Market scorecard

After a good start to the week, US markets took a hit on Friday, with Wall Street logging its worst session of 2025 so far. There was no particular reason for the decline, so pundits waffled about concerns like weak consumer sentiment and sluggish housing and services data. Cyclical sectors like transportation and small caps were particularly hard hit, and even the star-studded Magnificent Seven weren't spared, falling 2.5%.

In company news, payment company Block had a rough day, plunging 17.7% after missing fourth-quarter profit and revenue estimates. Elsewhere, Booking.com crushed last quarter's forecasts thanks to a busy holiday season, proving that wanderlust is still alive and well. The stock price is hovering near all-time highs.

On Friday, the JSE All-share was up 0.05%, but the S&P 500 fell 1.71%, and the Nasdaq was 2.20% lower. Oof.

Our 10c worth

One thing, from Paul

How secure are your investments? If you own direct equities in a Vestact account, you can see how your portfolio is doing, you receive dividends from time to time, and you get a weekly statement. Stock prices may vary, but your holdings are steady.

Your assets are highly liquid, which means that you can turn them into cash at short notice and get paid out a day later. Your shares and cash are held by a proper custodian, Fidelity, which has over $15 trillion under administration. They are huge and reliable and they aren't going to do anything to compromise your life savings.

If you die, the beneficiaries named in your will can access your savings, after due process is followed.

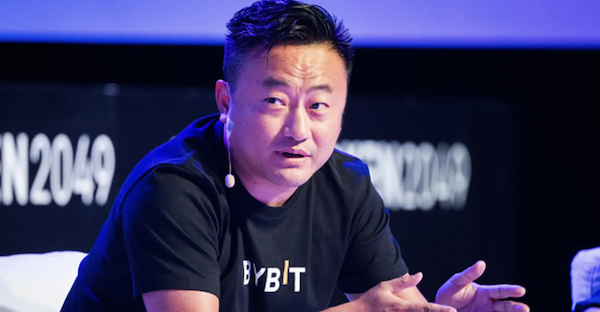

I raise this issue again, because I noticed over the weekend that yet another cryptocurrency exchange has gone up in smoke. Bybit said on Friday it was hacked, resulting in the loss of almost $1.5 billion worth of tokens.

Bybit is apparently the second largest in the world by crypto trading volume, having benefitted from the collapse of FTX in November 2022. They allow digital tokens to be used as collateral for margin trading.

The management team say they have "taken out bridge loans with partners and secured about 80% of funding needed to cover the loss". Over the weekend, another $4 billion flowed out in a "bank run".

Bybit says they will try to recover the funds and take necessary legal action against the hackers. However, it's believed that North Korean hackers were likely responsible, so good luck with that.

Byron's beats

I've really been enjoying Biznews content recently. Frans Cronje's takes on South Africa's geopolitical position with the US and the rest of the world is fascinating.

The pro-Capitalist stance on South African politics is also refreshing and very necessary. That drum needs beating louder than ever right now.

Well done Alec Hogg and team!

On that note, I am attending the Biznews conference in Hermanus from 11 to 13th March. If you will be there too, let me know so we can have a catch-up.

Michael's musings

The last James Bond film came out in 2021. Since then, Amazon bought the franchise distributor, MGM, for $8.5 billion, but the purchase only gave Amazon 50% control and relegated them to being a passive partner when it came to artistic choices.

On Thursday, it was announced that the creative impasse between all the parties had been resolved. Amazon MGM Studios, Michael Wilson and Barbara Broccoli have formed a new joint venture to house the James Bond intellectual property rights. The three parties will remain co-owners of the iconic franchise but Amazon MGM will have creative control.

Wilson and Broccoli are the children of the late Albert R. Broccoli, who originally produced the James Bond movies. The half-siblings took over producing Bond movies in 1979, and now that baton has been passed to Amazon.

Jeff Bezos asked on X who should be the next Bond. The most popular pick was Henry Cavill. In a parallel poll, Guy Ritchie was picked to direct the next Bond film. I agree, that would be an amazing combination. Don't screw it up Amazon!

Bright's banter

Meta's $22 billion bet on WhatsApp is finally paying dividends. A decade after acquiring the messaging giant, Meta's non-ad revenue surged 48% year-on-year in the latest quarter, largely driven by WhatsApp business messaging, where companies pay to chat with customers.

While this revenue stream still pales in comparison to Meta's $40 billion total ad revenue, it's growing twice as fast as the ads business, hinting at untapped potential.

Messaging is Meta's most under-monetised asset, analysts estimate it now contributes only 10% of total revenue. With AI-powered business interactions on the horizon, Zuckerberg sees messaging as a future cash cow.

As users shift from public feeds to DMs, Meta's strategy is to monetize private sharing via click-to-message ads, sponsored chats, and AI-driven e-commerce.

Linkfest, lap it up

Japan is an interesting place. Its ancient culture can still teach us things today - 33 Ways to improve your life, Japanese style.

The more society uses AI, the better for Nvidia. The company is developing new use cases - Nvidia launches free AI platform to make learning sign language easier.

Signing off

Asian stocks took a breather this morning, with benchmarks in Hong Kong and mainland China moving within a narrow range. The MSCI Asia-Pacific index also dipped slightly after reaching a four-month high on Friday.

In local company news, Sibanye-Stillwater narrowed its full-year net loss to R5.71 billion from R37.43 billion last year. Gold contributed 56% of adjusted EBITDA, with the rest coming from its platinum group metals (PGM) operations. How about aiming for a profit guys?

On Wednesday, Nvidia reports its results after the market closes. These results are probably the most watched on Wall Street at the moment.

US equity futures have rebounded pre-market, so that's good. The Rand is trading at around R18.31 to the greenback.

Enjoy the last week of February.