Market scorecard

US markets closed higher yesterday, with most major industries contributing to the gains. Despite all the distractions, earnings season has been going well. 350 of the S&P 500 companies saw their stocks rise, led by a 5.2% surge from Nvidia.

In company news, Uber fell 7.6% after delivering weaker-than-expected gross bookings guidance. Elsewhere, human resources platform Workday climbed 6.3% after firing 8.5% of its workforce, which is awkward. It was party time at Mattel (+15.3%) after they reported strong sales of Barbie dolls and Hot Wheels scale model cars.

Here's the lowdown, the JSE All-share was up 0.18%, the S&P 500 rose 0.39%, and the Nasdaq was 0.19% higher. That'll do.

Our 10c worth

Michael's musings

Google reported numbers on Tuesday night, and the shares promptly sank 8% because the cloud division only grew by 30% to $12 billion in revenue, instead of analysts' $12.2 billion forecast. Google said they had more demand than capacity available - good news for future growth, but not great that the current opportunity was missed.

This biggest news this quarter was the plan to accelerate spending on data centres and servers to $75 billion this year, up from $53 billion in 2024 and a third more than Wall Street had estimated. It seems the Google share price was punished for investing more than expected, and also for 'only' growing at 30%. Wall Street is a funny place.

Overall, group revenue rose 12% to $96.5 billion, thanks to a 13% growth in search-related revenue and an 11% increase in YouTube ads. Net income rose an impressive 28% to $26.5 billion. Google is one of the cheapest tech stocks around, only trading at 21 times 2025's expected profits.

We are happy holders of this great company, and the recent price drop means this is a good time to buy more.

One thing, from Paul

EssilorLuxottica is a stock I like. This Franco-Italian company is the worldwide leader in eyeglasses, including prescription spectacles and sunglasses. Their major brands are Ray-Ban, Oakley and Persol, and their retail outlets include LensCrafters, Sunglass Hut, and Vision Express.

The company is principally listed on the Euronext Paris stock exchange under the trading symbol "EL" but also trades in New York with the symbol "ESLOY". It has marginally outperformed the S&P 500 over the past five years.

The company is benefitting from widespread short-sightedness, and increased efforts to treat it properly in developing countries.

They also have an exciting partnership with Meta to develop web-connected, AI-powered, augmented reality smart glasses. The initial prototypes are still quite clunky, but they are getting there. Of course, Meta wants its users to access the web this way, not through an iPhone.

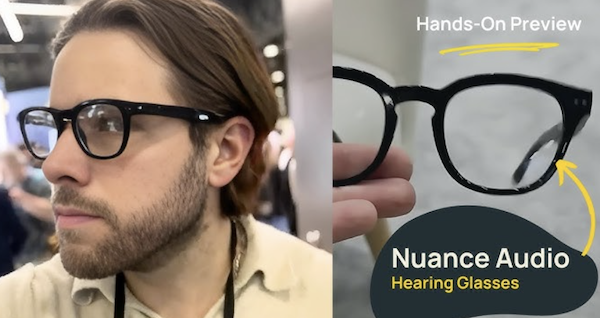

Finally, EssilorLuxottica has received FDA and EU (CE) approval for its new Nuance Audio Hearing Glasses. They sort out both your sight and your hearing problems, in one stylish, wearable device. I think I might get a pair, if my hearing deteriorates any further.

Bright's banter

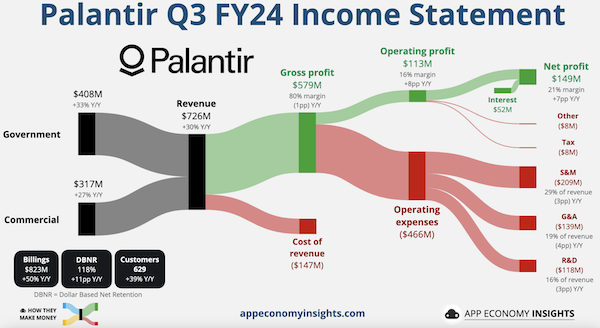

Founded in 2003 by Peter Thiel and a team of PayPal engineers, Palantir started as a data analysis platform designed to help US intelligence agencies fight terrorism. While PayPal was dealing with the cybercrime authorities, Thiel realised that the government had no idea what it was doing.

Over the years, the company expanded into commercial applications, helping businesses and governments process massive datasets with AI-driven insights.

Palantir made headlines in 2011 when its software helped track down Osama bin Laden, and in 2020, it went public via a direct listing. More recently, Palantir has solidified itself as a leader in AI-driven defence and intelligence, with its tech now embedded across all US military branches and allied forces in Ukraine and Israel.

Now, Palantir is riding the AI wave, forecasting 2025 sales of $3.75 billion, well ahead of analyst estimates. Fourth-quarter revenue surged 36% to $827.5 million, fuelled by strong demand from both government (+45%) and commercial (+64%) clients. The stock soared 24% on the day, following a 340% gain in 2024.

With deepening ties to the US intelligence services and a growing role in AI-driven intelligence, Palantir is positioning itself as a key player in the future of defence tech. While the company's AI story is compelling, the stock is at record highs.

Linkfest, lap it up

A young man used AI to build a nuclear fusor. He used Anthropic's Claude as a guide with some mail-order parts - You too can use electrostatic fields to accelerate ions.

Walmart bought Massmart in 2011. We always wondered why the Walmart brand hasn't been more prevalent since then - Walmart private label items coming to Game, Makro and Builders.

Signing off

Asia's stock markets are on a roll with equities rising for the third day in a row, hitting their highest level since mid-December. The Japanese Yen is also surging.

In Asian company news, Grab Holdings is eyeing a takeover of GoTo Group, with a price tag north of $7 billion. The deal would merge two of Southeast Asia's biggest internet players, potentially ending years of bleeding cash in the region's hyper-competitive market.

In local company news, Copper 360 hit a milestone at its Rietberg Mine near Nababeep in the Northern Cape. The first iron-ore blast in 42 years marks a shift to structured hard rock mining. They are targeting 40 000 tonnes per month by the end of 2025.

US equity futures are in the green pre-market. The Rand is trading at around R18.58 to the US Dollar.

Another big night is coming up for Vestact-owned stocks, as Amazon and Eli Lilly report their latest numbers.

Fare well today, we'll be back in your mailbox tomorrow.