Market scorecard

US stocks slipped on Monday, ending the S&P 500's longest winning streak in over 20 years, as uncertainty over trade policy put a dampener on sentiment. Ten of the index's 11 sectors closed in the red. Still, there was a silver lining: the ISM services PMI came in better than expected, rising to 51.6 in April from 50.8 in March, a sign that parts of the US economy are still ticking along nicely.

In company news, Palantir Technologies took a 9.3% knock in late trading after its results fell short of high investor hopes. ON Semiconductor also dropped 8.35%, not because it missed, but because its outlook didn't excite, despite a solid first-quarter beat. Meanwhile, Berkshire Hathaway ended the day down 5.12% following Warren Buffett's announcement that he plans to step down at year-end.

At the end of the day, the JSE All-share closed down 0.29%, the S&P 500 fell 0.64%, and the Nasdaq was 0.74% lower.

Our 10c worth

One thing, from Paul

Meta's first quarter results came out last week, and they were well ahead of expectations. Revenue for the 3 months was $42.3 billion, up 16.1% year-on-year. They are taking a larger slice of the overall digital advertising pie.

Their heavy investments in AI and infrastructure have created a deep moat, supporting continued user engagement growth on Facebook, Instagram, and WhatsApp, and delivering superior advertiser performance, at tremendous scale. The total number of people who access one of their services daily is now 3.43 billion, which is about 64% of the world's daily internet users.

Mark Zuckerberg is as hungry as ever. I think he might be the best CEO in America? Remember, he's the founder and controlling shareholder, not some hired hand. And he's only 40 years old.

Meta is a great business already, but they remain hugely ambitious. They are launching app-based AI tools to compete with OpenAI and Google and have a decent chance of breaking into search advertising (currently owned by Google).

They keep chipping away at wearables, especially web-connected eyeglasses, trying to capture some of the internet-access device market (currently owned by Apple).

Meta stock has traded higher since the results, rising above $600 per share again. The stock price is probably being held back somewhat by the heavy capex outlook. The all-time high is $740.91.

If you don't own Meta shares, now is a good time to add some to your portfolio.

Byron's beats

The media are making quite a fuss about Amazon founder Jeff Bezos' plans to sell around $5 billion worth of shares. Be careful not to form strong opinions based on the headlines you read; rather look into the details before getting carried away.

Firstly, the plan allows Bezos to sell 25 million shares over a period ending 29 May 2026. So he has over a year to offload these shares. It does not mean he has sold them immediately or is in a hurry.

Secondly, Bezos owns 910 million shares of Amazon, meaning 25 million is a tiny 2.7% of his total holding. This is pocket change for him.

Bezos has many side hustles, including space travel, yachts, and mansions. He's selling these shares so that he can enjoy his money, not because he thinks the company is in trouble. Let the man play!

Michael's musings

It's interesting to watch the pendulum of global politics swing back and forth. Last year, a number of countries elected right-leaning governments in response to widespread dislike of overtly leftist government policies. Woke issues and loose immigration policy were unpopular with many voters.

Fast forward a few months, and now things seem to have shifted again, with voters supporting anti-Trump parties. Recent elections in Canada and Australia have seen left-leaning candidates come out on top, despite trailing badly in the polls up to the start of this year. In both countries, getting attacked by Trump on trade issues sparked a counter-reaction.

The US is still very influential in global politics and economics. In my view, most voters are centrists and they like to push back if things seem to be swinging too far left or too far right.

Bright's banter

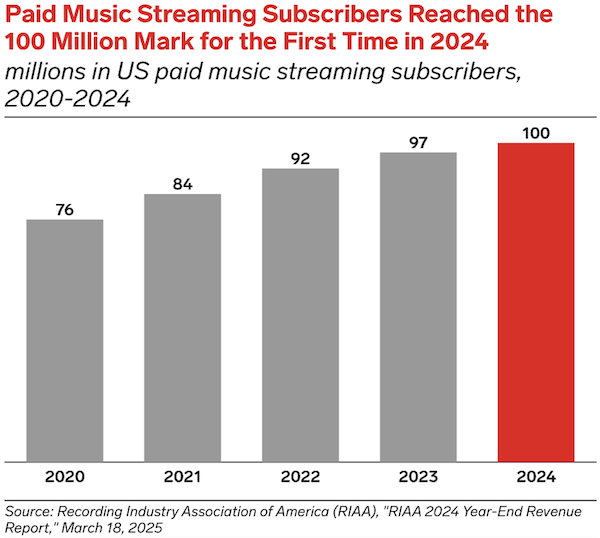

US digital audio subscription revenues are expected to hit $14.4 billion in 2025, making up nearly two-thirds of all digital audio revenues, according to eMarketer. Spotify leads the pack with over 105.8 million listeners, well ahead of Amazon Music (54.2 million) and iHeartRadio (51.5 million).

Apple Music isn't broken out in the Apple numbers, but older estimates from 2024 placed its US listener base at around 39 million, with a total number of subs at around 93 million, underscoring its strong position despite being more tightly integrated into Apple's ecosystem. It remains a major player, particularly among iPhone users and higher-income demographics.

Linkfest, lap it up

The AI boom is driving demand for data centres. Cities are offering incentives for their construction - Electricity supply can be a challenge.

Lady Gaga performed at a free concert in Brazil. This must have been a good party - Rio's Copacabana beach draws a record-breaking 2.5 million people.

Signing off

Asian markets are mostly in the green this morning, with mainland China leading the gains. India's Ather Energy edged up over 2% on debut this morning, with investors seemingly backing the electric scooter maker's strong R&D. Its $352 million IPO is the country's third-largest so far this year, with backing from the Abu Dhabi Investment Authority and Temasek.

In local company news, Astral Foods has warned that headline earnings for the half-year could drop by as much as 60%, as frozen chicken selling prices remain under pressure.

US equity futures are in the red pre-market. The Rand is trading at around R18.27 to the US Dollar.