Market scorecard

US markets rose again yesterday, with the S&P 500 crossing 6 000 points for the first time. Did you know that the index first closed above 60 points in July 1959 and above 600 in November 1995? The moral of the story is, own stocks and stay long because time is on your side.

In company news, Tesla continues to surge, up another 8.5% yesterday. Elsewhere, health-management companies Cigna and Humana confirmed that their deal to merge is officially off. Finally, AbbVie shares dropped 12.6% because their trial of a new schizophrenia drug failed.

In summary, the JSE All-share was down 0.41%, but the S&P 500 rose 0.10%, and the Nasdaq was 0.06% higher. Small gains, but a new all-time high in the US.

Our 10c worth

Bright's banter

Last week, Richemont reported a 1% decline in six-month revenue, due to weak watch sales and slumping demand in China. Sales in the Asia-Pacific region, including Hong Kong and Macau, dropped 27%.

On the bright side, sales in Japan jumped 42%, the Americas rose 11% (outpacing LVMH's 1% growth in the region), and Europe was up 4%. Despite these positives, operating profits fell 17% to EUR2.2 billion, leading to a 5% dip in Richemont's share price on the JSE.

Richemont's jewelry division, featuring Cartier and Van Cleef & Arpels, grew 2% and remained the group's core revenue driver. However, its watch segment, including brands like IWC and Jaeger-LeCoultre, declined by 17%, worse than the 8.5% drop analysts had expected.

The fashion and accessories unit reported 2% growth, helped by Alaia and Peter Millar, but overall, it recorded a EUR23 million operating loss due to uneven brand performances and strategic investments. Chloe's new collections under designer Chemena Kamali received positive press but has not boosted sales significantly yet.

Richemont also reported another EUR1.3 billion loss from its e-commerce unit Yoox Net-a-Porter, which needs recapitalisation ahead of its sale to MyTheresa. The deal will see YNAP provided with EUR555 million in cash and a EUR100 million credit line, while Richemont will take a 33% stake in MyTheresa when the transaction closes, expected in early 2025. What a sorry saga this has been.

The luxury sector as a whole is facing some serious headwinds. However, Richemont seems to be handling it well thanks to their portfolio diversification and strong market positioning. We have 169 JSE-based clients who own Richemont, this one can be accumulated on weakness.

One thing, from Paul

If you predicted a Trump popular vote win, full GOP control of Congress, and a strong market rally after that news, well done. I had no idea what would happen because expert analysts said the election was too close to call, and dependent on the turnout in swing states. I also had no clue how the stock market would react.

Humans are prone to hindsight bias. That's also known as the "knew-it-all-along phenomenon" - the tendency for people to perceive past events as having been more predictable than they were, and to remember that they made the right prediction beforehand, even if they didn't really.

In other words, our brains are wired to convince ourselves that an unknowable ending was obvious once we learn the outcome.

Michael Batnick (pictured) said it well: "whether it's a football game or a stock's reaction to earnings or whatever, you do not know the outcome, because the future is clear only when it's in the past."

Byron's beats

I am finding AI assistants more and more useful in my daily life. Last week I had to make a letterhead and a logo and AI did it for me in 10 seconds and the logo was great.

These days, I am using AI to help calculate how many shares to buy for clients instead of Excel. I simply paste in an email conversation and it does the calculations for me using live prices from Google Finance.

I mostly use Copilot from Microsoft although I have used Gemini from Google and WhatsApp's Meta AI on my phone. Let me know if you have found some creative uses for these assistants in your personal or work lives?

Michael's musings

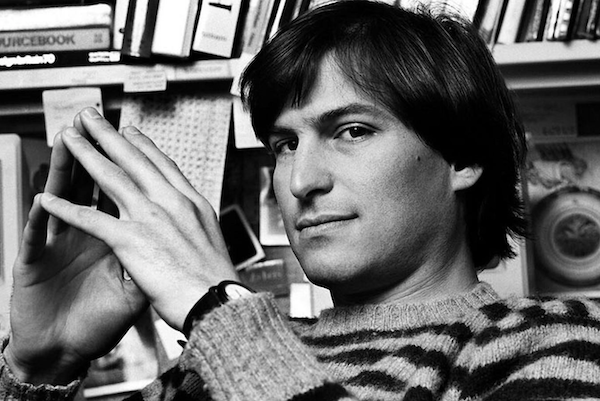

The Instagram algorithm figured out that I like watching Steve Jobs interviews, so for the past week many have come my way. Here are two where he talks about company leadership - product people and professional managers.

Jobs isn't very fond of professional managers, he even calls them bozos. He says they can manage but don't know how to create, which makes them useless. If you hire quality people, they don't need to be managed, they just need a central vision to work towards. That vision needs to be set by a CEO who actually understands the market and the product. This sounds relevant to Boeing, and its move away from engineering.

Jobs also says companies need to avoid pushing out product people in favour of promoting sales people. When companies do that, they lose sight of what works for customers and what does not. When Microsoft was run by Steve Ballmer they focused on sales at the expense of creating new products.

There are many companies that lost their way after 'management by spreadsheet' policies came to the fore, and costs were cut so much that they lost their competitive advantage. There is a reason that Apple is still relevant nearly 50 years after its founding.

Linkfest, lap it up

The Notre Dame cathedral in central Paris will reopen in less than a month. It burned down in 2019 - Iconic church has 3 new bells.

Apple has very loyal customers. Their designs are simple and scalable - They make unpopular decisions to stay true to the brand.

Signing off

Asian markets opened down today, with notable declines in Taiwan and Hong Kong. The Shanghai Composite stayed relatively flat, while Japan's Nikkei posted gains. Investors are looking ahead to Tencent and Alibaba earnings for insights on their cost-cutting and business streamlining efforts.

In local company news, Woolworths reported a 6.5% rise in turnover for the past 18 weeks, boosted by strong food sales (+12.1%) and a standout performance in beauty (+20.3%). Consumer sentiment is improving in South Africa, well done everybody.

US equity futures are unchanged pre-market. The Rand is trading back up at R17.92 to the greenback.

Have a pleasant day.