Market scorecard

US markets had a strong session yesterday, thanks to a rally in large technology stocks. The S&P 500 notched up its 54th record close this year, while the Nasdaq jumped just shy of 1%. The standout performers were Tesla (+3.5%), Meta (+3.2%) and Apple (+1.0%). That's a new all-time high for the iPhone maker.

In company news, Intel CEO Pat Gelsinger was forced out by his board after they lost faith in his turnaround strategy for the iconic chipmaker. Meanwhile, Super Micro's independent review cleared its management team of misconduct and its shares jumped by 26.9%. That stock has been ridiculously volatile.

In short, the JSE All-share was up 1.44%, the S&P 500 rose 0.24%, and the Nasdaq was 0.97% higher.

Our 10c worth

One thing, from Paul

Microsoft is about to turn 50 years old. The company was founded in 1975 by Bill Gates and Paul Allen, when they created a basic operating system for the Altair 8800 microcomputer.

Today, it's one of the world's most valuable companies, headquartered in Redmond, Washington. It sells office software, operating systems, Internet services, cloud computing, artificial intelligence, video gaming software and electronic devices.

Microsoft made three key shifts in the last decade which were all initiated by CEO Satya Nadella. The first was switching their software away from up-front sales to subscription services. The second was creating their cloud offerings, now representing 60% of group revenue. The third was to embrace AI to power all software tools, which is the future of their business. The last move was effected through a massive investment in OpenAI.

We are happy holders of Microsoft in our New York portfolios. Wired magazine did a great write up about the company, which you can read here. We've profiled this article before, but it's really worth a read.

Michael's musings

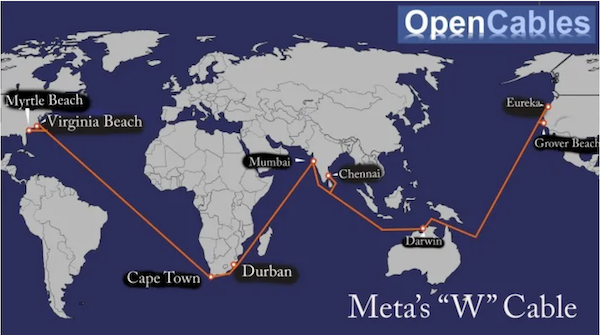

Meta is a hugely profitable company that has built up a $70 billion cash hoard. The advantage of having all that dry powder is that it can invest heavily in infrastructure, like the $40 billion project to improve its AI capabilities. Now, Techcrunch is reporting that Meta is considering a $10 billion investment in an undersea cable that goes around the world.

What makes this investment unique is that Meta will be its sole owner. In most cases, consortiums own the cables and then divvy up the bandwidth according to their needs. It makes sense that Meta wants to own their own cable because their sites are responsible for 10% of all fixed and 22% of all mobile traffic. Owning the cable will help to ensure a good user experience, regardless of where people are based.

I suspect that Meta is doing it to enhance their AI functionality. They can build AI data centres worldwide and have those servers easily talk to each other. For example, running costs in South Africa and India are significantly cheaper than in the US, making them perfect locations to do heavy data processing. Meta hasn't officially announced anything yet, insiders say more details will be released in early 2025.

Bright's banter

Last week, Warren Buffett announced a significant donation of over $1 billion in Berkshire Hathaway shares to four family foundations. This is part of his long-standing pledge to give away the bulk of his fortune to charity rather than leave it to his family.

The focus in this message was on life, leadership, and preparing for the inevitable. At 94, Buffett knows "father time always wins" and he's keen to leave lessons about living well.

Here's what stood out:

Buffett makes it clear: dynastic wealth isn't his thing. He famously said parents should leave their kids "enough so they can do anything but not enough that they can do nothing." None of his children will ever be Berkshire's CEO, even though two sit on the board.

This is a sharp contrast to the nepotism fuelling drama at family-run businesses like Estee Lauder and LVMH. Instead, Buffett's approach of tasking his kids with giving away wealth, not hoarding it - feels refreshingly forward-thinking.

Buffett often credits his success to luck rather than skill, writing that his "lucky streak" began at birth in 1930 as a white male in the US. This perspective has grounded him, motivating his generosity toward those born less fortunate while keeping ego-driven mistakes at bay.

Buffett stresses the importance of transparency in estate planning. He believes every parent should discuss their will with their kids, explaining their decisions now to avoid confusion or resentment later. This openness mirrors his approach to succession at Berkshire - no mystery, no drama, just clarity.

Buffett's frugality is legendary. His 1958 Omaha home is proof of his belief in the power of compounding. By saving and reinvesting over decades, he's amassed a fortune that keeps growing, allowing giving well into his later years.

Buffett ends his memo by telling his kids he's proud of them. Sometimes, the simplest things leave the biggest impact.

You can read the full memo here.

Linkfest, lap it up

A low probability of loss doesn't equal low risk. More important is asking how much you lose if your forecast is wrong - Avoid investments where an adverse outcome can completely wipe you out.

Coffee is an important part of our modern lifestyle. Bad weather in Vietnam and Brazil has put pressure on bean supply - Coffee at highest price in 47 years.

Signing off

Asian markets are mostly higher this morning, with tech stocks leading gains as the latest US restrictions on Chinese access to key chip and AI components turned out less severe than anticipated. Indices in Hong Kong, India, Japan, South Korea, and Australia posted increases.

In local company news, Alexforbes delivered a strong interim performance and boosted its dividend by 10%. Assets under management rose by 25% year-on-year to R568 billion.

US equity futures are marginally higher in early pre-market trade. The Rand is at around R18.16 to the US Dollar.

Farewell.