Market scorecard

US markets had a rough week, with the S&P 500 sliding 3.1%, its worst weekly drop since early September. Friday's session was volatile, but stocks managed to close slightly higher after a long day of wild swings. For reference purposes, we are now 6.13% lower than the all-time high a month ago. We have to take the rough with the smooth.

February's employment report showed 151 000 jobs added, slightly below expectations. The unemployment rate ticked up to 4.1% instead of holding steady.

In company news, McDonald's shares climbed 4.2% for the week, as investors bet on its resilience during economic slowdowns. Hamburgers from the Golden Arches are always a popular family option if your monthly food budget has run out. Elsewhere, DoorDash, TKO Group, Williams-Sonoma, and Expand Energy are set to join the S&P 500 as part of the index's quarterly rebalancing.

On Friday, the JSE All-share was up 0.35%, the S&P 500 rose 0.55%, and the Nasdaq was 0.70% higher.

Our 10c worth

One thing, from Paul

Vestact's benchmark is the S&P 500. That's because we invest in large-cap US stocks, which are that index's constituents. Each year we check to see if our model portfolio has done better than our benchmark (after costs, of course).

We focus on technology, healthcare, and consumer companies, but theoretically, we could also buy financials, industrials, and/or real estate, retail, or even railroad stocks. We probably won't, but we could. One day, we might add stocks in the "space travel" sector.

By the way, Standard & Poor's introduced the "Standard '500' Index" in 1957. It was revolutionary at the time because it used a "scientific formula" to measure the US stock market. That was the pitch, but all they were doing was weighing the index by market capitalisation. Easy to do now with dynamic Excel spreadsheets, but a bit harder back then when everything was manual.

The picture here is from Finviz, and the size of each box is determined by that company's market cap. The colours are red or green depending on the gains or losses in the past 3 months.

Byron's beats

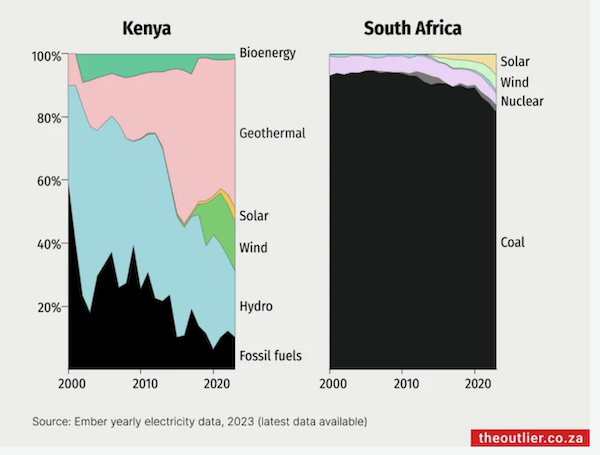

Energy is another topic that is very polarised these days. The far left believes that countries should be forced into renewables even if that compromises their economic growth or energy security. The far right believes that climate change is fake news and fossil fuels are still the best source of energy and all jobs in these sectors need to be protected. Of course, that's a rather crude characterisation, but you get my drift.

As with most things in life, a balance between these two extremes will most likely be the best outcome. Phase in the renewables with strong incentives while still leaning on fossil fuels to smooth the transition.

I was very interested to see the comparison of energy generation between South Africa and Kenya, provided by The Outlier team. Each country is playing to their own strengths and natural resources. South Africa has been blessed with huge coal deposits which we should continue to burn through, especially for mining and industrial uses. Going renewable for households, however, should be strongly incentivised by the government. The wonderful people in charge of South Africa have already done that, albeit by mistake, via loadshedding.

Michael's musings

Sometimes, all you need to succeed is confidence and a good story. Billy McFarland is famous for organising the 2017 Fyre Festival. The event was a complete disaster and a fraud which resulted in McFarland going to prison.

With his jail time behind him, Fyre Festival 2 is scheduled to take place at the end of May. Experience packages cost between $1 400 to $25 000, and an exclusive VIP package called Prometheus The Fyre Starter, is priced at a steep $1.1 million.

Interestingly, no performers have been confirmed yet. I suppose no big artist wants to be associated with the Fyre brand until it is clear that this festival will be a success. A bit of a chicken and egg problem - fans won't buy tickets until they know who will be there, and artists won't commit until they know there will be fans.

I have my doubts that the festival will happen. You have to give McFarland some credit though, not many people would have the guts to promote Fyre Festival 2 after the complete shambles of the first Fyre Festival. If this thing does go ahead in May, it is purely down to McFarland's self-belief.

Bright's banter

Klarna is gearing up again for a US IPO, aiming to raise at least $1 billion at a valuation north of $15 billion. The Swedish buy-now-pay-later payments giant could file publicly as soon as this week, with IPO pricing expected in early April.

Klarna was founded in 2005 by CEO Sebastian Siemiatkowski, and saw its valuation skyrocket from $5.5 billion to $46.5 billion during the 2020-2021 boom, only to crash to $6.7 billion in 2022. This forced the company to delay its listing.

This time their public debut will be led by Goldman Sachs, JPMorgan, and Morgan Stanley, and could breathe life into the sluggish tech IPO market.

Linkfest, lap it up

The race to build the best AI model is on. The big US tech companies are not the only horses in the race - Tencent says its latest AI model is faster than DeepSeek.

The Ithala Bank drama keeps getting worse. The Prudential Authority is trying to secure a liquidation order - One foot in the grave and the other on a banana peel.

Signing off

Asian markets are in the red this morning, with the MSCI Asia-Pacific index down as weak economic data from China weighs on sentiment. China's consumer inflation unexpectedly turned negative for the first time in 13 months. Adding to the gloom, Beijing announced retaliatory tariffs on Canadian imports, including rapeseed oil, pork, and seafood, escalating tensions.

In local company news, Rainbow Chicken's turnaround strategy is paying off. Revenue climbed 8.9% and headline earnings surged to 35.64c from just 2.46c a year ago. Elsewhere, Sanlam had a strong year, with solid growth across its insurance and investment businesses. Headline earnings per share climbed 37%, mostly due to organic growth.

We shouldn't bother looking at US equity futures so early on a Monday. For the record, they are slightly lower.

The Rand is trading at around R18.28 to the US Dollar. This time the exchange rate has improved as the market has fallen, which is unusual, so if you have some ZAR saved up, send it to your USD investment account with us today.

Another week, another time to shine.