Market scorecard

US markets closed in the green last night, with chip stocks leading the charge to new all-time highs. The S&P 500 broke its January record, ending at 6 129.58 points. US-Russia talks fuelled optimism for a possible resolution in Ukraine, although the exclusion of Europe and the Kyiv administration from the process is baffling.

In company news, Nike (+6.2%) scored a slam dunk with its latest collab with Kim Kardashian's SKIMS. The sportswear giant is launching NikeSKIMS, a fresh activewear brand about empowering women to get moving. Elsewhere, Constellation Brands rose 3.95% after Berkshire Hathaway revealed an increased stake in the maker of Corona and Modelo beer. Lastly, medical device maker Medtronic fell 7.26% after missing revenue expectations in its last quarterly results.

Here's the lowdown, the JSE All-share was up 0.75%, the S&P 500 rose 0.24%, and the Nasdaq was 0.07% higher. Splendid!

Our 10c worth

One thing, from Paul

What's going on with US inflation? Is it still something that we need to worry about? Is 3% per annum of inflation too much, and is 2% "just right"? Will the Fed continue to keep interest rates at high levels to get it back below that benchmark?

These are the questions that we have. We can't evade the issue, because everybody hates retail inflation and markets hate high interest rates, because it raises the cost of capital for big companies.

Inflation spiked in 2021 after Covid caused chaos in global supply chains. The Russian invasion of Ukraine added to those concerns. Inflation is like a genie in a bottle, once it gets out it's hard to stuff back in. Once prices start rising, businesses want to raise theirs. Inflation expectations rise, so everyone wants an escalation clause in their contract. This is especially true of banks and landlords, with housing, mortgage and rental accommodation prices. Collectively this expense item is called "shelter".

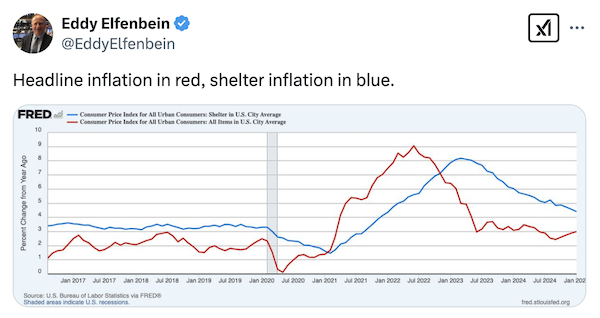

Anyway, my view is that the inflation spike from 2021 to 2023 was transitory, it just took a lot longer to go away than we hoped. As you can see from the chart below, posted by Eddy Elfenbein, inflation (in red) was at 2% before Covid, went much higher to 9%, and is now back down at 3%. The Fed seems stuck until it falls further, which is a drag, but it will cut rates when shelter prices (in blue) decrease some more.

As with most crises, if you wait long enough, they go away by themselves.

Byron's beats

According to a study done by Nebeus Research, South Africa is the 4th most popular destination for digital nomads. In case you didn't know, a digital nomad is someone who can work from anywhere in the world. These people like to live in unique places that offer different experiences and good standards of living.

South Africa is affordable, has amazing food, incredible natural wonders to explore, awesome people, great weather and some brilliant tourism facilities. It is also located in a very favourable time zone, in line with most of Europe. I am not surprised that it is so high on the list. Thailand, Malaysia and Argentina were the top 3.

Michael's musings

The minimum to open a Vestact account is $25 000. When I started here, that was less than R200 000, now it's close to R500 000. The minimum is in place so that we can buy clients a diversified portfolio from the start, with our eight core shares.

Clients regularly ask us if they can top up their account, and by how much. The answer is that you should be adding to your Vestact account as often as possible. Due to the cost of getting money offshore, we recommend sending at least R50 000 (roughly $2 500) per transfer. If you send less, that is okay too but you'll pay more in bank fees.

Research shows that the best time to invest your money is when it is available, particularly if your investment time frame is over a decade. Far too often people sit on cash for ages because they feel the exchange rate isn't good or the market is too high. Generally, when the exchange improves, markets go up too. So what you win on one side, you lose on another.

Adding regularly to your account takes timing luck out of your investment process. Some of your deposits might be 'lucky' and others might be 'unlucky', but over the long term all those short-term fluctuations will be forgotten.

The Vestact accounts that do the best are those with regular deposits. It allows us to buy shares that look cheap. A recent example was the drop in the Eli Lilly share price or Crowdstrike last year, after it became clear that their global outage hadn't hurt new business.

Bright's banter

Reddit's fourth-quarter user growth missed expectations. Its shares initially dropped 18%, but trimmed those losses to just under 7%.

They reported 101.7 million daily active users, falling short of the 103.8 million forecast. Google tweaked its search algorithm, cutting down Reddit's organic traffic. Given that Google provides up to 50% of Reddit's daily visits, the impact was significant, especially in the US among non-logged-in users.

Founded in 2005 by Steve Huffman, Alexis Ohanian, and Aaron Swartz, Reddit started as a simple link-sharing platform before evolving into a community-driven social media giant. Unlike traditional social networks, Reddit thrives on deep, niche discussions across thousands of "subreddits." Over the years, it has struggled to monetise its vast user base effectively but has recently been making strides in advertising and data licensing.

The company has been aggressively expanding its advertising capabilities and recently signed $203 million worth of AI data-licensing deals with firms like Google and OpenAI, an area that could provide a significant revenue boost in the future.

Linkfest, lap it up

Europe has a population problem. Not enough births and too few migrants - Europe's coming population crash.

There's no new James Bond movie on the horizon. No star, no script, no plan - What's gone wrong with 007?

Signing off

Asia's five-day stock rally came to an end as investors turned cautious. The MSCI Asia Pacific Index dropped 0.6%, with Hong Kong and Japanese stocks feeling the heat after President Trump threatened to impose 25% tariffs again. Sigh.

In local company news, Anglo American is exiting the nickel business, striking a $500 million deal with MMG Singapore Resources. The sale includes two ferronickel operations in Brazil, Barro Alto and Codemin, along with two greenfield projects, Jacare and Morro Sem Bone.

US equity futures are in the green again pre-market. The Rand is trading at around R18.41 to the US Dollar.

This afternoon is the South African budget speech. This is probably more important than last week's SONA. There are rumours that a VAT increase could be on the cards. Ugh.

Have a good Wednesday. It's very wet in Joburg, nice weather for ducks.

Over and out.