Market scorecard

US markets reached new all-time highs last night, buoyed by the Federal Reserve's latest interest rate cut. Jay Powell announced a 25 basis point trim to rates, as expected. The S&P 500 neared the 6 000-point mark, setting its 49th record of the year. Bank stocks calmed down, with a key index slipping 2.7% after a strong 10% rally the day before.

In after-hours trading, Expedia shares rose 5.2% on good earnings but Airbnb fell 4.5%, amidst mixed forecasts for the upcoming holiday season. Finally, Match Group shareholders cried about Tinder's earnings miss last quarter, but cheered up as Hinge beat estimates. Shares still dropped 17.9%. Ghosted.

Here's the lowdown, the JSE All-share was up 0.78%, the S&P 500 rose another 0.74%, and the Nasdaq jumped 1.51% higher. We are long and strong.

Our 10c worth

Byron's beats

Last week, our favourite medical devices business, Stryker, reported pleasing third-quarter numbers. Sales came in at $5.5 billion versus estimates of $5.37 billion and earnings were $2.87 per share versus $2.77. That's a solid beat.

This business is easy to track. They divide sales into two main segments, namely MedSurg and Neurotechnology, and Orthopaedics and Spine. Both divisions grew by over 10% this quarter.

The real magic happens under the hood, with exciting medtech innovations. If they cannot design it themselves, they usually acquire small businesses with innovative products.

We first started buying Stryker shares in 2014 after selling out of Caterpillar. Since then it is up 370%. Over the same period, the S&P 500 is up 230%. So this one has done a great job for us and our clients.

We continue to like the theme, in fact, Paul had a partial knee replacement this week. Good health and mobility are vital to enjoying life. Stryker sells happiness and we like it.

One thing, from Paul

Wow, what a week! I feel shook up. That may be due to undergoing knee surgery or watching Trump win by a landslide; I'm not sure.

Here's a photo from last week, before all that happened.

Anyway, it's a reminder to me to stay flexible, be pragmatic and keep moving. Life throws up surprises, and you have to roll with the punches. Don't take things too seriously.

In the face of challenges, keep working hard, and keep smiling.

Michael's musings

Peter Lynch is a famous Wall Street investor. He was the manager of the Magellan Fund at Fidelity Investments between 1977 and 1990, where he averaged a 29.2% annual return. One of the ways he found new ideas was through experiencing company products in everyday life. Warren Buffett deploys this strategy too, for example, he invested in Apple after taking his grandchildren out for ice cream and seeing how they were glued to their iPhones.

This is why we started buying Nvidia shares ten years ago. Paul's youngest son is into gaming, and Nvidia was selling the best gaming chips around. Once the stock was on our radar, we did further research on their chips, and who they were selling them to.

Our high-level thesis was that the world needed to process an increasing amount of data. AI wasn't on our radar back then, but machine learning, data analytics and self-driving cars were three fast-growing industries that were buying Nvidia chips. We noticed that Nvidia's technology was about 18-24 months ahead of their competition. So it became the stock to buy for clients to get exposure to the growing trend of intensive data processing.

Bright's banter

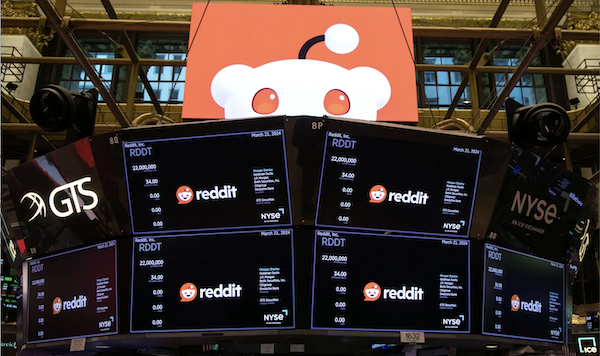

Reddit shares soared over 40% last Wednesday after smashing earnings expectations. It was their biggest one-day rally since going public in March.

For the third quarter, the company reported revenue of $348.4 million, surpassing the expected $312.8 million, and posted its first profit since its IPO. Shares have returned 185% this year, hitting a record high of $131.44.

Reddit's investments in advertising technology are starting to pay off. They do a good job of connecting businesses with their target audiences on the different subreddits.

The company is also expanding into data licensing, signing $203 million worth of deals with AI developers, including Google and OpenAI, which use Reddit's data to train language models. "Reddit" was the sixth-most searched term on Google in the US this year.

Reddit's daily active unique visitors surged 47% year-on-year to 97.2 million. While other social media platforms have come and gone, Reddit continues to thrive, maintaining a significant presence nearly two decades after its launch.

Linkfest, lap it up

Alpe du Grand Serre just disappointed its loyal followers. The French ski resort announced that they're permanently closed just before the season - Climate change sucks.

Australia wants to ban people under 16 from accessing social media. This is arguably government overreach - Technology isn't even available to enforce age limits.

Signing off

Asian markets gained this morning, as key benchmarks rose in Hong Kong, Shanghai, Tokyo, Seoul, and Taipei City. Shares of Nissan Motor took a 6.2% hit, dropping as they announced plans to cut 9 000 jobs and reduce global production by 20%.

In local company news, retailer Truworths International reported a 2.8% rise in sales, reaching R7.2 billion for the first 18 weeks of its financial year, thanks to stronger sales performance in the UK.

US equity futures are unchanged pre-market. The Rand is trading at around R17.37 to the US Dollar.

Have a good weekend. The Springboks play Scotland on Sunday evening, that should be fun to watch.