Market scorecard

US stocks closed higher yesterday, with the S&P 500 climbing almost 1% as investors reacted positively to President Trump's initial policy actions. Over 400 stocks in the index advanced, fuelled by the announcement of an AI infrastructure investment initiative involving SoftBank, OpenAI, and Oracle.

In company news, Netflix jumped 14% in late trade after posting its largest-ever quarterly subscriber growth and raising prices; they now have over 300 million customers. Elsewhere, Adidas beat expectations, thanks to strong demand for retro sneakers like the Samba. Those are all the rage.

Izolo, the JSE All-share was up 0.13%, the S&P 500 rose 0.88%, and the Nasdaq was 0.64% higher. On we go.

Our 10c worth

One thing, from Paul

We own a nice selection of the world's most valuable listed companies in our Vestact portfolios, including all of the so-called Magnificent Seven. Better still, we've owned them since well before they got grouped and given that name. We owned them even before they were called the FANGs, then the FAMGAs.

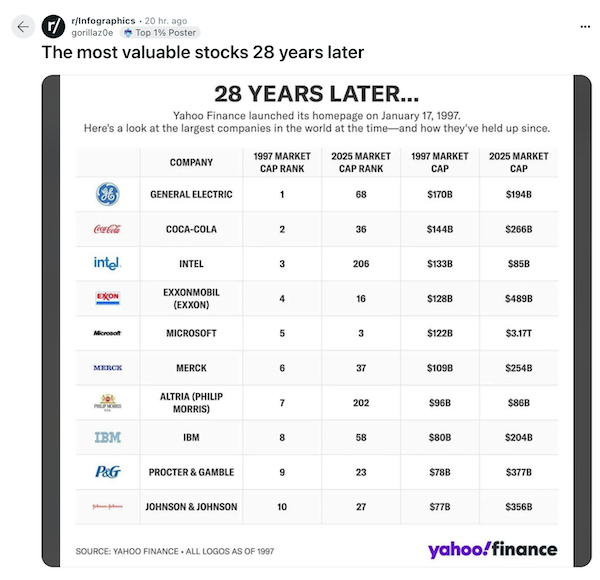

However, big companies don't always stay big, so caution is called for. Consider the chart below which was posted on Reddit in the last few days, and forwarded to us by a client.

Of the most valuable companies 28 years ago, in 1996, only one is still in the top 10 (Microsoft).

If you are still a Vestact client in 28 years from now, in 2052, what will your portfolio look like? I'd suggest that there may be a handful of survivors, but many changes will have been made along the way. That's what you pay us for - to tell you when to make adjustments to your holdings.

Byron's beats

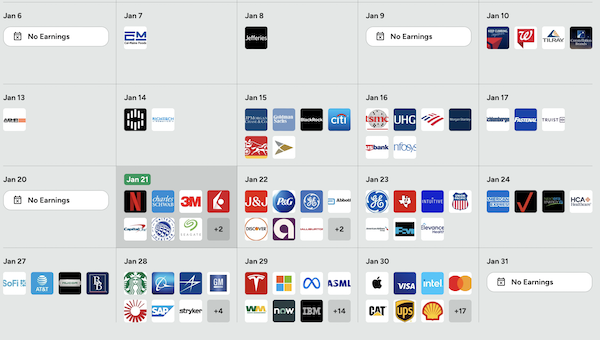

A new client recently asked me what "earnings season" is. We have a whole host of new readers, so I thought it would be worthwhile to elaborate as we tee up for another exciting few weeks.

Listed companies in the US must report to the market quarterly, which includes their operating numbers, management commentary and forward projections. As shareholders, this allows us to see what is happening at these businesses. Numbers don't lie.

We have 15 recommended stocks that we follow religiously because both our clients and ourselves personally own them. We read those quarterly reports very closely, then we summarise them in this newsletter.

For example, Netflix reported last night and Johnson & Johnson will report before the market opens today. Next week, things really rev up, with Stryker, Tesla, Microsoft, Meta, Apple, and Visa all putting out results. Stay tuned for the highlights.

Michael's musings

Last week, Goldman Sachs gave its CEO and COO retention awards valued at $80 million each. On top of that, Chief Executive Officer David Solomon (pictured here) received a 26% salary increase from $31 million to $39 million a year. Goldman argues that these massive numbers are justified because of the competition from rival firms for top talent.

When I read the Goldman news, I asked myself if one person is really worth that much money? If a rival poached Solomon, would his replacement be significantly worse? The Goldman board thinks he is worth it, and that is all that matters.

Large salaries aren't a new thing. I recently listened to a series about the historic rivalry between Ford, GM and Chrysler. Robert McNamara became the first president of the Ford Motor Company from outside the Ford family, in 1960. You might know of McNamara because he went on to become a US Secretary of Defence. His salary as Ford president was $3 million a year. When adjusted for inflation that would be $32 million today.

Bright's banter

Shares of SoftBank surged 10% after President Trump announced a massive AI push, referred to above.

The "Stargate" joint venture plans to invest $100 billion immediately into US-based AI infrastructure, with additional backing from Microsoft, Nvidia, and others. The initiative aims to strengthen US leadership in the global AI race, using Nvidia chips and supported by a diverse group of investors, including UAE-based MGX. SoftBank CEO Masayoshi Son will chair the board of the new entity.

Microsoft will retain exclusive rights to OpenAI's API under a deal lasting through 2030. The collaboration enables OpenAI to partner with Oracle for AI data centres.

Linkfest, lap it up

Capturing memories of our kids as they grow is important. But by over-documenting their lives, we might miss the joy of simply being present - You don't need to take a video of everything.

Share prices are driven by expectations of future profits. Here is a list of the world's 50 most profitable companies in 2024 - The list is full of familiar names.

Signing off

Asian stocks edged higher this morning. Tech stocks drove gains in Taiwan and Japan, while Chinese markets lagged on residual fears about a trade war, with the CSI 300 down 0.85% and the Hang Seng China Enterprise Index off 1.34%.

In local company news, MTN shares jumped over 4% after Nigeria's NCC approved its first mobile tariff hike in 11 years. Operators can raise prices by up to 50%, though that was less than the 100% some had requested. Elsewhere, Hudaco is set to acquire Isotec's assets and liabilities for R709 million. Isotec supplies insulation materials for transformers and electric motors, serving industries like mining, manufacturing, rail, and power generation.

US equity futures edged higher pre-market. The Rand is trading at around R18.48 to the US Dollar.

Things are looking good. Enjoy the day.