Market scorecard

US markets nudged higher yesterday, with a rally in tech stocks lifting the Nasdaq Composite to new all-time highs. As 2024 draws to a close, we will be happy to hang on to these great gains, it's been a very good year.

In late trading, Google rose over 5.8% after its results topped estimates, but Advanced Micro Devices (AMD) dropped 7.6% on a weaker revenue outlook. Visa also reported solid fourth-quarter earnings, beating analyst expectations. Finally, Reddit stole the spotlight, jumping 25% as it posted third-quarter sales above forecasts and predicted a strong holiday season.

In summary, the JSE All-share was down 0.39%, but the S&P 500 rose 0.16%, and the Nasdaq was 0.78% higher. Good times.

Our 10c worth

One thing, from Paul

According to Goldman Sachs, the S&P 500 is not very passive, it actually experiences a lot of turnover. Since 1980, 36% of S&P 500 constituents have changed, on average, over 10-year periods.

In other words, about a third (by number) of the 500 stocks change every 10 years. That's because weak companies decline and get kicked out, and replaced by others that are thriving, and growing their market capitalisation.

I took a look at the Vestact model portfolio, to assess its turnover in the last decade. We don't swap out stocks very often, since we run quite focused accounts. There are currently only 16 holdings in the portfolio, and we've typically made 1 or 2 changes per year, never more.

When we do make adjustments, the value has typically been about 4% of the portfolio. To be clear, a 4% holding is sold and a new 4% holding is added, on average. We have mostly bought quality and held on.

The changes we made in the last decade were to exit Cisco, General Electric, Wells Fargo, Illumina, JP Morgan, PayPal and Starbucks, and use the sales proceeds to buy Amgen, Meta, Tesla, Netflix, Microsoft, Nvidia, CrowdStrike, and Eli Lilly.

Vestact's model portfolio has beaten the S&P 500 by a wide margin in the last decade, thanks to its focus on technology and healthcare sectors. In the last 10 years to December 2023, our compound annual return has been 16.2% (after fees) versus 9.9% for the S&P 500.

Byron's beats

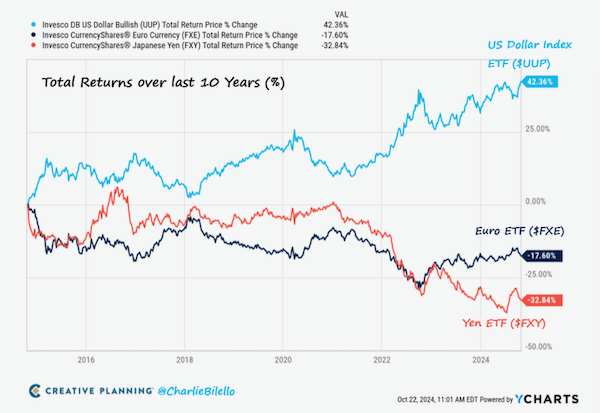

Not only has the US stock market outperformed every other major market over the last decade, but the US Dollar has also crushed its biggest rivals. Take a look at this graph, which compares the USD to the Euro and the Japanese Yen.

Why is this case? Because the US economy has been growing faster than everywhere else. This attracts investment, talent, innovation and more demand for the currency. It also results in more taxes being collected, so there is extra wiggle room for the US government to borrow money at lower rates.

The positive knock-on effects of a consistently strong economy are huge. I really hope we can start seeing that effect here in South Africa.

Michael's musings

We don't own Boeing shares for our clients, but given the company's legacy, it has been interesting to follow its current troubles. The share price is down 40% this year, and 56% over the last five years.

Yesterday, Boeing raised around $21 billion in a share sale, at a 7.7% discount on the current share price. They desperately need cash because workers have been on strike for 6 weeks, and the company expects to burn through $4 billion over the next three months, and $10 billion in the coming year. Having factories at a standstill is expensive.

Between 2013 and 2019, Boeing ploughed $43 billion into share buybacks. They did some buying at very cheap levels, but the bulk of the repurchases were at prices much higher than now. It hurts to reissue these shares at the current depressed levels.

It's been widely noted that Boeing shifted from aero engineering to financial engineering, hollowing out the company's culture and expertise. Boeing now has an engineer back at the helm, hopefully this is a positive step towards regaining its former glory.

Bright's banter

L'Oreal's sales for the last quarter came in lower than expected, mainly due to slowing demand in China, where consumer confidence is still shaky. Overall, sales were up 3.4% to EUR10.3 billion, slightly below expectations.

North Asia, including China, saw sales drop by 6.5%, marking the fifth quarter in a row of declines. Analysts had been expecting growth, so this miss stood out. Despite the Chinese government introducing stimulus measures, spending on beauty products like makeup and skincare has remained subdued. Hainan, a popular duty-free spot, has struggled as well.

L'Oreal shares dropped just over 3% on the news. There are also concerns about the underperformance of the dermatological beauty division, which CEO Nicolas Hieronimus blamed on bad weather affecting suncare sales and fewer product launches.

Hieronimus is hopeful that government action will boost demand, but acknowledged the need to win back younger consumers, especially Gen Z, through innovation. The global beauty market is expected to grow by 4-5% next year and L'Oreal should enjoy a chunk of it.

Linkfest, lap it up

Payment apps are popular. If you store cash on them, be careful - Thieves target in-app balances.

Marijuana use by teens is down. Teen vaping is also at a decade low - More teen girls smoke weed than boys.

Signing off

Most Asian equity markets opened lower today. Japanese stocks bucked the trend, supported by the Yen's recent dip and strength in the tech sector.

In local company news, the Competition Commission has blocked the planned merger that would have given Vodacom a 30% stake in Maziv, the holding company for Remgro's fibre assets, Vumatel and Dark Fibre Africa, valued at around R13 billion. Elsewhere, there was some muttering on social media when it emerged (of course, this is not new-news) that Naspers' new CEO, Fabricio Bloisi, stands to earn a $100 million payout if he can double Prosus' market value by mid-2028.

US equity futures are in the green pre-market. The Rand is trading at around R17.63 to the US Dollar.

After last night's excitement, today we'll be awaiting earnings reports from Microsoft, Meta, Eli Lilly, Amgen, and Booking.com.

How exciting! This is what we live for.