Market scorecard

US markets ended the day in positive territory, with the S&P 500 inching to another record high. Healthcare stocks like Eli Lilly and Merck led the way, while most other sectors were mixed. Oil traders held their breath as meetings between the US and Russia commenced.

In company news, Prada is reportedly exploring a bid for Versace, working with advisers to assess the brand's value. Meanwhile, shares of craft goods retailer Etsy dropped 10% as it fell short of expectations in its fourth-quarter results. Finally, Palantir fell by 10.1% on reports that the White House has ordered the Pentagon to prepare for sweeping budget cuts.

In summary, the JSE All-share was down 0.81%, but the S&P 500 rose 0.24%, and the Nasdaq was 0.07% higher. A slow burn, but a win nonetheless.

Our 10c worth

One thing, from Paul

It's that time of the year when we field queries from clients about single-premium retirement annuities (RAs). They are sold by financial advisers as a way to reduce a person's tax burden, before the end of February.

I hate RAs. They are like herpes, they never go away.

Financial advisers adore them because they generate great commissions. The providers (institutions) love them because they get to keep your capital forever, only feeding it back to you in dribs and drabs. They have high ongoing fees, and extortionate charges when you retire and convert your RA to a living annuity.

The RA funds are almost always the worst-performing in the provider stable. They hold too many bonds, because of Regulation 28. They are sold in Rands, and you can only ever get Rands back.

The future payouts from RAs are fully taxable. If you have zero income later that's fine, but it's pointless if you'll be making money from side gigs well into your senior years.

If you have an active RA, I suppose that you could add to it if you really want to cut your current tax bill? In other words, if you already have herpes, it's less worrisome to have another shag?

In general, it's better to just pay your taxes each year, and invest what's left with Vestact. You'll have maximum flexibility in Dollars, in the future.

Byron's beats

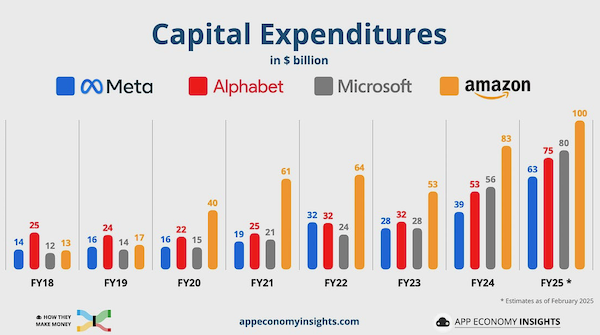

Capital expenditure by the US tech titans is a hot talking point, especially if you own Nvidia shares. Take a look at this image from App Economy Insights which looks at previous annual capex spend, and compares that to projections for 2025. Clearly, spending is not slowing down.

Amazon is planning to crest $100 billion in capex this year, which is huge. They are also the only company out of the big 4 that has not returned any money to their shareholders in the financial year 2024, in the form of share buybacks or dividends. They are sticking to the Bezos mantra that it is always "day 1" and they will continue to invest for growth. If you want dividends buy another stock.

During the latest earnings call, CEO Andy Jassy said that capex was necessary to increase its server capacity to meet current demand. That's a good sign. We are happy long-term holders of all these companies in the graphic. Fortunately, their existing businesses are making more than enough money to pay for all this spending.

Michael's musings

Nike has been a rather disappointing investment for the last few years. It soared during Covid because people wore athleisure clothes while working from home, and there was a sudden surge in people wanting to get fit. Since then, a mixture of market changes and corporate blunders has seen its share price struggle. Over the last five years, it is down 24%. At the end of 2021, it was trading at $180 a share, it is now at $77, after bouncing off a recent low of $68.

To turn its fortunes around, Nike appointed a new management team last year. They seem to be working hard at mending relationships with the company's wholesale partners. Nike's previous set of results were better than expected, but the new CEO warned that things would worsen before they get better. If you were in his position, you'd probably say that regardless of the business trends.

An exciting partnership was announced on Tuesday. Nike is joining with Kim Kardashian's Skims brand, to create a new product line called NikeSkims. It will include training apparel, footwear, and accessories.

Some clients have called it quits on their Nike holding, others have decided to give the new management team a few more quarters to see if they can turn things around. It's too early to know how this will end, but Nike is a very strong brand, so I think you have to back them to stop the slide of the last two years.

Bright's banter

While the rest of the luxury market is feeling the heat, Hermes is still cruising in first class, sipping champagne. The French fashion powerhouse smashed fourth quarter forecasts, posting a 17.6% revenue jump to EUR4 billion.

The US and Japan led the charge with 22% revenue growth, while even a slowing China couldn't hold Hermes back, with Asia ex-Japan up 9%. Its leather goods and saddlery division, nearly half of total revenue, grew a whopping 21.7%. This brand still has customers on waiting lists. They don't even bother with celebrity endorsements. When customers are still lining up to drop five figures on a bag, recession fears look overblown.

Hermes shares popped 5% intraday before settling up 0.8%. Even with potential US tariffs looming, Hermes probably has enough pricing power to keep margins intact. With EUR4.6 billion in net profit, a EUR16 per share dividend, CEO Axel Dumas seems unfazed by economic turbulence.

Linkfest, lap it up

Apple launched a new phone last night. The more budget-friendly version still has an impressive list of features - 8 things to know about the iPhone 16E.

Saturday Night Live just turned 50. Here are some big names that they rejected over the years: Stephen Colbert, Kevin Hart, and Jim Carrey (twice) - 31 stars overlooked by SNL.

Signing off

Asian markets took a hit this morning as risk-off sentiment returned. The tech rally in Hong Kong hit a speed bump.

In local company news, Discovery shares soared 7.6% as it expects a significant 30-35% boost in earnings. Elsewhere, AngloGold Ashanti's 2024 financials dazzled with a 93% surge in earnings to $2.75 billion.

US equity futures are down in pre-market trade, for what it's worth. The Rand is at R18.52 to the US Dollar. A delayed budget speech doesn't help ZAR sentiment, but the fallout hasn't been as bad as some expected.

Goodbye.