Market scorecard

US markets zoomed higher yesterday, as some slightly more favourable inflation data was published, and Trump deferred some tariff measures. Only he seems to know what's going on. The S&P 500 inched closer to a record, and the MSCI World Index actually did hit a fresh all-time high. Among the big winners, Tesla rose 5.8%, CrowdStrike was up 4.4%, and Nvidia climbed 3.2%.

In company news, Apple closed 2% higher on confirmation that they are teaming up with Alibaba to bring AI to iPhones in China. Elsewhere, Deere fell 2.2% as it braces for a tough year. Lastly, Nestle jumped 6.2% after reporting a slight pickup in sales growth last quarter. People have to eat.

In short, the JSE All-share was down 0.11%, the S&P 500 rose 1.04%, and the Nasdaq was 1.50% higher. Nice one!

Our 10c worth

One thing, from Paul

It's time for some Friday advice, so read on. Here's an unusual one: get better at speaking in short punchy sentences.

Joe Weisenthal (pictured here) is a journalist in New York. He's very funny, and always provocative. He's a good person to follow on social media, because he's probably the most influential person in the FinTwit community.

Joe's latest writings have been emphasising the societal shift back to orality. The world is awash in soundbites, social media and talk shows, so public opinion is increasingly shaped that way. Hardly anyone reads books or newspapers anymore. Long reports must be prefaced by an executive summary, or they will get binned. Everyone loves memes.

He says that, like thousands of years ago, "all-important communication must be delivered in a memorable, easily communicable way, in a way that today we would call viral".

People like Donald Trump are particularly adept at navigating this new environment. Speaking this way is a skill that you can develop. If you can't beat them, join them.

There's more on the topic of orality here, including some information about the key thinkers in the field, like Walter Ong: Weisenthal's newsletter.

Byron's beats

Tariffs are top of the news at the moment, for obvious reasons. I am not a fan. Where one industry benefits another will suffer.

For example, Ford CEO Jim Farley was complaining bitterly after Trump introduced steel tariffs this week. More expensive steel and aluminium prices will make US automakers less price competitive at a time when Chinese competition in the sector is rife. He said that the consequences could be dire.

For every action, there is a reaction and when it comes to tariffs, most of those seem to be negative. Tariffs are anti-business, inefficient government meddling, exactly what the Republicans should be getting rid of.

Sadly it is the consumer that will bear the full brunt because prices usually increase due to these inefficiencies.

Michael's musings

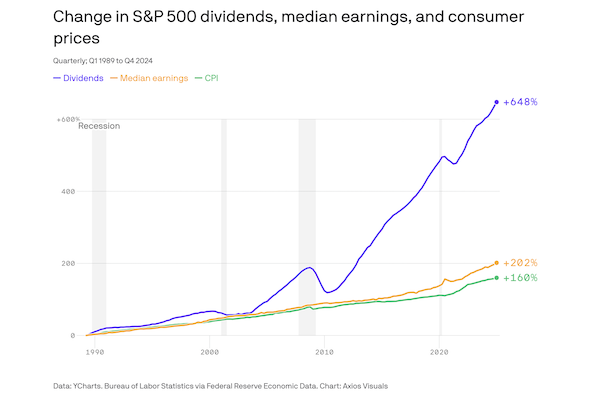

My retirement plan is to have a big enough share portfolio so that I can live off of the annual dividends and capital growth. This way, my investment will keep up with inflation. For South Africans, in particular, inflation is terrible for their spending power once they retire.

An article in Axios yesterday seems to confirm that my plan to live off of dividends is a good one. Have a look at the graph below; the growth in dividends paid has far outpaced inflation.

You can read the article here - The best inflation hedges turn out to be the simplest.

Bright's banter

Shopify ended 2024 on a high note, posting fourth-quarter revenue of $2.8 billion, up 31% and beating expectations. Gross merchandise volume, the total value of sales processed on Shopify's e-commerce platforms - hit $94.5 billion, its strongest growth in three years.

The company also swung from a $1.4 billion loss in 2023 to a $1.1 billion operating profit, with free cash flow margins hitting 22% by year-end.

Shopify started in 2006 when founder Tobi Lutke, a German-born software engineer, was trying to launch an online snowboard shop. Frustrated with the clunky e-commerce tools available, he built his own, and soon realised the software itself had wider potential. Shopify has since evolved into a leading e-commerce platform, empowering millions of businesses worldwide, from small startups to major brands like Mattel.

Linkfest, lap it up

Robots are the intersection of design and technology. They'll be AI powered soon - Apple is exploring humanoid robots.

Museums are wonderful. It's a great way to learn about a country and its culture - How to tour a museum.

Signing off

Asian markets extended their rally this morning, with investors encouraged by signs that reciprocal US tariffs might be delayed, opening the door for potential negotiations. The MSCI Asia-Pacific index climbed for a third straight session.

In local company news, British American Tobacco took a hit yesterday, dropping 9% at one point before closing down 8.3% on the JSE. The stock is still up 7% over the last month though. The sell-off came after the company booked a hefty GBP6.2 billion charge tied to ongoing litigation in Canada.

US equity futures are in the green pre-market. Meta rose yesterday, so it's aiming for its 20th up day in a row today. LFG!

The Rand is trading at R18.48 to the US Dollar.

Have great weekend.