Market scorecard

US shares posted solid gains yesterday as markets held their breath for the votes to roll in. All US polls are now closed and Trump has a commanding lead. The market has reacted positively with US futures moving higher, a stronger US dollar, lower gold prices and Bitcoin reaching record levels.

In company news, data management company Palantir jumped 23% on better than expected results. They noted higher demand in the US for their security analytics and artificial intelligence software. At the other end of the spectrum, chemicals company Celanese Corp dropped 26% after reporting poor numbers.

In summary, the JSE All-share closed up 0.81%, but the S&P 500 rose by 1.23%, and the Nasdaq ended 1.43% higher. More to come tonight? Probably.

Our 10c worth

Bright's banter

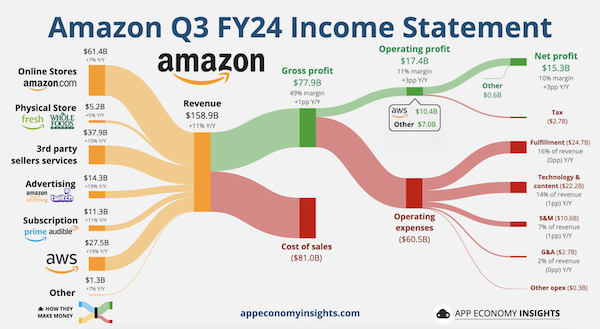

Amazon reported an impressive quarter last week, showcasing the benefits of its well-diversified business model, cost-cutting and AI innovation. Total revenue rose 11% to $159 billion, surpassing estimates, driven by strong growth across Amazon's e-commerce, cloud services, and advertising operations.

Amazon Web Services (AWS) regained momentum with a 19% increase in revenue, reaching $27.5 billion for the quarter. What a great business! Operating income from AWS hit $10.4 billion. The company is still investing heavily in infrastructure to capitalise on this, with a record $75 billion planned in capex spending for 2024, most of which will support cloud and AI services.

Amazon's e-commerce segment continues to show resilience, with a 7% growth in revenue to $61.4 billion. That's a lot of diapers and dogfood sold! The advertising arm had another great quarter with a 19% year-on-year increase to $14.3 billion, highlighting the effectiveness of Amazon's ad platform in reaching its vast customer base. Resellers pay big bucks to be featured prominently in the online store.

Amazon remains competitive across so many retail categories, notwithstanding competition from new players like Temu and Shein. They're launching budget-focused services inspired by these platforms and are expanding fast delivery to more rural areas.

Operating profit soared to $17.4 billion, significantly outpacing the $14.7 billion anticipated by analysts. These results led Amazon's stock to jump 7.3%, marking a 30.1% rise year-to-date. Its trading very close to its all-time high, which is just above 200 bucks a share.

We feel great about owning this one!

One thing, from Paul

As a follow up to my note yesterday about beating the S&P 500 by having a focused portfolio of the right stocks, I found these stats from Ben Carlson (pictured here) very illuminating.

The wider US stock market is comprised of about 2 700 stocks, and this is how they have done this year.

-101 stocks up 100% or more

-13 stocks up 300% or more

-5 stocks up 500% or more

-1 000 stocks are down

-137 are down 50% or worse

-Median stock is +14%

The S&P 500 is up 21.4% year-to-date. The Vestact model portfolio is up 24.0% in the same period.

Byron's beats

The scope of Google's businesses never ceases to amaze me. I read that Google Chrome has 66% of the global browser market. That would be a huge business on its own. The browser fits perfectly into Google's model with their search platform as the default start page and all the Google browser apps like gmail, meet and maps visible in the top righthand corner.

They also have plans to create AI tools which can autonomously take over a web browser and perform tasks like research, booking a trip or online shopping. This is called project Jarvis and is set for a demo as soon as December.

You can read more about it here - Google is reportedly developing a computer-using agent AI system.

Michael's musings

I love reading company results, and hearing from people on the ground about what's happening in different industries. Last week Balwin Properties reported a rather weak set of numbers. If you live in Gauteng or the Cape, you will have seen a number of their developments when driving around. Balwin noted that they are seeing a renewed interest in Gauteng properties, with the region being its top revenue generator again.

Estate agents are saying that they've noticed a slowdown in semigrations from Joburg to the Cape, and dare we say it, some people are even moving back. As a property-owning Joburger, this is great news. A renewed interest in Gauteng properties should drive up prices after years of stagnation.

Linkfest, lap it up

It isn't often that Switzerland is the worst in the world at something. Internet access is very expensive there - The cost of 1 GB of mobile data worldwide.

Helping blind people to see. Here's a milestone for humanity - Science Corporation says its eye implant restored vision.

Signing off

Chinese markets are down this morning on worries that a Trump win means a fresh trade war. Naspers owned Tencent is off 2.7% this morning.

In local company news, Sibanye Stillwater jumped 10% as profits from SA gold production tripled to R1.4 billion thanks to higher gold prices. Unfortunately for the group, PGM prices were down, meaning overall company profits were only up 9% for the period.

Developing market currencies are also weaker this morning particularly the Mexican Peso. The Rand is at $/R17.80. A more closed US would be bad for global trade.

Have a good day.