Market scorecard

US markets were mixed yesterday, with major equity benchmarks losing momentum late in the New York session. Inflation data out early in the day met expectations, resulting in mid-morning gains, but the S&P 500 ended flat.

In company news, Mastercard closed down 1.4% after saying it expects slower growth for the next three years, as it aims to expand its presence in digital payments. Elsewhere, electric vehicle-maker Rivian rose 13.7% after announcing a new joint venture with Volkswagen. Finally, Spirit Airlines crash landed (-59.3%) after canning its deal with Frontier Airlines and heading into bankruptcy proceedings. Hayibo, shem.

Izolo, the JSE All-share was down 0.47%, the S&P 500 rose just 0.02%, and the Nasdaq was 0.26% lower.

Our 10c worth

Bright's banter

Eli Lilly reported quarterly results at the end of October that came up short of forecasts, causing its shares to slide over 10%. They have since recovered somewhat. Sales of the company's blockbuster diabetes and anti-obesity drugs, Mounjaro and Zepbound, fell short of very high revenue expectations. Mounjaro sales more than doubled to $3.11 billion and Zepbound sales were $1.26 billion, so they are not exactly battling.

The company attributed the underwhelming performance to inventory decreases by wholesale distributors. Eli Lilly's CFO, Lucas Montarce, said wholesalers were grappling with the complexities of high-volume cold-chain products. Management remains optimistic, citing strong underlying demand for the drugs.

The company's valuation has sparked debate, with Eli Lilly trading at 40 times forward earnings compared to the average pharma company's 17 times. Investors are paying up for growth potential, which has been hard to come by in the sector. Despite the short-term setback, we view this as a buying opportunity, given the transformative potential of GLP-1 drugs in treating obesity.

Overall, one soft quarter doesn't justify panic. Eli Lilly's growth prospects, driven by its innovative drugs, remain intact. Investors should focus on the company's long-term trajectory rather than a single quarterly blip. Their pipeline also includes promising Alzheimer's drugs, which could further fuel growth.

One thing, from Paul

The S&P 500 is up 26.3% in 2024. We still have 6 weeks to go, and it could rise some more, or go down a bit before the final number is known.

Ben Carlson asked, "how rare is a gain like this?" You can read his blog post here: every calendar year return on the S&P 500 going back to 1928.

The answer is, gains like that are not rare at all. Annual advances of 30% or more have happened 18 times in the past 96 years, which means 1 out of every 5 years. The S&P has been up 25% or more, 1 out of every 4 years.

Keep in mind that the index returns for the last 5 years have looked like this: 2020 - solid; 2021 - good; 2022 - disgusting; 2023 - good; 2024 so far - good. We can't complain.

Byron's beats

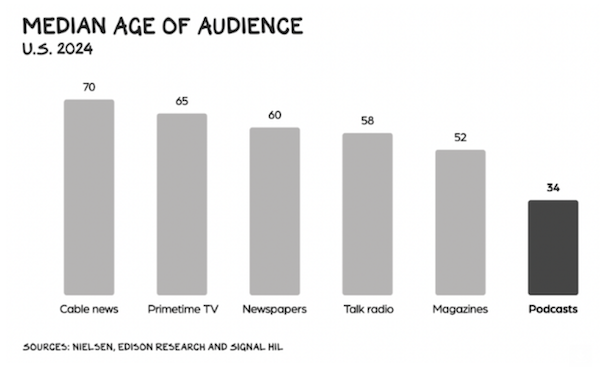

This has been a big year for high-profile elections. There's been a lot of debate about which platforms work best for mobilising political support. It seems to me that election winners did so by targeting younger audiences using social media, podcasts and YouTube. Legacy media like news stations on TV, talk radio and newspapers were far less relevant.

Take a look at the image below, which looks at the median age of the audience for the various sources of news. Podcasts have been a big talking point after the US election because many feel this is where Trump really won over young male voters. The 3 hour Joe Rogan interview got 50 million YouTube views in less than 2 weeks. That is a lot of views for such a long clip.

Michael's musings

I was shocked to read that roughly 81% of Ethiopians don't have access to the internet. Uganda, the DRC and Tanzania are slightly better with 73%, 71% and 68% of their respective populations offline. The developed world is excited about AI, but in rural parts of the developing world, people still get information from the village rumour mill.

It's hard to make a return on the capital outlay for internet backhaul infrastructure when the customers have no money. This is where Starlink could make a huge difference. The satellites are already in orbit, so can easily link rural populations to the rest of the world.

Starlink operates in 15 African countries, unfortunately, none of the four mentioned above. You can see a nice graphic on the regions that still need to be brought online - The world's largest unconnected populations.

Linkfest, lap it up

Rivian is a US-based competitor to Tesla. VW is investing up to $5.6 billion in a JV - Rivian-Volkswagen partnership to roll out new cars in 2027.

Nothing beats the thrill of watching live sports. The current generation of children are less interested than ever - Will kids become fans when they are older?

Signing off

Asian markets fell this morning, pressured by weakness in China that dampened regional risk appetite. Hong Kong's market also declined amid low trading volumes, remaining open despite severe weather conditions.

In local company news, Brait bounced back to a R724 million profit for the six months to September, recovering from a R300 million loss a year ago. Virgin Active was a key contributor, with active membership up 6% and revenue climbing 16% (23% including Kauai and Nu). UK-based clothing retailer New Look continues to stink.

US equity futures edged lower pre-market. The Rand is looking lame at R18.26 to the US Dollar.

Catch you later.