Market scorecard

US markets bounced back last night as Trump granted a one-month auto tariff exemption for Mexico and Canada. It's a clown show folks. Tech stocks led the charge, while Ford, GM, and Stellantis all rallied over 5%.

In company updates, Disney is cutting 6% of its news and entertainment staff, nearly 200 jobs, with ABC News and politics-focused site 538 taking the biggest hits. Elsewhere, Moderna (+15.9%) got a shot in the arm from its CEO, who bought $5 million worth of shares this week. Lastly, Grindr missed fourth-quarter earnings and 2025 margin forecasts, sending its stock 7.7% lower. They'll have to grind hardr in future.

At the close, the JSE All-share was up 1.14%, the S&P 500 rose by 1.12%, and the Nasdaq bounded 1.46% higher. Ok, let's build on this, please.

Our 10c worth

Michael's musings

When markets are jittery they tend to overreact to news. On Tuesday night, Crowdstrike reported stronger-than-expected numbers for their past quarter but marginally missed profit expectations for the year ahead. As a result, the stock closed down 6.4% yesterday.

Revenue for the quarter was up 25%, with the more sticky and important ARR (annual recurring revenue) up 23% to $4.2 billion. The company forecasts that it will have $10 billion in ARR by 2031. Very solid growth, that's what we like to see.

A big contributing factor to the adjusted outlook is the concessions they gave to key customers after their global outage in July last year. They agreed to give longer free trials, or offer complementary bolt-on packages, or do some discounted work. These distortions should work their way out of the numbers after this year.

CrowdStrike handled that outage very well, considering that it could have been a company-sinking event. Instead, customers chose to stick with them, thanks to their market-leading products and best-in-class customer service. There was no better test of the sticking power of future contracts and revenue, and it is why we back management to more than double sales in the next five years.

Crowdstrike is a higher-risk holding, as displayed by the volatility in its share price. It is one of our "future hero" stocks, so we only initiate smaller positions for our more risk-tolerant clients.

One thing, from Paul

Betteridge's law of headlines is an adage that states: any headline that ends in a question mark can be answered by the word no. It's named after Ian Betteridge (the guy in the picture), a British technology journalist who wrote about it in 2009.

It's based on the assumption that if the publishers were confident that the answer was yes, they would have presented it as an assertion; by presenting it as a question, they are not accountable for whether it is correct or not.

Here are some examples: "Are Electric Vehicles a Flash in the Pan?", "Will these Startups Challenge Google's Dominance in the Search Business?", "Will There be a Sustainable Base on Mars by 2026?", and "Is the US Market About to Crash?".

If you are not convinced, perhaps you need a few more wild examples: "Is Vladimir Putin Now the Most Powerful Man in the World?", "Will Melting Polar Ice Caps Drown All Coastal Cities?", or "Do Low Fertility Rates Signal the End of Humanity?"

Or finally, "Will Trump Destroy Western Civilization?"

The answer to all of those is a firm "No". Keep calm and carry on.

Byron's beats

Shoprite is a well-run business that has proven to be very innovative (Checkers 60) and has executed on its goals well for the last decade. This shows in their market share gains amongst South African retailers.

Despite doing all these wonderful things, the Shoprite share price is only up 78% in 10 years. It marched as high as R265 a share in 2018. Today it trades at R271. As a large retailer, you can only do so much, but if the main economy you are operating in is going backwards, it is going to be a struggle.

By comparison, Walmart is up 217% in 10 years and that's in US Dollars. At the beginning of 2015, 1 USD was worth R11.38. That company has been operating in a strong economic environment and you can see it in the equity returns.

Why invest in companies that are swimming against the tide when you can buy shares with the mighty US economic tailwind?

Bright's banter

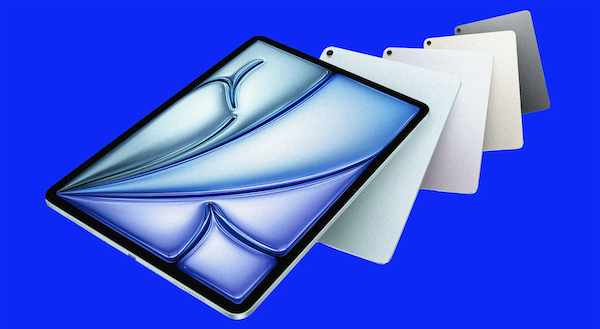

Apple has refreshed its iPad lineup, introducing a new iPad Air with the M3 chip, a redesigned keyboard, and an upgraded entry-level tablet. The latest iPad Air, available in 11-inch and 13-inch sizes ($599 and $799), now runs twice as fast as the M1 version. AI tasks also perform 60% faster than the 2022 model.

Apple is keeping the iPad Air's design unchanged but has upgraded its Magic Keyboard with a larger trackpad, a metal hinge, and function keys ($269 or $319, depending on size). The base iPad also gets a boost, moving to the A16 chip for a 30% performance jump, priced at $349.

Orders are open now, with shipments beginning on the 12th of March. Meanwhile, Apple is working on an M5-powered iPad Pro, expected later this year or in early 2026. A MacBook Air refresh with the M4 chip is also on the horizon.

Apple is for winners.

Linkfest, lap it up

You want to cut down on information overload? Curate your sources properly - Focus on the outcome.

The first successful moon landing by a private company happened on Sunday. Another company is hoping to land their spacecraft on the lunar surface today - Blue Ghost aces moon touchdown.

Signing off

Asian markets are rallying for a second day, pushing the MSCI Asia-Pacific index higher. Hong Kong, mainland China, Japan, and South Korea are leading the charge, while India and Taiwan are still warming up.

In local company news, Old Mutual headline earnings are projected to rise by up to 30% to R9.6 billion. Elsewhere, Woolies posted a 25% drop in half-year earnings, weighed down by a struggling clothing segment, particularly Country Road. As usual the food business was a standout, with turnover up 11.4%. We buy all of our office fruit snacks from their Rosebank store.

US equity futures are slightly in the green pre-market. The Rand is trading at around R18.29 to the US Dollar.

Stay cool.