Market scorecard

US tech stocks had a rough day yesterday, with AI-focused companies leading the selloff after China-based DeepSeek's low-cost, open-source language model shook up the AI industry, despite questions about its origins and durability. Nvidia plunged 16.9%, losing $589 billion in market cap, the largest one-day loss in history. We think it will recover soon.

In other company news, Constellation Energy tumbled 20.9% as AI-linked energy plays also took a hit. Elsewhere, Apple rose by 3.25% because investors felt that it wasn't an AI company at all. Lastly, AT&T surprised the market with strong Q4 results, driven by gains in mobile and fibre subscribers thanks to seasonal promos and bundling.

Yesterday, the JSE All-share was down 0.12%, the S&P 500 conked by 1.46%, and the Nasdaq ended an eye-watering 3.07% lower. Don't panic, and keep in mind that 300 of the S&P 500 stocks actually posted gains yesterday.

Our 10c worth

One thing, from Paul

Johnson & Johnson reported quarterly results last week for the period ending December 2024. At first glance they looked solid, with decent revenue gains in both their pharma and their medical device units.

Sadly, negative comments from the management team about 2025 profits resulted in a 2% stock selloff on the day. Their gripes included a key cancer drug coming off patent, foreign exchange effects, the ongoing talcum powder lawsuit, slow elective surgeries in China, and pushback on drug prices from Medicare.

The Johnson & Johnson share price has literally gone sideways for the last 5 years. The chart looks like an upturned plate (see below). The only ameliorating factor is that dividends were paid out at a steady rate of 3% per annum over the period.

We hope to buy and hold companies that are transformative, changing the world and growing sales rapidly. Unfortunately, Johnson & Johnson has failed us in this regard. We had hoped that they would develop multiple new blockbuster drugs by now.

We can do better. We suggest that you sell Johnson & Johnson and use the proceeds to buy Eli Lilly shares (unless you have a lot of the latter already, in which case we will propose an alternative).

Byron's beats

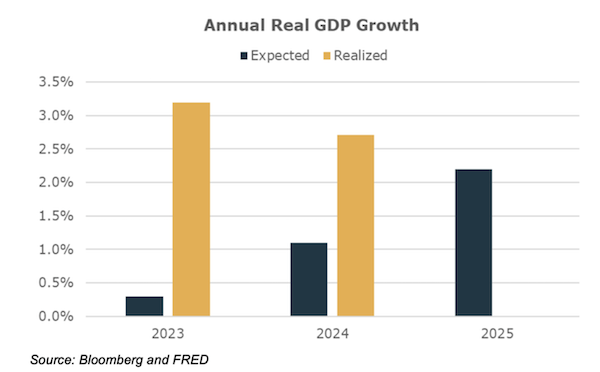

The following chart makes for interesting reading. It shows what economists expected US GDP growth would be for the year versus what actually transpired.

It is quite clear that over the last 2 years, economists grossly underestimated the US economy. Remember, there was supposed to be an "inevitable" recession in 2023, after all the interest rate hikes in 2022. That did not transpire at all.

It's clear that professional economists have been increasing their estimates in recent years to avoid further embarrassment. There are higher hopes for 2025 which is probably justified, but unknown unknowns might intervene.

Forecasts aren't entirely useless, as I think they provide a good barometer for general expectations. You just can't base important long-term investing decisions on consensus forecasts. Sometimes the pundits can lead you astray.

Michael's musings

Yesterday, I was reminded of how bad the job crisis is in South Africa. Cartrack has an 18-month learnership program for people aged between 18 and 33, where applicants can do a walk-in application or an electronic one.

Walk-in applications opened yesterday morning at their head office in Rosebank, a few streets away from our office. The result was a massive queue, about 4 people wide, around a very big block. Everyone looked well-dressed and energetic. Thousands were applying for a learnership, which probably only accepts a few hundred people.

It is heartbreaking to see so many people eager to work, but with not enough jobs available to meet the demand. South African economic growth has been terrible for over a decade now, meaning our economy doesn't come close to absorbing new job seekers, let alone those who have been trying to get a job for years.

Runaway corruption, nepotism and bureaucracy have meant that almost anything the state touched imploded. The recent matric results highlighted how badly the education system lets down our youth. Far too few pupils reach grade 12, not to mention how dismal the results are for maths and science. Even worse, 81% of South African grade 4 pupils, across all 11 official languages, cannot read for meaning.

Turning the South African ship around will be slow. It seems that the GNU is making early strides, but the ANC's own-goals like trying to ram through its NHI agenda doesn't help.

Bright's banter

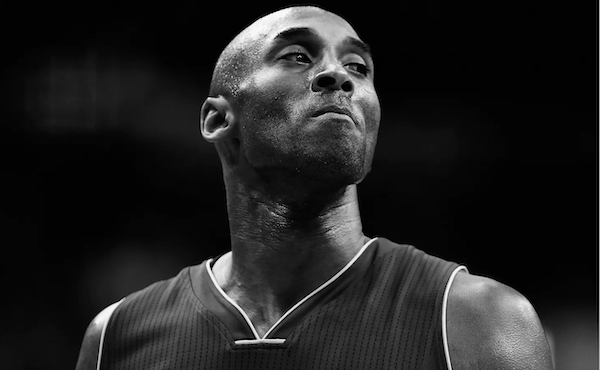

I was reading about Kobe Bryant's legacy beyond basketball over the weekend. His off-court achievements are just as remarkable as his time on the court.

He had a well-known 20-year sports career, which includes five NBA titles, two Olympic golds, and that iconic 81-point game, but what really stood out to me was his savvy as a businessman. Take BodyArmor, for example - he put $6 million into a then-tiny sports drink company in 2013, which later sold to Coca-Cola for $5.6 billion. That single investment earned his estate $400 million, a bigger payday than his 20-year NBA career.

He co-founded a $100 million VC firm, Bryant Stibel, backing companies like Alibaba, LegalZoom, and Epic Games. By 2020 the fund was managing $2 billion with multiple successful exits.

What impressed me most was how hands-on he was. He wasn't just slapping his name on things, he was a creative director, board member, and storyteller. His media company, Granity Studios, produced an Oscar-winning short film, Dear Basketball, and other standout projects.

It's a reminder that the modern athlete has opportunities beyond the field. Bryant set a benchmark for leveraging influence into long-term, meaningful investments and ventures. His second act as a business leader and creator was just getting started when he died tragically in a helicopter crash.

Linkfest, lap it up

Spain wants to make it more expensive for non-residents to buy a house. Discouraging foreign investment can be risky - Huge taxes on foreign bought homes.

When it comes to collecting, having a unique story is vital. An upcoming auction could set the record for the most valuable Porsche - Jerry Seinfeld's car, driven by Steve McQueen, is going up for auction.

Signing off

Most Asian shares dipped, with the MSCI Asia Pacific Index down 0.6% as Japan's top tech firms extended losses for a second day. Trading activity was subdued with major markets like mainland China and South Korea closed for the Lunar New Year holidays.

In local company news, Lewis Group reports a 9.9% rise in third-quarter merchandise sales, driven by strong Black Friday sales. Revenue was up 13.6% for the nine months to December.

US equity futures are flat pre-market. The Rand is trading at around R18.84 to the US Dollar. Stryker reports results this evening which we will report on later in the week.

Investing can be tough, and when stock prices are volatile it's gut-wrenching. Take a deep breath, everything is going to be ok.

Have a good day.