Market scorecard

US markets cooled yesterday, just slightly coming off record highs as Wall Street shifted focus to upcoming jobs data, which could influence the Fed's December rate decision. Both the S&P 500 and the Nasdaq Composite closed in the red after a steaming hot rally.

In company news, Tesla gained 3.2% after a price target boost from Bank of America. Applied Materials slid 5% following a Morgan Stanley downgrade. Meanwhile, Eli Lilly is investing $3 billion in expanding US manufacturing for its diabetes and weight-loss drug portfolio.

Yesterday, the JSE All-share was up 0.62%, the S&P 500 retreated 0.19%, and the Nasdaq cooled off 0.17%. Nothing serious.

Our 10c worth

One thing, from Paul

Here's some Friday advice: become a cheerful conservative. Stay optimistic about the future, and work for change, but in a responsible way.

George Will (pictured here), long-time columnist in the Washington Post said: "Conservatives are realistic about human limitations, and do not flatter of the species".

Wild-eyed progressives are always coming up with hopelessly ambitious ways of changing the world, usually through more state intervention. Due to maladministration and corruption, most of these ideas have no chance of successful implementation. They end up doing more harm than good.

A good example of this ridiculous mindset is the relentless pursuit of an NHI scheme in South Africa, being driven by two demented men - Aaron Motsoaledi and Nicholas Crisp. They hope to destroy the private medical industry, just because it irritates them that well-off people save for their own medical care.

It makes more sense to fix existing state institutions instead of destroying the ones that work in pursuit of "equality". The state should focus on repairing its own shoddy facilities.

Byron's beats

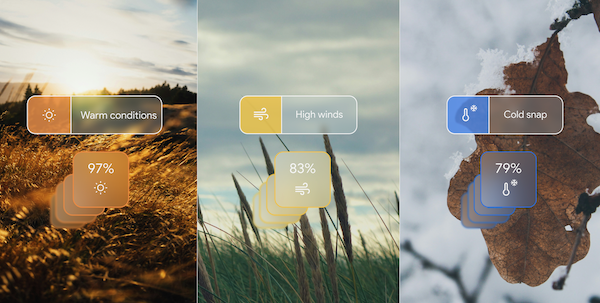

Google recently revealed an AI-powered weather forecast model called GenCast. The program can produce 15-day forecasts that, according to studies, are more accurate than original systems 97.2% of the time. That makes sense as weather predictions are based on probabilities, which are determined by patterns and data. AI is very good at processing data and picking up patterns.

According to Google, "a GenCast forecast comprises an ensemble of 50 or more predictions, each representing a possible weather trajectory. The diffusion model has adapted to the spherical geometry of the Earth, and learns to accurately generate the complex probability distribution of future weather scenarios when given the most recent state of the weather as input".

That sounds impressive. The weather is a very important element in so many people's lives. Farming, transport, travel, entertainment and many other industries rely heavily on weather forecasts. And then, of course, there is the threat of extreme weather, which, if picked up early, can save people's lives. I love checking the weather, when GenCast goes mainstream, sign me up!

Michael's musings

On Tuesday, Amazon unveiled its new AI-training chip, called Trainium 2. They also plan to create a supercomputer that will use hundreds of thousands of the new chips. It should be ready for use sometime next year. The first user of the supercomputer will be Anthropic, an AI startup which Amazon has invested $8 billion.

On top of the supercomputer, Amazon is linking 64 Trainium 2 chips together in a very efficient configuration which they call an ultraserver. These will be rented out on AWS to companies looking to train AI programs. One of these users is Apple, who has been a beta-tester of the new chips. According to Apple, they have seen up to 50% efficiency savings by switching to Trainium 2 chips.

In the fast-growing world of AI, companies are having to find a balance between chip costs, availability, performance and heat generation. On top of their new Trainium 2 chips, Amazon still gives their customers access to Nvidia chips. It is worth noting that many AI programs are designed to run on Nvidia infrastructure, so using a competitor's chips means software engineers need to spend time making changes to the programs. Leaving Nvida infrastructure isn't a simple switch.

We are happy to see Amazon innovating to keep AWS useful and relevant in our fast-changing world.

Bright's banter

I read an interesting report on the state of sportswear, and where it's headed in 2025. Here's my takeaway:

In 2024, challenger brands like Deckers (Hoka) and Asics are outshining giants like Nike, Adidas, Puma, and Under Armour in growing profitability and market share. Their focus on visible innovations, like Hoka's midsoles and On's CloudTec soles, has delivered standout products while incumbents rely on incremental improvements.

Targeting niche categories has also been key. Lululemon expanded in women's athleisure, Salomon embraced outdoor communities, and Arc'teryx catered to adventure sports, successfully capturing underserved segments. Meanwhile, cultural marketing has fuelled growth, with challengers leveraging grassroots strategies and celebrity endorsements like New Balance's Jack Harlow and Alo Yoga's Kendall Jenner.

Smaller brands capitalised on the big guys missteps in wholesale, partnering with retailers like Dick's Sporting Goods and JD Sports. While Nike and Adidas leaned heavily on direct-to-consumer (DTC) channels, they left shelving space empty, allowing challengers to fill the gaps.

Looking to 2025, sportswear is set to outpace broader fashion growth, buoyed by athleisure demand, health-conscious consumers, and rising sports tourism. Brands like Alo Yoga and Lululemon are diversifying into performance gear, blending innovation with cultural relevance.

To compete, incumbents must prioritise breakthrough innovation, authentic partnerships, and balanced channel strategies - something Nike is doing under the new CEO. Direct to consumer channels should focus on brand storytelling, while wholesale partnerships enhance reach and profitability. The battle for dominance in sportswear is heating up.

Linkfest, lap it up

The year is almost over. Blogger Tom Whitwell annually reflects on what he learnt - 52 things I learned in 2024.

Weight loss is a very fast-growing industry. Eli Lilly's horse in the race seems to be winning - Zepbound tops Wegovy for weight loss in head-to-head trial.

Signing off

Asian markets showed a mixed performance this morning. Hong Kong and mainland China edged higher on hopes for stronger growth stimulus.

In local company news, African Bank has been named the preferred bidder for Eskom's R5.7bn staff home loan book, with the deal expected to close by May 2025. African Bank aims to diversify its offerings and strengthen its presence in the home loan market.

US equity futures are mixed pre-market. The Rand is trading at around R18.02 to the US Dollar.

It is Friday again. Enjoy the weekend and the long summer days in the southern hemisphere. Stay cool out there.