Market scorecard

US markets edged higher yesterday, at the start of the busiest week for corporate earnings. Energy stocks fell as Israel focused its strikes on Iranian military sites, easing concerns over disruptions to oil production in the Middle East.

In company news, Apple has begun releasing its first Apple Intelligence features and launched a new 24-inch iMac with an AI-centric M4 chip. Meanwhile, Meta is developing a search engine to power responses in its AI chatbot by sourcing information from across the web. Lastly, after hours, Ford shares dropped 6% following a cut in its profit outlook.

Here's how it went down. The JSE All-share was up 0.72%, the S&P 500 rose 0.27%, and the Nasdaq was 0.26% higher. Nice one.

Our 10c worth

One thing, from Paul

Berkshire Hathaway sold nearly half of its Apple stake in the second quarter of 2024, unloading about 389 million shares. That's on top of the sale of about 115 million shares in the first quarter. They still own just over 400 million shares, but may be selling more at the moment.

Berkshire's base price for its Apple purchases up to the end of 2021 was around $31 per share. It's not clear what levels they sold at, but the average price in the first quarter was around $180 per share, and around $190 in the second quarter.

Since then Apple shares have gone higher, and are now close to their all-time highs, around $235 per share. This means Berkshire has forgone gains of about $6 billion on the first-quarter sales and about $20 billion on the second-quarter sales. That's a lot of cash "left on the table".

What makes this move even more mystifying is that Berkshire's cash pile has now swelled to a record $277 billion. What's the point of that? Particularly as interest rates drop. Now they are just sitting on a pile of cash (see picture).

Warren Buffett probably should have heeded his own maxim about his favourite holding period being forever.

Byron's beats

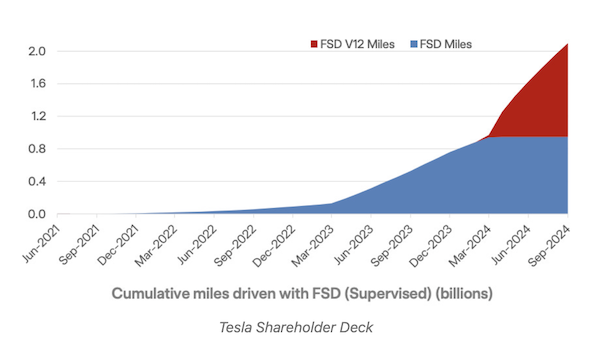

Take a look at the image below from the latest Tesla shareholder deck. It shows the cumulative number of miles driven by Tesla owners using the FSD (full self-driving) software under supervision. The red section is what was driven using the new version 12 software. They crossed 2 billion miles in September.

The success of AI, which will power self-driving vehicles, is dependent on historical data. No one can compete with Tesla when it comes to real-life behavioural data, which is fed to them with every mile driven. That is why I believe they will be the first to perfect self-driving for the mass market and, more importantly, convince the regulators to let people use it at scale. Elon Musk reckons that by the second quarter of next year their software will be safer than humans.

Tesla is going to need a lot of GPUs to process all this data and will be ramping up their H100 clusters from 70 000 to 90 000 by the end of the year. That is also great news for Nvidia.

Michael's musings

Google's self-driving taxi business, Waymo, just raised $5.6 billion in a series-C round. This is the second capital raise that includes outside investors. It previously raised $3.2 billion in 2020, reducing Google's shareholding from 100%.

Google was the lead investor in this round, with some very heavy hitters investing, including Andreessen Horowitz, Silver Lake, Fidelity, Tiger Global, Perry Creek, and T. Rowe Price. We are not entirely sure of Google's current holding in Waymo, but it is probably still north of 80%.

The fresh funds will be used to expand into new US cities, to complement its recent partnership with Uber. Waymo currently operates in San Francisco, Los Angeles, Phoenix, and is expanding to Austin and Atlanta. It gives paid rides to more than 100 000 customers per week, with each ride providing valuable information that the company can use to improve its models.

Public opinion on autonomous vehicles remains cautious, with a Pew survey indicating most Americans would still avoid driverless rides. Yet, Waymo's data claims there are fewer crashes compared to human drivers, though incidents like blocking traffic and wrong-way moves have occurred.

The latest Waymo model, based on the Geely Zeekr, includes custom sensors and a robust AI driver. Waymo has also partnered with Hyundai to bring the Ioniq 5 EV into its fleet.

Waymo may well be the Google side-bet that really ramps up and starts paying dividends.

Linkfest, lap it up

Money can be a touchy topic in any family. Generations have different perspectives on wealth - Ben Carlson shares his thoughts on inheritance.

A small team of scientists is fighting rapid industrialisation. Saving Europe's iconic cat - Can the Lynx be protected in the Balkans?

Signing off

In Asia, shares of Waaree Energies surged nearly 56% in their market debut following a $514 million IPO, reflecting strong demand for India's largest solar panel maker. Subscriptions to participate in the listing exceeded the number of available shares by 70 times.

In local company news, PPC is expecting an 18% profit lift for the half-year ending in September, thanks to a steady rise in demand for products like ready-mix and aggregates. Boxer also reported strong numbers, with a 12% boost in turnover to R19.8 billion and an 11.8% jump in trading profit to R809 million. Their upcoming listing is one to keep an eye on.

US equity futures are flat in early pre-market trade. The Rand is at R17.70 to the US Dollar.

Today we'll see earnings reports from three Vestact-recommended stocks, Google, Visa, and Stryker. Very exciting!

Have a great day.