Market scorecard

US markets closed in the green last night as big tech stocks bounced back after a rough Monday. Both the broader S&P 500 and the tech-heavy Nasdaq gained. Nvidia rose 8.9% as investors reconsidered the rash sell-off that followed the sketchy news about DeepSeek's capabilities over the weekend.

In company news, Apple moved 3.7% higher on news that it has been quietly working with SpaceX and T-Mobile to integrate Starlink support into its latest iPhone software, offering an alternative to its own satellite service. Elsewhere, Microsoft rose 2.9% as it might be in talks to buy TikTok's US operations from ByteDance. That's according to President Trump, so take that insight from whence it comes.

At the end of another thrilling day, the JSE All-share was up 0.31%, the S&P 500 rose 0.92%, and the Nasdaq was 2.03% higher. Haha!

Our 10c worth

One thing, from Paul

Humans feel monetary losses far more acutely than gains. It's a well-known behavioural bias that has been carefully researched, and replicated in many studies.

We are well acquainted with this phenomenon. For example, we've owned some shares for clients that have enjoyed tremendous one-day gains, mostly after announcing good quarterly results. Those moves don't get much reaction. By contrast, big sell-offs like Nvidia on Monday make people very unhappy.

Investing legend Charlie Munger (pictured) reminds us that "A lot of people with high IQs are terrible investors because they've got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains. You need to keep raw, irrational emotions under control. You need patience and discipline and an ability to take losses and adversity without going crazy. You need an ability to not be driven crazy by extreme success."

Byron's beats

DeepSeek made more than just a massive impact on the market on Monday. It has also dominated the app charts in recent days. I saw some articles suggesting that the drop in Nvidia's share price is the least of the Western world's worries. DeepSeek officially marks the entry of Chinese companies in the race for AI dominance.

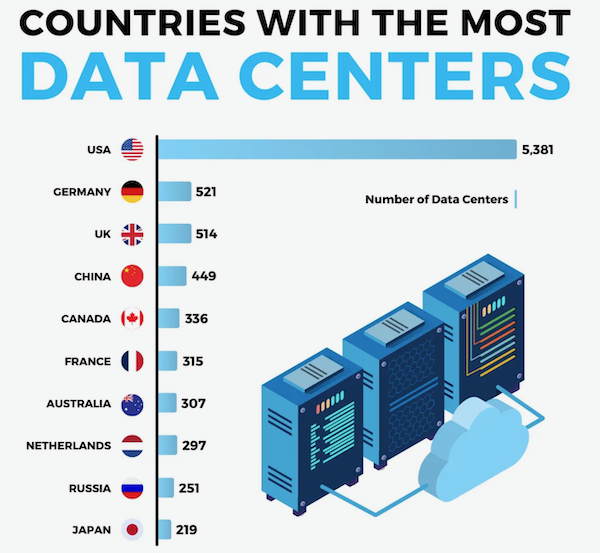

Not so fast. Take a look at this image which shows the countries with the most data centres. The US is 10 times bigger than number 2 on the list, Germany. The competition still has a lot of catching up to do.

Innovation in the field is surely welcome and if DeepSeek have managed to process more data with less infrastructure, well done to them. Ever heard of Jevons Paradox? It means that the companies buying all these chips will use the extra efficiencies to add more capacity rather than spend less on infrastructure. Instead of slowing down the sales of chips, they may end up consuming more because they are getting better bang for their buck.

Michael's musings

Elon Musk has long said that he wants to make X the "everything app", similar to Tencent's WeChat in China. Yesterday, X and Visa announced a partnership, moving X closer to this goal. The deal with Visa means that X doesn't need to be licensed to move funds around in each US state, and gives them global reach from day one.

The new financial feature will be called an X Money Account, and will enable peer-to-peer payments from users' debit cards and allow users to transfer funds to their bank accounts. Visa Direct will make it possible for US X Money Account users to fund and transfer money in real-time.

One of the use cases for X Money will give clients the ability to tip content creators. If you find a video or post on X very entertaining, then you could give the person a small tip. If the idea works, it could see more content creators moving to X.

We are Visa shareholders, so this is a positive development.

Bright's banter

LVMH is selling its stake in Stella McCartney back to the clothing designer after a five-year partnership. The luxury giant is streamlining its portfolio during a tough time for global high-end goods sales.

Terms weren't disclosed, but the move follows other recent transactions by LVMH, like the offloading of Off-White's parent company in September. Stella McCartney will continue advising LVMH on sustainability, despite taking back full control of her brand.

The label, known for eco-friendly, animal-free designs, reported GBP40 million in sales in 2022 but posted an operating loss of GBP8.8 million.

Linkfest, lap it up

Mr. Money Mustache tried to spend more cash. He lost some credibility from the FIRE community - Retired man tries to splurge, mostly fails.

McDonald's is a global brand with some very unique restaurants. A photographer visited the best Maccas in more than 55 countries - Imagine if this was your local Macca's.

Signing off

Asian markets climbed this morning, tracking Wall Street's tech-driven rebound after a sharp selloff. Japanese and Australian shares gained, while most other major markets remained closed for Lunar New Year.

In local company news, Woolworths expects its first-half headline earnings to fall as much as 27% as the weaker performance of its apparel business overshadows a strong performance from food. Elsewhere, Shoprite sales rose 9.6% to R128.6 billion with the Checkers business up 13.5% and Sixty60 up 47.1%. You will have noticed their motorbikes on local roads.

US equity futures have edged higher in pre-market. The Rand is trading at around R18.67 to the greenback.

This afternoon the Fed is expected to announce no change in US interest rates. After the market closes tonight, there will be results from three Vestact portfolio stocks: Microsoft, Meta and Tesla.

Keep cool, stay positive.