Market scorecard

US markets closed mixed yesterday, with the Nasdaq up but the S&P 500 experiencing its first back-to-back decline in six weeks. For what it's worth, the current expectation is that the Federal Reserve will slow down its rate-cutting pace. Standout performers amongst the mega caps were Microsoft (+2.1%) and Meta (+1.2%).

In company news, McDonald's shares dropped 5.8% after hours due to an E. Coli outbreak tied to its Quarter Pounders in the western US. Verizon also fell 5% after reporting weaker-than-expected revenue, largely impacted by sluggish mobile phone sales. Finally, L'Oreal struggled with disappointing sales last quarter, with consumer demand in China continuing to decline.

Here's the lowdown, the JSE All-share was off 0.37%, and the S&P 500 slipped by just 0.05%, but the Nasdaq rose by 0.18%.

Our 10c worth

One thing, from Paul

Nike is the worst-performing Vestact stock over the last few years. We are waiting patiently for a turnaround.

We were pleased to see that their new CEO, Elliott Hill, just inked a 12-year deal to extend Nike's partnership with the National Basketball Association and the Women's National Basketball Association. Nike will continue to design and manufacture the on-court uniforms and fan apparel. They have had this role since 1992 (NBA) and 1997 (WNBA).

Basketball-related items are very important for Nike, given that shoes from the Jordan brand and court-inspired styles such as the Air Force 1 and Nike Dunk are a big part of the company's sneaker sales offering.

Shares of Nike went sideways yesterday and are still stuck at around $80. We'd like to see them back above $100 in short order.

Byron's beats

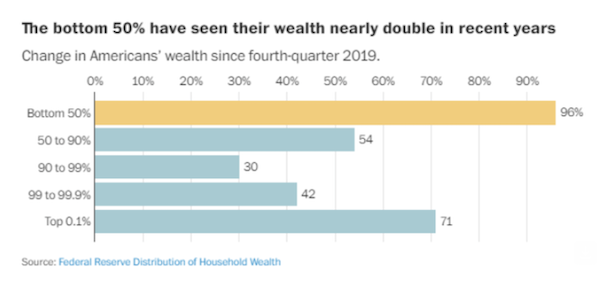

It's widely believed that the rich get richer and middle to low-income groups see very little improvements. Well, that has not been the case in the US over the last 5 years. For reference purposes, US GDP has grown 10.7% over that period. This image shows the growth in wealth for each income group. The bottom 50% have nearly doubled their worth in the last half-decade.

Yes, the super-wealthy have racked up more dollars in absolute terms, but it does show that in a properly functioning capitalist society that is able to consistently grow their economy, like the US, a rising tide does lift all the boats. In my opinion, this is a far better system than a flawed socialist ideology that erodes wealth for everyone.

Michael's musings

What do you think Harvard spends annually? In its previous financial year, the university had revenue of $6.5 billion, over $1 billion of which is gifts, and expenses of $6.4 billion, where 52% is spent on 'people', which includes salaries, wages and benefits. They also raised $1.6 billion in a bond issuance exercise.

These numbers are simply mind-blowing. For reference purposes, the City of Joburg has a budget of R65 billion a year, roughly half of what Harvard spends.

According to Wikipedia, Harvard caters to around 23 000 students, on roughly 1 square kilometre of land, across the different campuses. Am I missing something? How can a university have double the budget of a city?

A big chunk of Harvard's annual income comes from its monster endowment fund, which has grown to $53 billion. I was shocked to read that 32% and 39% of that fund sits in hedge funds and private equity. It seems like overcomplicating things because, being Harvard, it would be too simple to just buy stocks.

You can read more about their finances here - Harvard's finances in a challenging year.

Bright's banter

Hyundai Motor India shares slipped 7% in their debut on the Mumbai stock exchange. Although the IPO was India's largest ever and oversubscribed twice, retail investors showed less enthusiasm, buying only half of their allocation.

Hyundai Motor India was valued at $19 billion, which some considered expensive compared to its Korean parent. However, analysts like Nomura are optimistic, citing strong long-term growth potential in India's car market.

The IPO market in India has raised over $12 billion this year, and there are still upcoming listings from Swiggy and NTPC's renewable energy unit.

Linkfest, lap it up

Ferrari released its first supercar in 11 years. The F80 costs $4 million, and all 799 planned for production are sold out - Ferrari deploys the best F1 tech in a road car.

Running is a serious sport. You, your shoes and the road - Super-expensive shoes have changed marathon times forever.

Signing off

Asian markets are mostly in the green this morning with the MSCI Asia-Pacific index rallying. A leading government-affiliated think tank has urged Chinese authorities to issue 2 trillion yuan ($281 billion) in special government bonds for a market stabilisation fund. These interventionist measures probably won't work, but they'll give them a try anyway.

In local company news, WeBuyCars shared that its headline earnings are expected to drop by up to 60%, mainly due to some one-off costs, though core earnings are set to rise by as much as 26%. Elsewhere, Sasfin is delisting from the JSE after reporting a R58.7 million loss. They've been hit by higher credit losses and a dip in non-interest income, on top of hefty provisions for administrative penalties.

US equity futures are slightly higher pre-market. The Rand is trading at around R17.55 to the US Dollar.

It's a spectacular morning in Johannesburg. The streets around our office are ablaze with purple Jacaranda blooms. If you are in the area, take a walk this afternoon.