Market scorecard

Yesterday was quiet as traders waited in anticipation for Nvidia's after-market results. The S&P 500 and Nasdaq closed nearly flat, while defensive sectors like healthcare showed modest gains, reflecting a shift toward safer bets in an uncertain environment.

In company news, Nvidia crushed earnings expectations again but the stock response was muted, down 2.5% in late trading. The management team highlighted strong demand for its new Blackwell product line. Elsewhere, big-box retailer Target reported dismal results for its third quarter and the stock plummeted 21.4%. More on that below.

In summary, the JSE All-share was up 0.89% on the day, the S&P 500 was unchanged, and the Nasdaq was just 0.11% lower.

Our 10c worth

One thing, from Paul

Robert Heinlein (pictured here) was an American science fiction author, aeronautical engineer, and naval officer. He lived from 1907 to 1988.

He's famous for this quote:

"A human being should be able to change a diaper, plan an invasion, butcher a hog, conn a ship, design a building, write a sonnet, balance accounts, build a wall, set a bone, comfort the dying, take orders, give orders, cooperate, act alone, solve equations, analyze a new problem, pitch manure, program a computer, cook a tasty meal, fight efficiently, die gallantly. Specialization is for insects."

Sounds good. How would you update that list for 2024? I'll start. A human being should also be able to follow the business news and invest sensibly in the stock market.

Byron's beats

Virgin Media have created an AI granny called Daisy that is designed to scam scammers. The program will lead on a scammer with an AI bot that speaks just like a sweet old granny, a prime target for these criminals.

Virgin have posted her number on notorious scammer forums and she has taken thousands of calls already, wasting countless hours. She even had one scammer on the phone for 40 minutes. Bless you Daisy dear!

I suggest MTN and Vodacom get ahold of this software and start sharing the number far and wide. Scam calls in South Africa are off the charts at the moment. Here is a sound clip which shows how Daisy operates.

It's that time of year when criminals and scammers are working overtime. Be careful taking calls from unknown numbers. Especially if they claim to be your network service provider, suggesting that you have been a victim of sim card fraud. Do not give them your details.

Michael's musings

Yesterday, Stats SA released South African inflation data which looked like something from the US or EU. Inflation for October came in at a scant 2.8%. This is down from 3.8% in September, and better than the 3% economists forecast. Month -over-month inflation was actually negative, thanks to a splendid 5.3% drop in fuel prices.

This 2.8% inflation reading is below the SARB's 3 to 6% target. That means the Monetary Policy Committee (MPC) is guaranteed to cut today by at least 25 basis points. They may even surprise us with a 50 basis points rate reduction.

I think the SARB should drop their inflation target to 3%. Now is the perfect time. Usually, abandoning inflation targeting requires high interest rates to squash economic demand and dampen prices. We are in a beautiful place where inflation has fallen below 3% thanks to global cycles.

Bright's banter

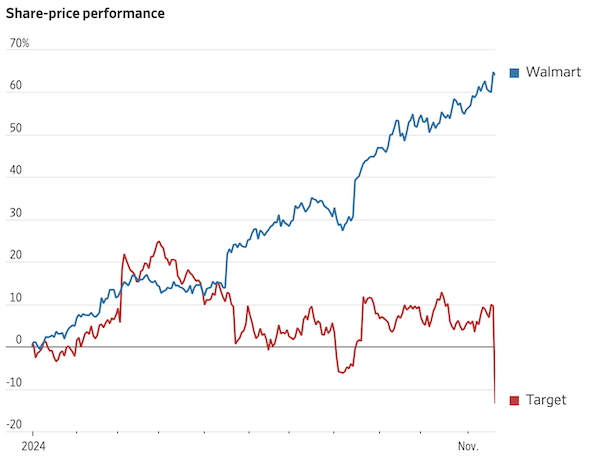

Walmart is off to a strong holiday season, with US sales rising 5.3% last quarter, well above the 3.8% expected by analysts. This marks its 11th straight quarter of beating expectations, driven by market share gains from higher-income households - 75% of its growth came from families earning over $100 000.

Meanwhile, Target's shares collapsed yesterday, hitting a 52-week low as competitive pressure mounts with comparable sales only up 0.3%. Gains in digital sales (+10.8%) were offset by a 1.9% drop of in-store sales. Essentials, food, and beauty performed well, but discretionary categories like home goods and toys were weak. These were areas where Walmart saw strength. Trump tariffs on imports, if imposed next year, could further hurt Target's margins, as it relies heavily on imported goods.

Walmart's investments in efficiency, including $72 billion in capital spending since 2021, have really paid off. E-commerce sales grew 22%, and high-margin areas like advertising and Walmart+ membership income are climbing.

With the ability to cut prices further if needed, Walmart has the upper hand, leaving competitors struggling to match its value and convenience. This holiday season may bring Walmart cheer but more woes for Target and other rivals.

Linkfest, lap it up

Jaguar is repositioning itself as an ultra-luxury EV brand. Part of the change is a new logo - First steps of a rebirth.

GLP-1 drugs are primarily used for treating diabetes and weight-loss. They have been found to have a host of other benefits too, here is the latest - Weight-loss medications may also ease chronic pain.

Signing off

Asian markets dipped this morning. A 1% drop in regional semiconductor stocks followed Nvidia's results.

Over in India, Adani Group's US-dollar bonds tumbled after its founder, Gautam Adani, was charged in the US over an alleged bribery scheme. The group immediately scrapped plans for a $600 million bond issue, raising fresh concerns about its financial outlook.

In local company news, Ninety One is looking to buy Sanlam Investment Management (SIM) for around R5 billion. If the deal goes through, it'll add about R400 billion in assets under management to Ninety One, giving a big boost to its local growth strategy and market reach.

US equity futures have edged lower in early trade. The Rand is at around R18.10 to the US Dollar.

Soldier on, it's already Thursday.