Market scorecard

Sloppy conditions continued in the US last night, as markets slipped back from the all-time highs reached last week. Consumer confidence data was published yesterday, and it slid to a level last seen in August 2021. The tech-heavy Nasdaq extended its losing streak to four days. Nvidia dipped 2.8% but has its earnings release tonight. We are excited!

In company news, Eli Lilly rose another 2.3%, cresting $900 per share after launching a cheaper, single-vial version of Zepbound, its blockbuster obesity drug, to fend off copycats. Elsewhere, Krispy Kreme plunged 21.9% to a new record low after disappointing sales of doughnuts.

Here's the lowdown, the JSE All-share was up 0.38%, but the S&P 500 got clipped by 0.47%, and the Nasdaq sagged by another 1.35%. On we go.

Our 10c worth

One thing, from Paul

One of humanity's oldest debates is whether outcomes are more a function of nature or nurture. In other words, are the things that happen to us pre-ordained because of our genetics, or can a solid upbringing, hard work and sound decision-making lead to a better future?

It's increasingly clear that to prevent poor health, nurture (not smoking, getting exercise, avoiding risky conduct) is more important than nature (who your parents were). In new research just published, a joint team from Oxford and Harvard found that external factors were almost 10 times more likely than genetic risk to explain premature death.

What about personal financial outcomes? In 2025, people have a better chance than ever to transcend their class origins. If you come from a tough background, you do not need to stay poor forever. It's not easy, but you can do it. Education, discipline and regular saving will transform your prospects.

Conversely, you may have been born into a rich family, but if you spend recklessly and make foolish investments, you can easily blow up your family's generational capital.

Byron's beats

In early February the CEO of YouTube, Neal Mohan, released an article titled Our big bets for 2025. YouTube turns 20 this year and as Neal mentions in the piece, the platform has become the epicentre of today's culture.

I get a lot of clients sending me stuff that may be of interest for someone who follows US markets. These days, 90% of what is sent are YouTube clips made by some independent journalist pushing an agenda. It is up to you, the viewer, to determine whether it is of interest or complete BS.

Mohan also says that YouTubers are becoming the startups of Hollywood. I have not watched any of Mr. Beast's content on YouTube, but while travelling a few weeks ago I watched his new Beast Games series on Amazon Prime and it was loads of fun.

YouTube is the new television, according to the CEO, and I agree. The use of AI to feed you the right content is only going to enhance the experience. We are happy investors in YouTube via our holding in Google.

Michael's musings

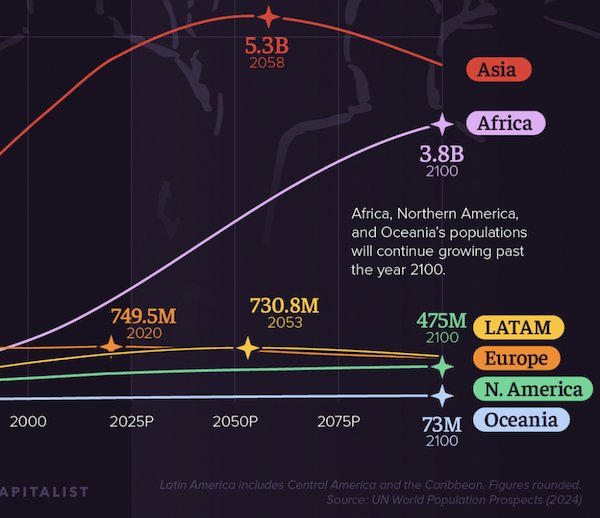

I've written about population growth a few times in this newsletter. Population numbers and demographics play a huge role in how a society operates, and also impacts which companies thrive or fail. As I wrote yesterday, Gen Z has very different drinking habits to previous generations.

China and Europe already have shrinking populations, which affects housing markets. Labour shortages are also a problem, so Spain is trying to make it very easy for immigrants to come work and live in their country. Even Trump acknowledges the need for skilled immigration into the US.

Latin America and Asia are expected to see their populations peak in about 30 years. The only continent where birth rates aren't slowing is Africa, and the forecast is for at least an extra 2 billion people to be living on the continent by the end of the century. Read more here - When every continent's population will peak.

Africa is a big place, but there is massive poverty too. The whole African continent produces less than France, and is roughly half that of Germany's GDP. With an extra 2 billion young people, I suspect that there will be some pretty big political upheavals. Along the way, there will be big opportunities too. Stay tuned; the coming decades will be interesting.

Bright's banter

Founded in 2021 by former OpenAI employees, including CEO Dario Amodei, Anthropic was built on the idea of developing safer and more controllable AI models. Their Claude chatbot is gaining traction, particularly among developers and businesses, though it still trails OpenAI in consumer adoption.

Anthropic has just locked in a $3.5 billion funding round at a massive $61.5 billion valuation. They were originally only seeking $2 billion, but upped that after receiving strong investor demand.

Anthropic's annual revenue hit $1.2 billion, but it's still burning cash. By comparison, OpenAI projected $3.7 billion in revenue last year and is reportedly looking to raise up to $40 billion at a $300 billion valuation.

Linkfest, lap it up

Lab-grown diamonds are taking over. In 2011, Anglo American paid the Oppenheimer family $5.1 billion for their 40% stake in De Beers - Diamond company gets a $2.9 billion write-down.

The problem with socialism is that you eventually run out of other people's money. Tim Cohen highlights some places that South Africa could cut back on wasteful government expenditure - How to avoid another VAT increase.

Signing off

Asian markets opened higher this morning, with Hong Kong leading the rally. The boost came after DeepSeek reinstated access to its core programming interface following a nearly three-week suspension.

In local company news, school operator Curro is expecting a solid financial year, with earnings per share set to jump between 117% and 217%. This boost comes despite expected impairments of up to R380 million on underperforming school assets.

Tonight, Nvidia will report its latest quarterly numbers. We expect these results to influence the market's mood for the rest of the week. US equity futures are in the green pre-market. The Rand is trading at around R18.43 to the US Dollar.

Have a good one.