 13.2% to R42.3 billion, and trading profit rose nearly 10% to R2.3 billion.

US equity futures are slightly lower. The Rand is at around R18.26 to the US Dollar.

Have a good Tuesday.