Market scorecard

US markets had a mixed session as hotter-than-expected inflation data dampened hopes for Fed rate cuts. Stocks fell sharply out of the gate, but regained some composure later in the day. Tesla (+2.6%) led gains in megacaps, while Meta (+0.8%) extended its amazing winning streak to 18 sessions. The Nasdaq ended in the green.

In company news, DoorDash (+4.0%) , the largest food delivery platform in the US, projected first-quarter order volumes that came ahead of Wall Street expectations. Elsewhere, CVS Health surged 14.9%, their biggest jump in over 25 years, after a successful quarter under their new CEO David Joyner.

Izolo, the JSE All-share was up 0.43%, the S&P 500 fell 0.27%, but the Nasdaq crawled into the green with a gain of just 0.03%.

Our 10c worth

Byron's beats

Amgen is one of our less flashy holdings. Can I say boring? Sometimes boring is good. Last week, they released solid results. Fourth quarter revenues were up 11%. Ten products in their pipeline managed double-digit growth, including their blockbuster cholesterol drug Repatha which grew by a whopping 45%.

Sales for the whole of 2025 increased by 19% thanks in part to the $28 billion purchase of Horizon Therapeutics. That deal added two key products, Tepezza (for eye bulging and double vision) and Krystexxa (for gout).

Amgen's financials are in very good shape. The company generated $10.4 billion in free cash flow. Earnings came in at $19.84 per share which means that the stock trades at a very modest PE of 15. The dividend yield is over 3%.

Amgen offers something unique in Vestact portfolios. They have a solid pipeline of drugs, pay a decent dividend and are still showing good growth. The big upside will come if they crack another blockbuster. They do have a horse in the weight-loss drug race. It is definitely worth holding on to this one.

One thing, from Paul

I know that the world seems a little topsy-turvy right now, but I remain very optimistic. Humanity is making great progress. Our lives are improving.

Here are two stats to prove my point: (1) people are getting smarter and (2) they are living longer. What a combination!

Researchers have found that IQ scores are rising steadily, thanks to better living conditions, good diets, exposure to information, and familiarity with complex tasks. The average person from 1900 would be considered cognitively impaired, compared to the average person today. The IQ tests are much harder, and the average score is still 100.

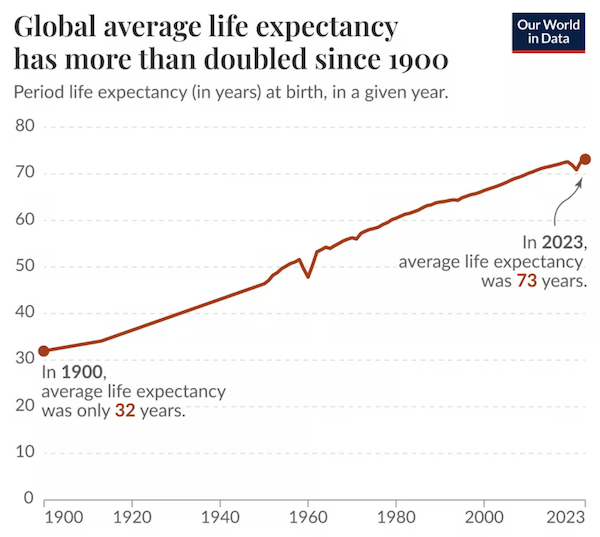

We can now expect to live more than twice as long as our ancestors in 1900. As the chart shows, global average life expectancy was just 32 years at the beginning of the 20th century. Now it's 73 years. That's 41 years longer. Wonderful.

Again, this remarkable increase is due to improved homes and workplaces, modern nutrition and sanitation, and advances in healthcare, such as antibiotics and vaccines.

You need to save more, to finance your old age. You'll still be sharp and you'll need some spending money.

Michael's musings

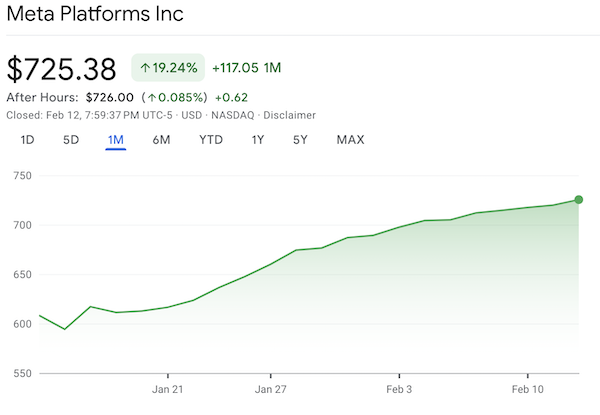

You have to go back to the 16th of January for the last time Meta shares closed in the red. The stock is currently on its 18th consecutive day of share price gains, and after-hours trading says it will open in the green again this afternoon. This winning streak is unprecedented and hasn't been done before by any stock on the Nasdaq 100.

There are a few reasons for this impressive rally. The first is that the market is a fan of Meta's big infrastructure spending plans. A few years ago, when they announced massive spending on the Metaverse, the share price tanked. It is good to see the opposite happening here. All that is left of that misguided Metaverse push is the share name - Meta.

Another reason for the positive share price move is the aftermath of the DeepSeek shock. Meta has created their own AI model, and the efficiencies created by DeepSeek benefit big AI creators like Meta. They are able to get more bang for their buck on the tens of billions being spent on data centers.

Onwards and upwards.

Bright's banter

Specialist chip maker Arm posted good quarterly numbers, with revenue up 19% year-on-year to $983 million. The outlook for 2025 was tweaked downwards, causing a 6% drop in the share price on the day.

The long-term AI story is intact, but Arm doesn't benefit in the same way as Nvidia. Instead, it makes money through licensing fees and royalties, which it's trying to increase, most notably with its new Armv9 design used in Apple's latest iPhones. A recent legal setback against Qualcomm suggests pricing power won't come easy, however.

On the bright side, Arm is a named tech partner in Trump's $500 billion AI infrastructure plan, a sign of its growing relevance beyond mobile phone chips.

Arm's share price has more than tripled since IPO, and while it has a strong position in chip design, the valuation already prices in a lot of future growth. At current levels, it's a risky buy.

Linkfest, lap it up

Poulaines were pointy shoes worn in medieval London. They were alleged to promote deviancy - Some even blamed them for bringing the plague.

The Trump administration yanked USAID. What does this agency do? - Why is this organisation being targeted?

Signing off

Asian markets climbed as US-Russia talks raised hopes for an end to the Ukraine war. Japanese and Hong Kong stocks led the gains. Baidu made news by announcing that its 'Ernie' AI model will now be free for all users. Is Ernie Els involved?

In local company news, Trellidor stock popped a massive 42.3% after a bullish trading update. It's doing well in the UK. Do they need burglar bars there? Apparently so! Headline earnings per share are set to rise by at least 33%.

US equity futures are in the green pre-market, so all is well. The Rand is trading at around R18.47 to the US Dollar.

Take care.