Market scorecard

US markets were all over the map yesterday, with wild swings keeping traders on edge. The S&P 500 dropped back to pre-election levels as fears of a trade war rattled investors.

Old-school automakers sank as investors worried that the higher costs of parts from Canada and Mexico will cut profits: Ford fell 2.9%, General Motors dropped 4.6%, and Stellantis sank 4.4%. But after hours, reports that Trump may be considering a tariff compromise with those two countries sparked a rally. It's a circus out there!

In other company news, CrowdStrike delivered a solid earnings report, but the stock tumbled 9% as its outlook for the first quarter of 2025 came in weaker than expected. Elsewhere, Google is reportedly lobbying the Trump administration's Justice Department to reconsider efforts to break up the company, arguing that such a move could pose national security risks.

At the close, the JSE All-share was down 0.95%, the S&P 500 fell 1.22%, and the Nasdaq was 0.35% lower.

Our 10c worth

One thing, from Paul

Some investors are greedy, and they never learn. I'm thinking specifically of those who give hedge fund cowboys lots of money to speculate with.

Nicholas Maounis (in the picture here, with his wife) was responsible for one of the biggest hedge-fund disasters in history. In 2006 his fund, called Amaranth Advisors lost over $6 billion in a few days, thanks to some idiotic trades in natural gas futures that went awry. Amaranth blew up and was shut down.

Two years later, in 2008, Maounis launched a new fund called Verition with about $185 million of his own money (cash from fees charged before the Amaranth collapse).

Hedge funds typically charge 2% per annum, and then gobble 20% of any gains. There is only one winner in a hedge fund, and it isn't the investors.

As of today, Maounis is managing $11.8 billion at Verition Fund Management. Goodness knows why investors place funds with him? They are probably hoping for a "home run". Last year the fund returned just 11.6%. A low-fee S&P 500 index fund gained by 23%. The Vestact long-only portfolio was up 40%.

Verition is a "multimanager" firm, backing 140 trading teams, each managing a small percentage of the firm's overall assets while betting on various markets, including such niches as Canadian convertible bonds.

Byron's beats

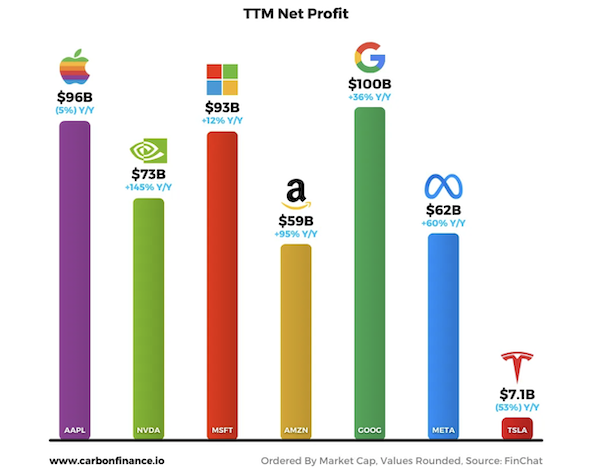

Have you ever wondered which company is the most profitable in your portfolio? The team at Carbon Finance have made a lovely image showing the net profits for the Magnificent 7 over a trailing twelve-month period.

I was a little surprised to see Alphabet on top of that list when you consider that its market cap is only the 5th biggest out of the seven. Apple is nearly twice its size. Here is the current top 5 by market capitalization:

Apple - $3.632 trillion

Nvidia - $3.048 trillion

Microsoft - $2.951 trillion

Amazon - $2.249 trillion

Alphabet - $2.087 trillion

Meta - $1.65 trillion

Tesla - $890 billion

In terms of valuations Alphabet and Meta are definitely looking the most attractive at current levels. Of course, there are other things to consider. If you factor in Nvidia's projected 50% earnings growth over the next 12 months that stock also looks attractive.

Michael's musings

We've had a few rough days on the market. Monday night was particularly unpleasant - the worst day for 2025 so far. Vestact clients really felt it given that Nvidia, a core holding, dropped 8.7%.

The market volatility, coupled with controversial decisions coming out of the White House has prompted a number of clients to ask if they should be selling. The short answer is no. Trump will be in office for the next 4 years, but most clients will still hold these shares for another 20 years.

I took advantage of Monday's drop by adding to my personal portfolio yesterday. The best time to buy is when the cash is available, which is what I did.

Things might get worse from here as Trump doubles down on his threats. Or the market could have a massive rebound because these recent tariffs could disappear as quickly as they arrived. I have no idea what will happen in the short term. I do know with reasonable certainty that the shares I own today will be higher in years to come.

Bright's banter

Prada is reportedly closing in on a deal to acquire Versace from Capri Holdings for nearly EUR1.5 billion ($1.6 billion), according to Bloomberg. If finalised, the deal could be completed as early as this month.

Capri, which also owns Jimmy Choo and Michael Kors, originally acquired Versace in 2018 for EUR1.83 billion, including debt. Prada has had priority access to Versace's financials, giving it an edge over other potential buyers.

Linkfest, lap it up

Your earbuds are gross. When really dirty they look bad, give poor sound quality, and cause infection - Banish that ear gunk.

South Africa's finances are a mess. To be fair, the Reserve Bank does a good job in protecting the value of the Rand - Lesetja Kganyago says inflation target review still on the table.

Signing off

Asian markets rallied this morning, with the Asia-Pacific index breaking a four-day losing streak. Chinese shares in Hong Kong led the gains after the National People's Congress in Beijing reaffirmed its economic growth target of around 5% for 2025, the third consecutive year it has stuck to this goal.

In local company news, Discovery delivered strong half-year results, with headline earnings up 34%. The South African business saw a 27% rise in operating profit. Discovery Bank continued to scale, with revenue up 42% and monthly operational break-even now achieved. The group's stake in Ping An Health Insurance also performed well.

US equity futures are unchanged pre-market. The Rand is trading at around R18.48 to the US Dollar.

Don't worry, be happy.