Market scorecard

US markets were all over the place yesterday, but a late surge of buying pulled the S&P 500 back into the green, stretching its winning streak to five straight sessions. It was another classic case of whiplash, for the fifth time in a month, the index fell more than 1% during the day before snapping back. Boeing (+2.4%) and IBM (+1.6%) led the charge among the blue chips.

In company news, Nvidia slipped 2% after reports surfaced that Huawei is gearing up to test a new AI chip of its own. While the market didn't panic, the drop suggests investors are watching the China tech race closely - and maybe wondering if Huawei's "innovation" came with a little too much inspiration from Nvidia's playbook?

On Friday, the JSE All-share was up 0.19%, but yesterday the S&P 500 rose 0.06%, and the Nasdaq was 0.10% lower.

Our 10c worth

One thing, from Paul

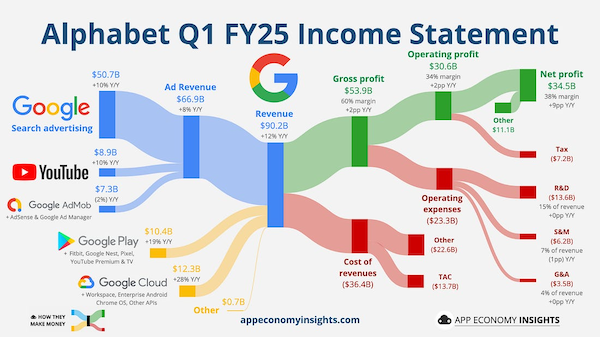

Google reported results last week that blew past expectations, along with a 5% dividend increase and $70 billion in stock buybacks. Earnings per share were $2.81, much more than analyst estimates of $2.02.

Ads sold on Google's search platform rose 8.5% to a gargantuan $66.9 billion for the quarter. Have you tried 'AI Mode' in a normal Google search? It's really impressive!

Revenue from the important Google Cloud hosting business rose by 28%. YouTube had another stellar year, rising to 125 million subscribers and raking in lots of cash.

Google does have some problems. US regulators are attacking them in court, threatening to force them to sell the Chrome browser business. A deal with Apple to make Google the default search may be banned. And a recent court ruling labelled its ad business a monopoly.

Google probably has too many employees. I read that there are 184 000 people on their payroll and only about 500 work on the core search business (described above, and 75% of group revenue). What do the rest of them do? Work from home? Come into the office for the free food and massages, and then email each other all day?

CEO Sundar Pichai should cut some overhead, starting with the staff complement. That would transform their profit margins, and maybe improve the share rating. Google trades on a price-to-earnings ratio of 17.8, which is too low. Meta is on 22.8 times and Microsoft is on 31.2 times.

Byron's beats

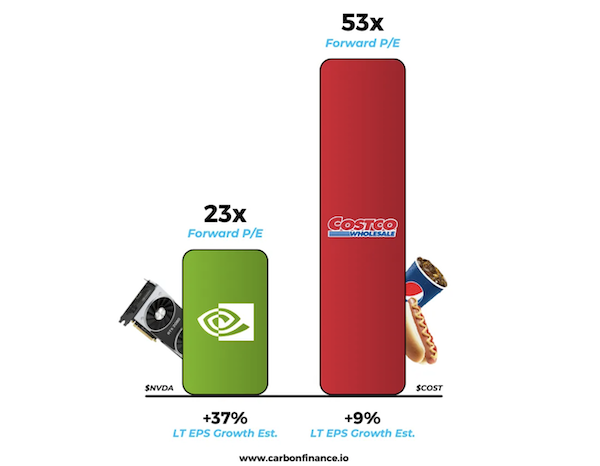

The team at Carbon Finance (they have a great Substack if you are interested in subscribing) noticed an interesting anomaly. High flying, fast growing, Nvidia currently trades around 23x forward earnings while sluggish Costco is fetching 53 times. The long-term expectation of earnings growth for Nvidia is 37%, while Costco is expected to deliver 9% per annum.

Because Nvidia has done so well recently it falls hard when general market sentiment goes negative. The market has nothing to do with the company, that is just the way the cookie crumbles.

If you missed out on the Nvidia train, I think now is a good time to be buying some. You are getting a great business for a pretty decent price.

Michael's musings

Last week Stats SA released a great inflation print. Official inflation for March was 2.7%, down from 3.2% in February, and is now below the SARB's target range of 3-6%. The big reason for inflation slowing is that fuel prices have come down nicely over the last year. According to Stats SA data; "A litre of 95-octane petrol (inland) was R22.34 in March, down from R24.45 a year before." More petrol price cuts are coming next month.

Many South Africans are doing annual salary reviews at the moment; it is weird to think that a 3% salary increase is now considered above inflation. It will take a mental adjustment from thinking that increases need to be between 6-10%. While South Africans adjust their long-term inflation and salary expectations, the SARB should use this opportunity to officially drop its inflation target to 3%.

The experiment of anchoring inflation at 4-6% hasn't worked. We have the unique opportunity of rebasing inflation without causing an economic catastrophe.

Enjoy this low-inflation environment. Apart from protecting the value of your money, it also means that interest rate cuts are on the horizon.

Bright's banter

Did you know that Google has a stake in SpaceX? This investment added rocket fuel to the quarterly numbers. Hidden in the fine print was an $8 billion boost from an early, long-forgotten bet on SpaceX.

Back in 2015, SpaceX was a more hopeful startup than what it is today. Google and Fidelity ploughed a combined $1 billion into the company for a roughly 10% stake. Fast forward to December 2024, SpaceX has a jaw-dropping $350 billion valuation, making it the world's second-most-valuable private company behind TikTok's parent, ByteDance.

Google's share of the 2015 SpaceX investment (about half the $1 billion) could now be worth around $17.5 billion, almost 35x the original investment. That's nearly the market cap of companies like Goldfields or T Rowe Price, from what was basically a "non-core" side hustle.

SpaceX itself isn't slowing down. The company is generating around $9 billion in annual revenue, with Starlink and commercial launches doing the heavy lifting. They are aiming to hit $15 billion revenue by next year, and rumours are swirling about a potential Starlink IPO by late 2025 or 2026.

In March, SpaceX notched its 300th successful orbital launch, a record that cements its dominance in the commercial and government space race.

Linkfest, lap it up

Some events shape society. It isn't just 1.4 billion Catholics who will be following the election of a new pope - 'Conclave' movie viewership soars after Pope Francis' death, up 283%.

Some of us love maths and stats. But not every problem can be solved by that - How to cure 'premature enumeration'.

Signing off

Asian stocks climbed to their highest levels in a month, fuelled by optimism that President Trump might soften the blow from his proposed auto tariffs. Hopes for a broader easing of trade tensions lifted the MSCI Asia-Pacific Index, with South Korean automakers like Hyundai Motor leading the charge. A White House official indicated that imported cars could catch a break from separate tariffs on aluminium and steel, giving markets a fresh dose of relief.

In local company news, the JSE is getting a new tech company on its bourse, the US-listed ASP Isotopes (ASPI) plans a secondary listing later in 2025. Elsewhere, Caxton wants to tidy up its shareholder list by offering to buy out investors who own fewer than 100 shares. Turns out, about a third of their 5 498 shareholders are "odd lot" holders, but together they make up just 0.27% of the company.

US equity futures are in the green pre-market. The Rand is trading at around R18.55 to the US Dollar.

Enjoy another short week.