Market scorecard

Yesterday was uneventful, with markets trading sideways. After a very good 2024, the S&P 500 has settled into a narrow range around 6 050 points. Jerome Powell had a drama-free appearance before the Senate, delivering his twice-yearly testimony to lawmakers. The Federal Reserve chairman largely reiterated the message that officials are in no rush to lower interest rates further.

In company news, Intel, the struggling chip-maker closed 6% higher on Vice President JD Vance's promise to make more AI systems and chips domestically. Elsewhere, Marriott International reported better than expected numbers but gave poor guidance for coming quarters due to slowing Chinese demand. Finally, Meta Platforms continued its epic run, rising for the 17th day in a row. Booyah!

In summary, the JSE All-share closed down 0.23%, the S&P 500 rose by 0.04%, and the Nasdaq ended 0.36% lower. Patchy.

Our 10c worth

One thing, from Paul

We've been actively accumulating Eli Lilly shares for clients for the last 18 months. We are very bullish on the prospects for their market-leading weight-loss drugs. They also have a very good business making other drugs.

The company had Q4 results out last week, and they were well-received. Revenues for the period increased by 45% compared to the year before. Profits were over 100% higher. The stock is up 12% year to date.

When a company is growing top-line revenue very quickly it's hard to value, and it's share price may be volatile. A slight change in their sales forecast can lead to some wild moves. Investors need to concentrate on the story, hold the stock, and not worry too much about their entry price. Buy some more, and wait to see where you are in 5 years time.

GLP-1 drugs like Zepbound turn off your hunger reflex, so you don't eat so much. Most users lose over 20% of their body weight in about 6 months, with very minor side effects. After years of ineffective dieting, these treatments are a revelation to those who take them, and stay on them.

Eli Lilly's Zepbound is slightly more effective than Ozempic, made by competitor Novo Nordisk. Their next version, Retatrutide, will be even better. These drugs have to be injected currently, which can be challenging for those who suffer from needle anxiety, but Lilly has a treatment in trials called Orforglipron that can be taken orally.

The company has put enormous effort into expanding its manufacturing plants and honing its product pipeline through further research and licensing. Americans prefer to support American companies.

Currently, these drugs are used by rich people who pay for them themselves, at a cost of more than $1 000 per month. In future, medical aids, health insurers and life insurers will cover everyone who is obese. They will do that because a healthier customer will live longer and pay more premiums.

We would like all Vestact clients to hold Eli Lilly in their portfolios, with a solid allocation, up to 10%. If you are not there yet, send some money to buy some more.

Byron's beats

When I visited the US last year I noticed a lot of very nice-looking Rivian vehicles on the roads. They specialise in all-electric pickup trucks and SUVs. I took the picture shown here in Malibu (sadly that building is probably burnt down now).

You may remember that Rivian is partly owned by Amazon and that they have been exclusively supplying Amazon with electric delivery vans. On Monday it was announced that they will now be supplying delivery vans to anyone else looking for a commercial fleet.

This is good news because it means that Rivian has the capacity to make these vans beyond Amazon's demand. AT&T is apparently already placing orders.

Electric vehicles have been unfairly caught in the middle of polarised political agendas. Regardless of who you support, if it makes more economic sense to go electric, then that is what businesses and individuals will do. I bought a few Rivian shares after that trip and have been following it closely. If you don't like Musk but want to be invested in the EV theme, Rivian could be an option, albeit very speculative.

Michael's musings

I recently saw a headline about the rise of online shoplifting. I was rather confused, how can you shoplift from a digital store? It turns out that it is rather simple. You simply claim the package was stolen or never delivered, or you dispute the charge via your credit card company.

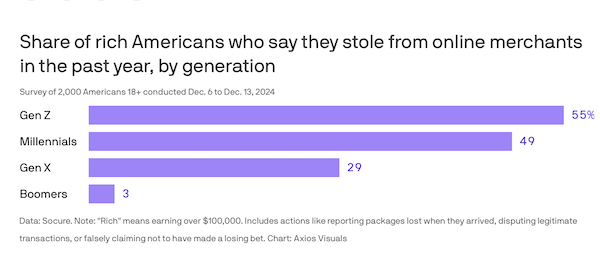

The problem stretches across generations and income groups. A recent study by antifraud tech company Socure, found that 55% of Gen Z and 49% of Millennials earning more than $100 000 a year said they have stolen from online merchants in the 12 months. What?! That is terrible.

The research finds that people feel they are committing a victimless crime and think that the big retailers can afford the theft. It does not help that some social media influencers talk about all the different ways to 'hack' the system, and get away with it. The study paints a grim picture of the moral fabric of the US society. I would hope that if a similar study was done in South Africa, that it would have a significantly different result.

Bright's banter

Lyft is finally getting serious about autonomous rides, announcing plans to roll out a self-driving service in Dallas by 2026 with Mobileye and fleet operator Marubeni. The long-term goal is to get thousands of these vehicles in more cities.

This move helps Lyft catch up to Uber, which has been offering Waymo-powered rides in Phoenix since 2023 and expanding into Austin and Atlanta this year. Investors liked the news, Lyft popped 7.2%, while Mobileye surged 18% after a bullish call from Bank of America.

With Marubeni managing over 900 000 vehicles, it'll tap into Lyft's fleet management expertise to keep things running smoothly. The driverless race is heating up, and Lyft is finally in the game.

Linkfest, lap it up

Netflix is a very strong brand. Its popular series are well known across generations - Netflix opens a restaurant in Las Vegas, serving show-inspired food.

The world is becoming more reliant on AI. These algorithms have an influence on our view of the world - Recent study finds that 51% of all AI answers about the news are wrong.

Signing off

Asian markets are a mixed bag this morning, with Hong Kong's Hang Seng the standout performer, up 1.5%. Alibaba shares surged as much as 8.6% after a report that Apple is working with them to roll out AI features in China.

In local company news, Implats said their headline earnings would be up to 49% weaker for the six months ended December. Higher production was offset by lower Rand sales prices. The share initially fell 7%, but closed the day 0.8% higher.

The Rand is at 18.50 to the US Dollar, seemingly unaffected by the latest kerfuffle between South Africa and the US.

US equity futures are flat. The only noteworthy company with results out today is Cisco.

It's Wednesday, half way to the weekend. Keep up the good work.