Market scorecard

The S&P 500 and Nasdaq both stumbled midway through the trading session and ended in negative territory. Markets were pained by President Trump saying that tariffs targeting Canada and Mexico "will go forward" next week. We shall see.

In company news, Berkshire Hathaway closed up 4% after it reported good operating earnings in the fourth quarter, thanks to a solid performance from their insurance business. Elsewhere, Domino's Pizza's US sales fell short of expectations, underscoring the growing challenge of attracting budget-conscious consumers. Finally, Nike had a good day, up 4.9% after Jefferies analysts said it was "a good turnaround investment". It's about time.

At the end of the trading day, the JSE All-share was down 1.68%, the S&P 500 fell 0.50%, and the Nasdaq was 1.21% lower. Eish.

Our 10c worth

One thing, from Paul

Donald Trump, Elon Musk and members of their "DOGE Force" want to cut the numbers of Federal Government workers in America. I have no view on this matter because I'm not a US resident, citizen or taxpayer. I apologize for the picture shown here, LOL.

There are about 3 million federal employees nationwide. The US Postal Service employs 628 000 of them. In addition to those there are 1.3 million active-duty military personnel. Sounds like a lot, but then again, it's a big country.

The only Federal Government employees I routinely run into are the Transportation Security Administration (TSA) screeners at US airports. There are 45 000 of them. I'd prefer if they all went away?

In more interesting news, Apple said Monday that it will create 20 000 jobs at a new manufacturing facility in Houston. That's part of Apple's $500 billion investment in the US over the next four years, mostly related to AI services. Sounds good! The private sector remains the engine of economic growth.

Byron's beats

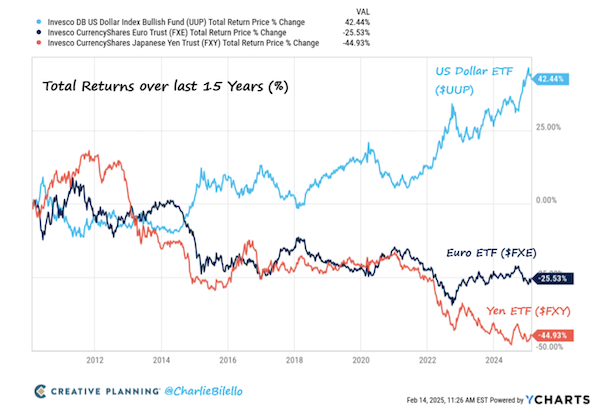

Not only is your Vestact US portfolio invested in the best companies in the world, they are also denominated in the best currency, the mighty USD. Take a look at the updated chart showing the divergence between the USD, the Japanese Yen and the Euro.

Over 15 years the Dollar has strengthened 42.44% while the Yen has deteriorated 44.93% and the Euro has fallen 25.53%. Why, you may ask? Most importantly the US economy has shown very strong growth over that period. Growth attracts investment. The US Fed has also enforced tighter central bank policies than the others.

The Dollar has maintained its status as the go-to global currency. I don't see that changing anytime soon, sorry BRICS fans, don't @ me.

Michael's musings

Many years ago, the team at Vestact explored trading futures contracts on JSE stocks. One of the in-house positions we took was a short on British American Tobacco because we felt smoking was a dying industry - literally. It didn't work so well because the cigarette companies were able to raise prices faster than people stopped smoking.

Short sellers are now targeting alcohol companies. People under 34 consume considerably less booze than previous generations. There seem to be a few reasons for the shift.

Younger people are more conscious of alcohol's negative health effects. They spend more time at home than going out, so opportunities to drink are reduced. An increase in marijuana usage has also had an impact. Finally, alcoholic beverages like wine are expensive, compared to sparkling water.

One of the only drink varieties that is growing is the pre-mixed segment. I'm not sure if that is a convenience thing or if it is perceived as a healthier alternative to a carb-heavy beer.

These two articles give some more stats - Why America is in an alcohol recession and Wine sales drying up.

Bright's banter

Elon Musk's social media company X/Twitter is reportedly back in the funding game, aiming to raise cash at a valuation of at least $44 billion. This is the same price tag Musk slapped on the platform when he bought it two years ago.

The funds would help tackle the company's $13 billion debt pile and fuel new ventures like payments, video content, and AI-driven features via Grok3, the chatbot from Musk's xAI. Despite early turbulence, fleeing advertisers and frustrated users, X seems to be finding its feet. Revenue is down, but profits are up.

Some investors are drawn to Musk's growing political influence, with his ties to Donald Trump offering a potential edge in future deals. Meanwhile, Musk's other ventures are also thriving. Tesla shares have surged roughly 40% since Trump's election win, and SpaceX now boasts a $350 billion valuation.

His AI company, xAI, is also making moves, seeking fresh funding that could value it at around $75 billion. X conveniently holds a $6 billion stake in xAI.

In short, while scepticism lingers (Fidelity marked down its X stake by 70%), debt restructuring and new revenue streams could put X back on the path to profitability.

Linkfest, lap it up

Eli Lilly's Zepbound sales increased more than 10-fold over a year. Success breeds success - Weight-loss drug profits to fund fight against Alzheimer's and hearing loss.

How small are the fundamental particles of the Universe? Matter is made up of indivisible components - Is there a finite minimum size?

Signing off

Asian markets slipped this morning, on the latest bout of Trump tariff talk. Chinese tech stocks swung wildly, with indices in Hong Kong and mainland China falling. The Asia-Pacific index also declined for the second straight day.

In local company news, Prosus has finally landed JustEat Takeaway.com, one of Europe's biggest food delivery firms, in a R79 billion (EUR4.1 billion) deal. This marks its largest investment to date. Back in 2020, Naspers/Prosus lost a high-stakes bid for JustEat to Takeaway.com. Since then, the JustEat share price has been heading in one direction, down. This is a risky move.

US equity futures are marginally higher pre-market. Home Depot and Intuit have results out today.

The Rand is trading at around R18.36 to the US Dollar.

That's it from us. Have a prosperous day.