Market scorecard

A risk-on mood returned to Wall Street yesterday, with US stocks gaining ground as President Trump pitched his trade deal with the UK as a first step in reshaping the global economic order. That was enough to lift the S&P 500, which briefly broke above its 2 April high before momentum cooled. Economically sensitive sectors led the advance, reflecting growing optimism around trade and growth.

In company news, Shopify slipped 0.5% after posting mixed first-quarter results and a softer profit outlook for the current quarter. Elsewhere, Toyota warned that tariffs could cost them $1.2 billion in just two months, while Ford, already in retreat after pulling their guidance, responded by hiking prices on three of its top models.

In short, the JSE All-share closed down 0.66%, the S&P 500 rose 0.58%, and the Nasdaq was 1.07% higher.

Our 10c worth

Michael's musings

Apple released results last week, which were broadly in line with analyst expectations. Apple's size and momentum make its results fairly predictable. Revenue for the previous quarter was $95 billion, up 5%, resulting in profits of $25 billion.

The two most important segments are iPhone sales and services, which brought in $47 billion (up 2%) and $27 billion (up 12%), respectively. Overall sales in China came in at $16 billion, down 2%, and missing analyst estimates by $1 billion. Increased competition from Chinese companies and a souring of US relations hurt demand.

Apple also announced a 4% hike in its dividend and a $100 billion share buyback. Given its size, that $100 billion will only reduce the shares in issue by around 3%. Every bit counts though, over the last year shares in issue dropped 2.7%.

Thanks to its amazing brand, Apple has very high profit margins and is a money-making machine. As a result, its shares are rather expensive, trading on a forward P/E of 30, with sales only expected to grow in the mid-single digits in the future. That valuation is fine as long as Apple steadily grows and maintains its healthy profit margins. We are happy to have this fantastic company as a core holding.

One thing, from Paul

Here's a thought for a Friday, which is the day that I post non-market, philosophical commentary.

I've always believed that success in life requires the ability to delay gratification. That feeds into my approach to investing, which is to save as much as possible, and avoid excessive consumption.

This conviction was amplified many years ago by reading about the Marshmallow Test. That was an experiment conducted in the late 1960s at Stanford, where kids were put in a room with a marshmallow and given a choice: eat it now, or wait a few minutes and receive two marshmallows instead.

Early findings suggested that children who could wait tended to be more successful later in life, helping popularize the idea that self-control was a key ingredient in achievement.

However, more recent research suggests that a child's willingness to wait turned out to have less to do with self-control and more to do with trust. Kids who believed adults would keep their promises were more likely to wait. Kids from less stable backgrounds often took what they could while it was available. Choosing the marshmallow wasn't a failure of character. It was a rational response to uncertainty shaped by experience.

Perhaps I need to update one of my central beliefs? I'm still thinking about that.

Byron's beats

The only way for self-driving cars to go mainstream, and for the regulators to give them the green light, is for manufacturers to prove they're safer than human drivers. I see crazy people driving the streets of Jozi every day, so the bar is not high.

Waymo has a fleet of 1 500 self-driving taxis which have travelled over 56 million miles. Their data as of 1 May 2025 shows 92% fewer crashes with pedestrians and 82% fewer collisions with cyclists and motorcyclists. The data also showed a 96% drop in intersection accidents and 85% fewer crashes, which resulted in serious injury. So even when there are collisions, they are less dangerous.

I'm strongly in favour of self-driving cars and am enormously grateful that my kids will one day travel on safer roads.

Bright's banter

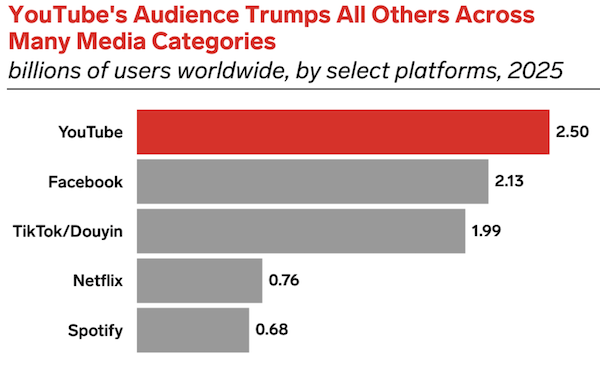

I love a good infographic, especially when it shows where the world's attention is really going. YouTube, for example, has a massive 2.5 billion monthly active user base, more than any other digital platform. That's even more impressive when you realise that YouTube isn't even available in China.

However, more users doesn't always translate to more money. YouTube may dominate in eyeballs, but when it comes to global digital ad revenue, Amazon leads the pack, followed by Instagram, ByteDance, TikTok, and even Pinduoduo.

We're happy holders of Amazon, Google (parent company of YouTube), and Meta (parent of Instagram).

Linkfest, lap it up

When big problems are solved, smaller ones start to seem bigger. Human progress means we're now worrying about little issues - Minimum levels of stress.

For decades people covered their bodies with tattoos. Now they're getting them erased as fast as they can - The pain of tattoo removal.

Signing off

Asian markets climbed on Friday, lifted by optimism ahead of this weekend's US-China trade talks. Japanese stocks rose 1.3%, marking an 11-day winning streak, the longest since October 2017. The MSCI Asia-Pacific index gained 0.4%, and is on track for a fourth straight week of gains.

In local company news, AB InBev posted a solid first quarter, with profits up 6.6% despite a 2.2% dip in overall volumes. The brewer leaned on stronger pricing and rising demand for its premium and no-alcohol ranges to deliver the earnings beat.

US equity futures are up pre-market. The Rand held steady at around R18.24 to the US Dollar.

Well done for surviving a 5-day week, take the next 2 days off.