Market scorecard

Stocks started in the red yesterday over concerns of an escalation in the Ukrainian war. The fear is that Moscow might get desperate and resort to using nuclear weapons. By mid-morning, the panic attack subsided and markets swung from red to green and continued to head higher. Technology stocks lead the pack.

In company news, Walmart rose by 3% to a new all-time-high yesterday. The retailer reported a 22% increase in e-commerce sales and issued a strong forecast for sales for the rest of the year. Elsewhere, AI server-maker Super Micro Computer climbed 31% after they named a new auditor which should help them stay listed on the Nasdaq. Last month, Ernst & Young resigned abruptly.

In summary, the JSE All-share closed up 0.12%, the S&P 500 rose by 0.40%, and the Nasdaq advanced by a pleasing 1.04%.

Our 10c worth

One thing from Paul

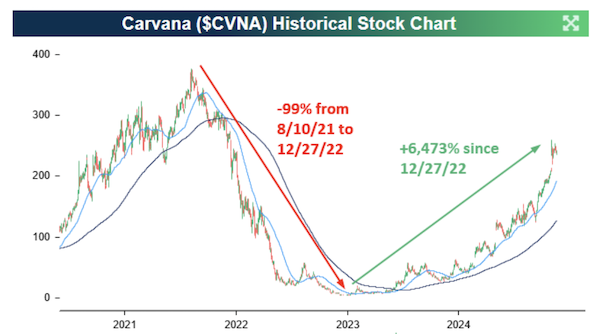

Do stocks ever come back from the dead? In other words, can one hold on to a position that has really crashed, down more than 70% from its highs, and hope to get your money back?

In general, it's best to call it quits if a company is going out of business due to fraud and mismanagement. There's no point flogging a dead horse. I'm thinking of cases like Enron and Steinhoff.

You probably also want to sell out of companies that have lost their competitive edge, or have seen their business proposition evaporate. A recent example would be space-tourism company Virgin Galactic. They are having trouble getting off the ground.

The more tricky case is where a stock has lost most of its value, but the company still looks fine. The largest drawdown Apple ever had was 82%. Amazon fell by 94% during the dot-com bubble burst before recovering.

I've written recently about Meta Platforms and Netflix, which both lost about 75% of their value in 2022, but have since rallied sharply and are now trading at new all-time highs. You don't want to sell those at their lows.

The example in the image below is even more extreme. Online used car retailer Carvana fell 99% in the same year, and has since rallied rather nicely.

Byron's beats

After Google was found to be monopolising online search by a federal judge, it seems the US Department of Justice (DOJ) is pushing for the company to sell off its Chrome browser. The original case was filed under the first Trump administration so the recent election result may not make this issue go away, I am afraid. This demonstrates how long this rubbish has been going on for. Google has appealed the verdict.

We believe that this will be a long, drawn-out process that will most likely result in no action whatsoever. Or at the very most, some small compromise which will make the DOJ feel like it has won. If Google was forced to sell the Chrome business, analysts think they could get $20 billion for it. The share price barely budged on the news.

The current timeline involves a Google appeal, a two week hearing in April 2025 and the final judgment in August next year. I highly doubt it will happen that quickly but we will keep you updated nonetheless.

Michael's musings

Y Combinator is a start-up accelerator and venture capital firm launched back in March 2005. They have an amazing track record and are considered Silicon Valley royalty. If you get backing from Y Combinator, you almost automatically get more funding from other parties.

They have invested in over 4 000 start-ups. Some of their big wins include Airbnb, DoorDash, Stripe, Dropbox, Coinbase and Reddit. If you have time to watch - Y Combinator CEO shares how they pick winners and advice for founders

An interesting observation from the video is that Y Combinator has some of the best returns around, but their process is very simple. To get funding, you submit a 1-page application form and do a 10-minute interview. Done. Compare that to the rest of the VC industry, who require lots of hoop-jumping from founders with extensive pitch decks and spreadsheets.

Most times, simpler is just better.

Linkfest, lap it up

Have you started to experiment with AI yet? Google's chatbot has just arrived on iPhone - Salesforce CEO is 'absolutely blown away' by the new Gemini AI voice assistant.

Don't like your eye colour? Don't worry, there's a surgical procedure for that - A $12 000 operation is surging in popularity.

Signing off

Even though US markets ended higher yesterday, Asian markets are mostly down this morning. Shares of Seven & i Holdings, the owner of 7-Eleven, among other brands, are up 7% on renewed speculation that the founding family will take the company private.

In local company news, Coronation Fund Managers closed up 3% after reporting a pleasing set of numbers. It's trading at just under R40 a share, still well below its high of R55 in 2022. Coronation's total assets under management increased 11% to a record R667 billion.

After the market closes tonight, we'll see results out from Nvidia. Barclays' strategists call these numbers more important for market sentiment than the Fed's next interest rate meeting. Buckle up, because markets may be volatile tomorrow.

The US Dollar is trading at $/R18.04. US futures are very slightly in the green.

Have a good hump-day Wednesday. It's nice and sunny in Joburg.