Market scorecard

The S&P 500 neared record highs last night after a 3-day rally. Enthusiasm in the tech sector continued, on news of ambitious AI infrastructure projects, so Nvidia rose 4.4% and Oracle was up 6.8%. It's a brave new world.

In company news, Johnson & Johnson fell 1.9% after a solid report but a weaker-than-expected 2025 outlook. Damn. Meanwhile, Travelers (+3.2%) and Procter & Gamble (+1.9%) gained on strong results. Lastly, Samsung announced a new ultra-thin phone.

At the end of the day, the JSE All-share was down 0.23%, but the S&P 500 tacked on 0.61%, and the Nasdaq climbed 1.28% higher.

Our 10c worth

Michael's musings

It's my turn to write about Netflix's latest numbers and luckily for me, the company made my job easy. On Tuesday night, Netflix reported that they added 18.9 million subscribers in the final quarter of 2024, more than double the number Wall Street was expecting, and crossing 300 million subscribers. As a result, the stock popped 9.7%. Frustratingly, the new all-time high is now $999, just shy of a new milestone.

This is the last quarter that Netflix will report subscriber numbers as the company wants Wall Street to be more focused on their financial metrics. They are going out with a bang, as this quarter set the record for most additions. The previous record was 15 million at the height of Covid, when everyone was stuck at home needing entertainment.

The strong growth in their subscriber numbers can be attributed to a mix of things. They hosted some massive sporting events, such as the Mike Tyson vs. Jake Paul boxing match and the Christmas Day NFL games. Cracking down on password sharing is still paying dividends. Their cheaper ad-supported membership tier also made it easier for people to get stuck in.

Netflix increased their guidance for 2025. They are also hiking prices again for some major markets, including the US. For the standard plan in the US, the monthly price rises by $2.50 to $17.99, which is still super cheap and great value for money. Netflix is a money-making machine.

The stock is expensive on a forward P/E of 37. The market assumes that the company will not only hold onto its 300 million subscribers but add more, while continuing to increase subscription fees. Both those assumptions seem valid. Their biggest challenge is to keep creating interesting content to keep members from looking at competitor offerings.

Netflix is a good holding for more risk-tolerant clients. Buy them while they are still under $1,000 per share.

One thing, from Paul

The best approach to economic forecasting is sunny optimism. I'm referring to the US economy which is very large and dominated by services and consumers, not the strange and constrained economy down here in South Africa.

Economic recessions in the US have become increasingly rare. In this century, we've only had recessions twice, the 2008 sub-prime crisis, and for 2 months in 2020 due to Covid. For the other 23 years, it's been one-way traffic, up. This is why the market is at an all-time high again today.

In both of those two tough periods, Vestact advised our clients to do nothing, hold on to their stocks and wait for a market recovery. That worked out fine.

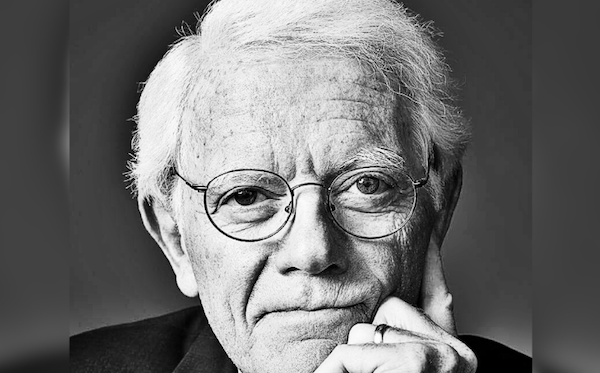

So be cheerful, buy quality companies, and never sell. Ok, very seldom sell. Ignore the day-to-day gyrations. Peter Lynch (pictured here) once said, "I'm always fully invested. It's a great feeling to be caught with your pants up."

Byron's beats

It seems that the size of the US deficit is going to be a recurring theme this year. The US government overspent again in 2024, this time by $2 trillion, which brings the total federal debt level to over $30 trillion. The interest expense on that debt alone was $1.15 trillion last year.

That sounds like a big problem, but keep in mind that investors like to hold bonds, and that the US is a very large country with a massive tax base and enormous physical assets. For example, what do you think Yellowstone National Park is worth? Or the US Interstate highway network? These are all very real, very valuable fixed assets that could, in theory, be sold to the private sector in order to pay off debts.

For example, Trump plans to sell two-thirds of the federal government's 370 million square feet of office buildings which he thinks are under-utilised. This is relatively small scale but it is a reminder that the US government has a massive balance sheet and obsessing about debt levels in isolation can be deceiving.

Bright's banter

Google secured a UK court ruling to block Russian media firms from seizing its global assets. The ruling also stops the Russians enforcing massive fines related to YouTube channel bans. The penalties had ballooned to an estimated $125 nonillion, an amount vastly exceeding global economic output.

The fines stem from Russia's demand that Google reinstate blocked media channels, a measure that escalates weekly. Google had previously sought protection in both the UK and US courts after facing mounting penalties.

The case highlights tensions between multinational companies and the Russian legal system, amid global sanctions that arose after that country invaded Ukraine. The Russian state is isolated and their laws are being ignored.

Linkfest, lap it up

The Kyalami Castle was built in 1992. Since then, it has been a house, a hotel and now is a spiritual retreat - Inside the secretive castle.

Learn to have a good relationship with money. Don't do things that don't improve your life in the long-term - Spend money on stuff you really care about.

Signing off

Asian stocks climbed as Chinese officials reiterated their commitment to propping up markets. The CSI 300 hit a near 3-week high, up 1.8% before easing back, while Hong Kong shares also surged. The MSCI Asia Pacific index edged higher overall.

In local company news, Clicks reported an 8.1% year-on-year increase in turnover to R18.2 billion for the 20 weeks to 12 January 2025. They said that they were doing well in their health and pharmacy units and that the Black Friday promotions had worked out well.

US equity futures are slightly lower in pre-market trade. The Rand is at around R18.49 to the US Dollar.

The only noteworthy companies with earnings reports out today are Intuitive Surgical and GE Aerospace. If you like trains, look out for numbers from Union Pacific and CSX.

Keep well.