Market scorecard

US markets took a hit yesterday, with the S&P 500 posting its worst drop of the year. The selloff came after the US president ruled out tariff exemptions for Mexico and Canada, and imposed another 10% on trade with China. On top of that, weak manufacturing data weighed on sentiment. The vibes are not good at the moment.

The market has been on a rollercoaster ride, with the S&P 500 swinging by at least 1.5% in both directions for three straight sessions, something we haven't seen since March 2020.

In company news, Taiwan Semiconductor (TSMC) is ramping up its US expansion plans with an additional $100 billion investment in new chip plants. Elsewhere, AbbVie announced a $2.2 billion deal to buy a next-gen obesity drug from Danish biotech firm Gubra. Finally, grocery company Kroger fired their CEO Rodney McMullen due to problems with his "personal conduct" not involving any colleagues. What did he do?

Yesterday, the JSE All-share was up 1.89%, but the S&P 500 fell 1.76%, and the Nasdaq was 2.64% lower. A nasty flop.

Our 10c worth

One thing, from Paul

It's tough to understand what's going on in the world of geopolitics right now. What is the US up to? What will Trump do next? Will NATO exist a few years from now? Imagine how people feel in Sweden, Finland, Poland and the Baltic States. And Ukraine, obviously. And Taiwan.

We are all battling, updating our mental models in real-time, and trying to decide where we stand on all these policy shifts.

In an uncertain world, it's refreshing to see some predictable research. University academics in the Netherlands, found that fish and chip shop density in the UK was correlated with higher Brexit vote share. By contrast, areas with more Japanese restaurants had lower Brexit support.

Read all about it here: fish, chips and leaving the European Union.

By the way, we are still very positive about the outlook for our portfolio companies, regardless of all this political noise. Wait for the dust to settle, and don't get too excited or depressed. It will all work out in the end.

Byron's beats

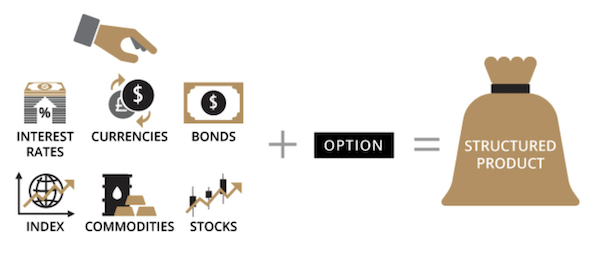

I have come across a few people (not clients) who have told me that they are in structured products that guarantee them market equivalent returns with no downside. This is of course impossible. No financial institution will guarantee you equity-related returns and take all the downside risk themselves. It just makes no financial sense.

Either you have misread the terms or you are in a Ponzi scheme.

There are legitimate structured products that do limit your downside, but that comes at a high cost because buying protection against losses is expensive. So, your fees will be high and your upside will be capped. Do your research before jumping into these products. It's far better to own direct stocks, with no overlay.

Michael's musings

Is it better to die with millions in the bank or to spend your last Rand on the day you croak? If we knew with 100% certainty when we would die, I think most people would go with the latter option. Leaving an inheritance for your children is nice, but it isn't everything. If you teach your children resilience, give them a good education, help build their network of people, and maybe provide funds to assist in starting a business, then an inheritance when you die isn't all that important.

Knowing how much to spend today is a tough question. On the one hand 'YOLO' (you only live once), but what if I live to 95, which would be expensive?

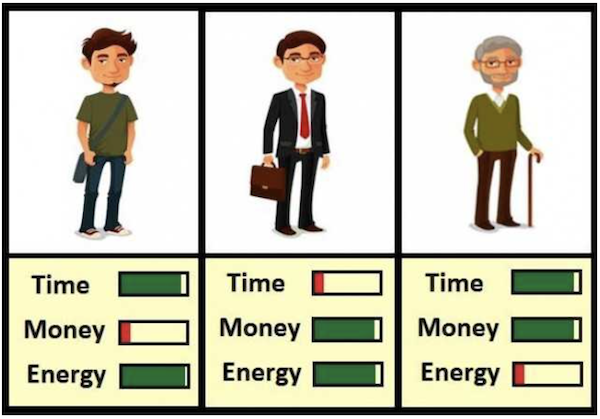

There is a limited period in life when time, money and health overlap. In most phases of our lives, only two of those three things are in place. For the early part of our lives, money is usually the element that is missing.

When you are young, you have to balance saving for your old age, with doing things that you can only do while you are young even though they are expensive. Remembering too that the earlier you start saving, the more time it has to compound.

The answer to these challenges is to draw up a budget when you don't have any spending pressures on your mind. When creating the budget, work backwards, starting with how much you want to save each month, and then work out how to spend what is left. The key is to not get into debt due to excessive consumption.

Bright's banter

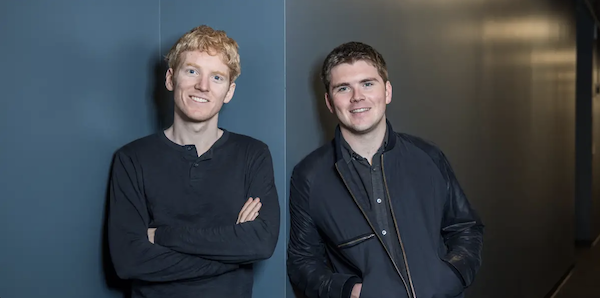

Digital payments giant Stripe, which is still privately held, announced a tender offer last week to employees and existing shareholders, who are allowed to sell shares at a $91.5 billion valuation, a 41% jump from last year's $65 billion mark. That's still shy of its $95 billion peak in 2021.

Stripe's 2024 payment volume surged 38% to $1.4 trillion, though still a fraction of Visa's $13.2 trillion. The company also revealed that half of the Fortune 100 now use its platform, with high-profile clients including Amazon, Hertz, Instacart, OpenAI, and Elon Musk's X.

Despite persistent IPO speculation, Stripe appears to be in no rush to go public, instead bringing in new outside shareholders and in the process offering liquidity to employees.

Linkfest, lap it up

Quantum computing is pushing boundaries. Scientists created a new state of matter - The coldest place in the known universe is in a Microsoft lab.

What is the point of financial freedom if we never feel free? The real prison isn't material, it's psychological - The point of F-you money.

Signing off

A broad selloff in equities extended to Asia this morning, pushing the Asia-Pacific index to its lowest level in a month. Market sentiment took a hit after China's Ministry of Commerce reaffirmed plans to countermeasure US tariffs. This follows President Trump's decision to double tariffs on Chinese goods to 20%.

In local company news, JSE Limited reported a 5.6% rise in full-year revenue to R2.97 billion. Elsewhere, Italtile delivered a stronger six-month performance, with trading profit climbing 3% to R1.2 billion on turnover of R6.1 billion.

US equity futures have edged higher in early pre-market trade. The Rand is at around R18.64 to the US Dollar.

Let's see what today's news will bring. We will roll with the punches.