Market scorecard

US markets reached a new record high yesterday after Trump addressed Davos and demanded lower interest rates and crude prices. Isn't the Fed supposed to be independent? It's also not clear why the Saudis would co-operate with his "vision", but cheaper oil eases inflation concerns, and that's good for stocks.

In company news, Netherlands-based chip equipment maker ASML dropped 4.4% on fears of tighter US export controls. Elsewhere, Union Pacific tooted 5.0% higher after the railroad company issued a positive forecast. Finally, ByteDance is working on a plan to keep TikTok running in the US without selling its operations.

Here's the lowdown, the JSE All-share was down 0.84%, the S&P 500 peaked, up 0.53%, and the Nasdaq was 0.22% higher.

Our 10c worth

One thing, from Paul

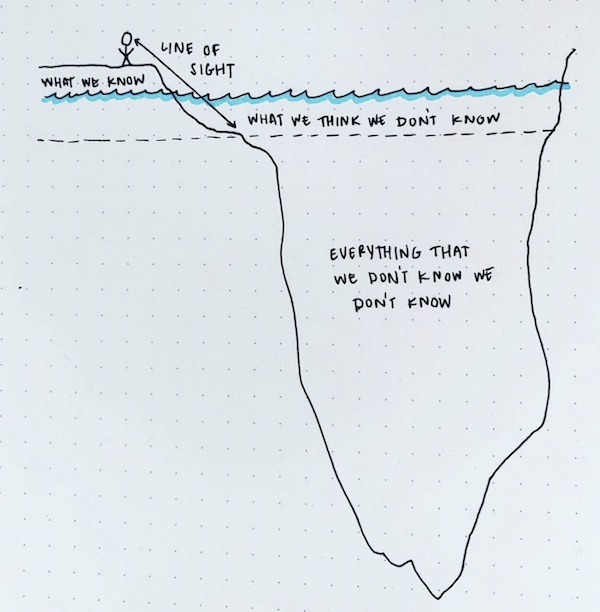

Fridays are for life advice, and to be honest, the intended target is often myself. So here's some: stay humble and recognise that you don't know everything.

If things are going well at home, at work, or with your investments, you might be inclined to believe that this is entirely due to your own brilliance, insight and hard work.

Keep in mind that positive outcomes are helped by good luck. There are unknown unknowns out there that could trip you up. Stay positive but alert, and keep an open mind.

Byron's beats

The wealthier you are, the longer you will live. That's not surprising. According to JAMA Internal Medicine, the top 10% wealthiest Americans had a median age of 86. That is about 14 years longer than the bottom 10% who have a median age of 72. Which, by the way, is still a lot higher than the wealthiest people on earth 100 years ago.

Rich people not only have the resources to access the best healthcare facilities, but they also have the time to look after themselves by exercising and cooking healthy meals. Healthy eating is more expensive and time-consuming than picking up some junk from a takeaway joint.

Money may not always buy you happiness but it will make you live longer. So keep on saving and adding to your Vestact accounts.

Michael's musings

Since the start of this year, we've had many new client queries. Prospective clients want to know about our stock selection process. At Vestact, we use a top-down approach, as opposed to a bottom-up one. Bottom up is better suited to short time frames, where investors seek out companies trading at a supposed discount, in the hope that the stock will re-rate soon.

With top-down methods, you choose the sector first and then the company. We are very long-term investors, so the sectors we choose to invest in are as important as the companies themselves. It is much easier to hold through market downturns when you know the sector has a very promising future.

Once we've selected the industry, we usually pick the biggest and most-recognisable company. It is rare for us to invest in a company with a market capitalisation under $100 billion. Having a strong brand name, billions in the bank and a global workforce means that the biggest company usually gets a disproportionate amount of the industry's growth.

The sectors that we like are technology, healthcare and speciality retail. Things like mining and financials are too cyclical, and 'sin stocks' (tobacco, alcohol and gambling) are in a steady decline as sociey's priorities change.

Bright's banter

Google just invested over $1 billion in Anthropic, a hot AI startup. This adds to their previous $2 billion investment, giving them a 10% stake. Anthropic's valuation could hit $60 billion with a new funding round.

Anthropic's best-known product is the chatbot Claude. The company's revenue is skyrocketing, with annualised sales reaching $1 billion in December 2024. That's a 10x increase from the previous year!

Anthropic is backed by big players like Amazon, which has invested $8 billion so far. The AI market is expected to balloon to over $1 trillion in the next decade.

Linkfest, lap it up

The most important lessons are hard to communicate. They always sound like cliches - Here's what experience has taught Nabeel Qureshi over the years.

Hyper inflation is terrible for people. An Aussie has written a piece about his experience of moving to Argentina - Dealing with hyper inflation.

Signing off

Asian markets are up today after Trump hinted at a softer approach towards tariffs on China. The yen also strengthened this morning after the Bank of Japan raised interest rates to the highest level since 2008.

In local company news, Super Group's profit took a hit due to supply-chain bottlenecks and declining coal exports. The company expects a 20 to 30% plunge in headline earnings per share.

US equity futures are slightly in the red pre-market. The Rand is trading at around R18.47 to the US Dollar.

On the 25th (tomorrow) around six of our planets in the solar system will line up in a row, something that only happens once every 396 billion years. Venus, Mars, Jupiter, and Saturn will be visible to the naked eye. Very cool!

Have a good weekend.