Market scorecard

US markets started well but ended lower last night, with chipmakers leading the decline. Earnings season is in full swing with quarterly numbers being reported left, right and centre. AMD dropped 10.6% following disappointing results, while Super Micro Computers plunged 33% after Ernst & Young resigned as its auditor.

In company news, Eli Lilly fell 6.3% after trimming its outlook due to slightly softer sales of its weight-loss drug, Zepbound. Meta dipped 3.2% post-market as higher ad revenue wasn't enough to excite investors given its AI-related capex spending forecast. Microsoft also gave up 3.7%, despite beating revenue estimates with growth from its cloud business and Office software.

At the end of the day, the JSE All-share was down 0.62%, the S&P 500 fell 0.33%, and the Nasdaq was 0.56% lower. Never mind, we will survive.

Our 10c worth

One thing, from Paul

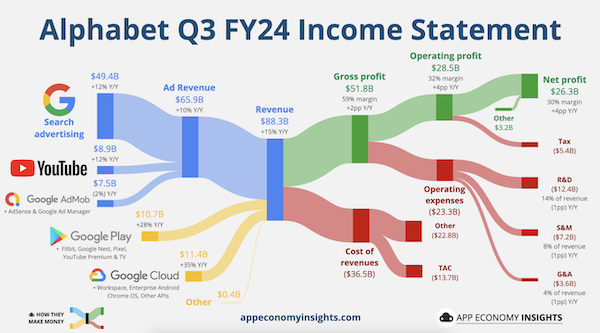

Google had quarterly results out on Tuesday night, and they were excellent. The stock price rose 2.8% on Wednesday, repairing some of the damage done since July by the US Government's annoying antitrust suit.

Revenue and profits beat Wall Street's estimates thanks to strength in the company's core search business and its cloud-computing operation. YouTube, subscriptions and devices also over-delivered. The whole company's operating margin is now 40.3%, the highest since 2019.

Google is currently fighting several antitrust challenges brought by the US Justice Department. The cases are nonsense and the officials pushing them are leftist zealots, in my opinion. The Feds are expected to file papers by 20 November that could seek a breakup of the company. Google's lawyers will fight these tooth and nail, and the process will drag on for years. The Feds might also lose interest, depending on who leads the next administration.

Google is displaying admirable restraint on costs, slowing hiring and office space development, while still investing heavily in datacentres for AI tools. Capital spending in the year ahead will be $51 billion.

CEO Sundar Pichai noted that over 25% of Google's code is now written by AI. That's quite something, given the scale of their operations.

Relative to its earnings, Google is cheaper than the other tech megacaps that we own in our portfolios. We recommend that you own a chunky amount of Google shares in your Vestact portfolio.

Byron's beats

I was quite surprised to see in the latest EssilorLuxottica results that the Ray-Ban Meta glasses were their best-selling Ray-Bans around the world. In the EMEA region, which includes Europe, the Middle East and Africa, 60% of all sales from Ray-Ban stores were the Ray-Ban Meta glasses.

These glasses start at $300, whereas the average pair of Ray-Bans cost around $200. To get all those extra smart features for an extra $100 explains why the sales have been so good.

I did some digging on YouTube to see how well they have been received by consumers. This review did a really good job explaining all the pros and cons. I was pleasantly surprised by how advanced they already are, taking into account that they look like a normal pair of glasses. The charging case feature is also very neat (see picture).

Well done Meta, I get the sense that this product is only going to go from strength to strength.

Michael's musings

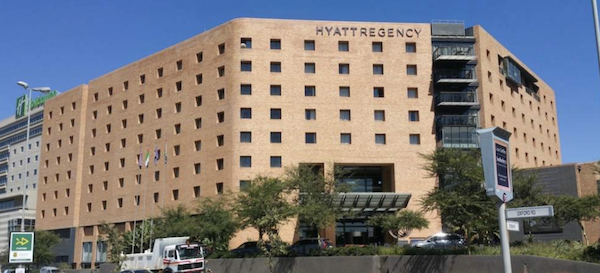

The late Charlie Munger used to say that people should pay more attention to the big decisions in life and spend less energy on the small ones. Choosing a career, your spouse or a business partner are all life-defining moments. I was reminded of this recently when reading about the fight over the mothballed Hyatt Hotel in Rosebank.

The Vestact office is in Rosebank, so I regularly drive past the barbed-wire fencing outside the hotel. I look over the hotel while cycling in the Rosebank Virgin Active gym, which is across the road.

The hotel is part of a sectional title complex, including offices, shops and restaurants. When it closed in 2020 due to Covid, the building owner simply stopped paying rates, taxes and levies to the complex body corporate. It means that the rest of the building needs to cover those costs while taking legal action against the hotel building owner. Just very messy and expensive.

Burstone Group (formerly Investec Properties) used to own the whole complex, but then sold the hotel portion to Georgia Avenue Investments, a Middle Eastern hotel owner - who are now not paying their dues. The Hyatt Hotels Corporation of Chicago is not involved in this scrap.

You can read more details in this article - The Hyatt Hotel Rosebank standoff.

Bright's banter

TSMC has made solid progress at its new Arizona plant, with early chip production yields surpassing those in its Taiwanese facilities. This is a strong start for its US expansion efforts, despite earlier challenges with labour and equipment.

This is good news for key clients like Apple, ARM, and Nvidia, which rely on TSMC for advanced chip production.

The Phoenix plant began limited production in April using 4-nanometer technology and plans to be fully operational by early 2025. The US government's backing, including $6.6 billion in grants and loans, aims to strengthen US domestic chip production.

TSMC's Arizona success aligns with Nvidia's growth ambitions, especially amid high demand for advanced chips. I have no doubt that the construction team that commissioned this plant will be in high demand for their skills as more production of these strategic chips moves back to America.

Linkfest, lap it up

18 lessons from 18 years of The Marginalian. Including 'Do nothing for prestige or status or money or approval alone' - Choose joy.

Antibiotic-resistant infections are on the rise. In 2019, up to 5 million people died from these ailments - Vaccines could help fight antimicrobial resistance.

Signing off

Asian markets are mixed today: Japan, Australia, and South Korea saw declines, dragging the MSCI Asia-Pacific index toward its worst month since August 2023. Meanwhile, Chinese and Hong Kong shares rose as investors welcomed a pickup in Chinese manufacturing activity for the first time since April.

In local company news, Tiger Brands anticipates up to 5% growth in full-year earnings through September as it builds on its earlier turnaround. Additionally, the company has pledged to cover medical expenses for some victims of the 2017 listeriosis outbreak, showing a commitment to addressing past issues, even if it is 7 years later.

US equity futures are lower pre-market. The Rand is trading at around R17.67 to the US Dollar.

Today's earnings line-up includes Apple, Amazon, Mastercard, and Uber. Definitely a busy day for big names in tech and finance.

We will be back tomorrow. Enjoy the day.