Market scorecard

US markets dipped early in the day but steadied after Fed Chair Jerome Powell eased fears of heightened inflation. There was no rate cut announced, sadly, but growth, jobs and inflation seem to be on trend. Both the S&P 500 and Nasdaq Composite closed slightly lower.

In company news, Meta jumped 2.3% after hours on strong results thanks to AI advancements and advertising pricing power. Microsoft dipped by 4.6% in late trade as its results looked good, but forward guidance was a little muted. In Europe, ASML surged 5.5% after reporting blockbuster chipmaking orders. Lastly, Tesla gained 4.2% as results, though weak, weren't as bad as feared. Elon Musk talks a good game.

Izolo, the JSE All-share was up 1.03%, the S&P 500 fell 0.47%, and the Nasdaq was 0.51% lower.

Our 10c worth

Bright's banter

Stryker delivered another strong set of numbers on Tuesday, with fourth-quarter sales rising 10.7% to $6.4 billion, driven by an impressive 10.2% organic growth. This medical technology company has been a Vestact-recommended holding since January 2014.

The MedSurg and Neurotechnology segment led the way, growing 10.6% in the fourth quarter, while Orthopaedics sales rose 10.8%.

Looking ahead, Stryker expects 8-9% organic sales growth in 2025. The $590 million Inari acquisition will expand its high-growth portfolio. Inari makes devices to treat deep vein thrombosis and pulmonary embolisms.

Stryker shares are just off their all-time highs above $400 a share after an impressive 25% rally since August. With steady demand in MedTech, strong product launches, and a disciplined acquisitions strategy, Stryker remains well-positioned. This is a high-quality long-term hold in the portfolio.

One thing, from Paul

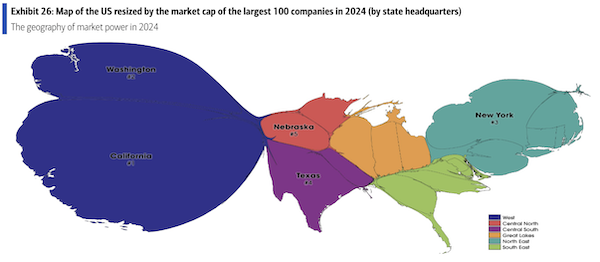

It's been a week of screaming headlines and challenging issues, so here is one thing from me that is merely "interesting". The chart below shows a map of the US where the state is resized to reflect the market capitalisation of the largest companies that are headquartered there.

California and Washington State are huge, thanks to the tech giants based in Silicon Valley, and the Seattle area. New York has big finance and property companies. Nebraska is large, that's Berkshire Hathaway. Texas, probably Tesla and some oil companies are moving the needle there.

When members of the team here at Vestact visit the US, we like to go to company headquarters to see what they look like.

Byron's beats

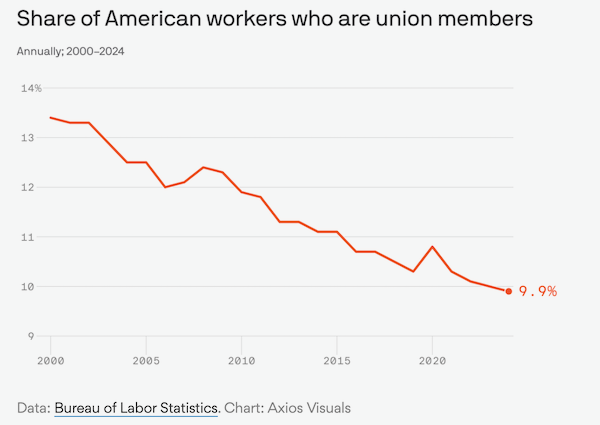

We believe that the US remains the shining light of capitalism, innovation and the encouragement of business success. Here is another statistic which backs that contention. Take a look at the graph which shows the share of American workers who are union members.

Thanks to strong corporate opposition and weak legal protection for the unions, memberships have been consistently declining over the last 25 years. This is the kind of trend I like to see.

Michael's musings

Earlier this week, a local writer called Finance Ghost pointed out how the new two-pot retirement savings structure resulted in massive withdrawals that benefitted local retailers. Savers are able to access a portion of their retirement funds without paying punitive penalty taxes. The policy change was introduced to allow people to access their savings in an emergency, rather than incurring expensive debt.

The change was implemented on 1 September 2024, and people started withdrawing billions from day one, and not just for emergencies. One of the primary beneficiaries of all this extra money was Lewis, the furniture retailer. Cash sales between September and December were up 14.4% compared to a year earlier. Mr Price was another benefactor, with sales up 11%.

All this spending has been a nice shot in the arm for our local economy. The extra billions spent in the economy allow businesses to pay salaries and bonuses, which also get spent. The cycle continues a few times. Added to that, there were some taxes paid on the withdrawals, and more taxes will be paid by retailers on these higher profits. SARS will be happy about that.

This stimulus is a once off though, and there may be a comparative slump at the end of this year.

Linkfest, lap it up

Google Maps is the king of navigation. Waze gets you around traffic in a flash - Some say Apple Maps does other things better.

The last flight of the Concorde was in 2003. A number of companies still dream of re-introducing supersonic commercial travel - A jet from Boom broke the sound barrier.

Signing off

Asian markets rose this morning as traders digested the Fed's rate pause. Benchmarks in Australia, India, and Japan rebounded, lifting the MSCI Asia Pacific index.

In local company news, AVI expects headline earnings to rise 8-10% for the first half of the financial year, with revenue up 1.1% to R8.47 billion. Elsewhere, Tiger Brands is selling its stake in Chilean fast-moving consumer goods company Carozzi for a cool $240 million. The cash will be redeployed back into Mzansi operations.

US equity futures edged higher pre-market. The Rand is trading at around R18.67 to the greenback.

This afternoon, the SARB announces South African interest rates. Unlike the US, there is a good chance for a rate cut. Companies reporting numbers tonight include Apple, Visa, Mastercard and Intel.

Soldier on. We have your back.