Market scorecard

US markets had a mixed session yesterday, with the S&P 500 pausing after its longest weekly rally of the year. Nvidia surged 4.1% to hit a record high, lifting the Nasdaq. Interestingly, the S&P 500 hasn't seen back-to-back losses in nearly 30 sessions. While a month without consecutive down days might not seem significant, this current streak ranks among the best since 1928, according to SentimenTrader.

In company news, Kenvue jumped 5.5% after activist investor Starboard Value took a stake in the company, aiming to drive changes that could lift its stock price. Meanwhile, Microsoft is rolling out new AI tools aimed at helping business workers handle tasks like sending emails and managing records more efficiently.

At the close, the JSE All-share was down 0.14%, the S&P 500 fell 0.18%, and the Nasdaq was 0.27% higher. Our portfolios went up.

Our 10c worth

One thing, from Paul

Investing in equities requires that you take a long-term view. Share prices rise over time because companies grow, make more sales, report higher profits, gain market share and develop a good reputation. That takes years.

Once we decide to buy a company's stock, we monitor their progress even more closely. They will probably go from strength to strength, but if they don't, we'll have to decide what to do about it. We are patient, but not to the point of switching off our brains and becoming mindless disciples.

I read about a "trick" you can use to stay invested in tough times. Imagine you are the Chief Investment Officer for your kids, who probably lack the ability to invest on their own. Expanding your investment time horizon to 20 years can make staying the course much easier.

Byron's beats

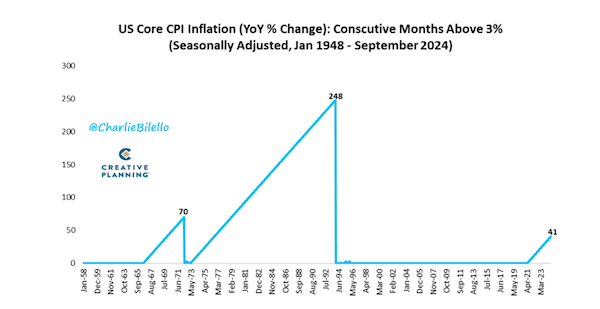

The inflation-induced market crash of 2022 was pretty rough. It might feel like a distant memory now, but it was quite a lengthy period of panic which required a cool head to navigate.

Take a look at the graph below. It shows the periods where inflation was consistently above 3%, since 1948 in the US. There have, in fact, only been three prolonged spells of heightened inflation over the last 65 years. At 41 months, 2022-2024 was the second longest.

If you buckled in and held your stocks through that tough period, well done, you deserve a pat on the back and all the upside that followed.

Michael's musings

It's highly likely that most cars on the road in the future will be self-driving. They are safer and allow people to do productive things while moving around. If that is the case, I also see a day when most people don't own a car but hail a self-driving taxi like Uber, Waymo, or a Tesla CyberCab.

Cars are terrible for wealth creation. They are an 'asset' that loses value regardless of whether you use it or not. If your car sat in a garage for a year, doing nothing, it would probably still lose 10% of its value. Not to mention the monthly insurance costs, and the need to maintain it. Most cars sit idle for 95% of the time. Imagine not needing to own one at all.

A large cost of providing a taxi service is the human driver. If you can replace that person, driving becomes significantly cheaper. A key takeaway from Tesla's CyberCab launch was that the company expects to offer robotaxi rides for as little as $0.30 to $0.40 per mile at scale. For comparison, the average cost per ride-hailing mile in Western markets is about $2.40, and a personally-owned vehicle comes in at around $0.70 cents per mile.

At those prices, self-driving cars will become ubiquitous - good news for the likes of Uber, Google's Waymo and Tesla.

Bright's banter

JAB Holdings has agreed to buy Mondelez's EUR2.16 billion stake in JDE Peet's, boosting its holding in the coffee maker to 68%. JAB, the holding company for the Reimann family fortune, is paying EUR25.10 per share - a 32% premium over Friday's closing price. JDE Peet's shares jumped 16% on the news.

JDE Peet's is a massive coffee and tea company, formed in 2019 through the merger of Jacobs Douwe Egberts (JDE) and Peet's Coffee. It owns brands like Douwe Egberts, Peet's Coffee, and Jacobs.

This marks a turnaround for JAB, which has struggled to lift JDE Peet's stock since its IPO back in 2020. Shares hit a record low as demand for home-brewed coffee waned post-pandemic and management issues lingered after CEO Fabien Simon's exit in April. Rafael Oliveira, the new CEO from Kraft Heinz, is expected to bring stability and renewed investor confidence.

Linkfest, lap it up

We can learn a lot from other people. They've already walked the journey - The simple secrets of modest millionaires.

Not all degrees are created equal. Study something hard - Which tertiary qualifications have the best return on investment?

Signing off

Asian markets are mixed this morning, which is normal.

In local company news, BHP Group is being sued in London over the 2015 collapse of the Mariana dam in Brazil, one of the country's worst environmental disasters. The dam, run by BHP and Vale's joint venture Samarco, caused significant ecological damage. Now, claimants are pursuing up to GBP36 billion in damages from BHP.

US equity futures are lower in pre-market trade and the Rand is at R17.60 to the US Dollar.

Over and out.