Market scorecard

US markets were mostly flat yesterday, losing steam towards the close after the S&P 500 briefly reached new all-time highs in the morning. Semiconductor stocks gained thanks to a positive earnings announcement from chip manufacturer TSMC.

In company news, Netflix shares are up 5% in pre-market trading after the company exceeded Wall Street's expectations, adding over 5 million new subscribers in the third quarter and outperforming most of their financial targets. Elsewhere, Expedia rose 4.8% after a report by the Financial Times that Uber had explored an acquisition of the travel site. Uber CEO Dara Khosrowshahi used to run Expedia so he knows what's under the hood. Uber shares sank 2.5%. For reference purposes, Expedia is worth about $20 billion and Uber is worth $170 billion.

In summary, the JSE All-share was up 0.22%, the S&P 500 dropped a tiny 0.02%, and the Nasdaq was just 0.04% higher. Yeah, sideways.

Our 10c worth

One thing, from Paul

On Fridays I pass on useful pieces of advice that I find on the internet. I can't remember when I started doing this, but people seem to like it, so I'll keep going.

Phil Pearlman has a blog called Prime Cuts, and he writes about lifestyle changes that you may want to consider. I met him in New York for a meal, many years ago.

In September he noted that many people have a 'busy addiction'. He thinks it's as bad as smartphones or alcohol. It's especially rife among financially successful people, "it's like they can't stop even though they already have a lot of dollars".

He says the cure is 'priority flipping'. Here's the quote:

"You take the things you are wedging in at the bottom of your priority stack if you have time and you flip them to the top of your priority stack. The first things you schedule are the morning walks, the midday workouts, and the full evenings cooking dinner with your spouse and eating with the kids. These are the first things you schedule before anything else ever."

Byron's beats

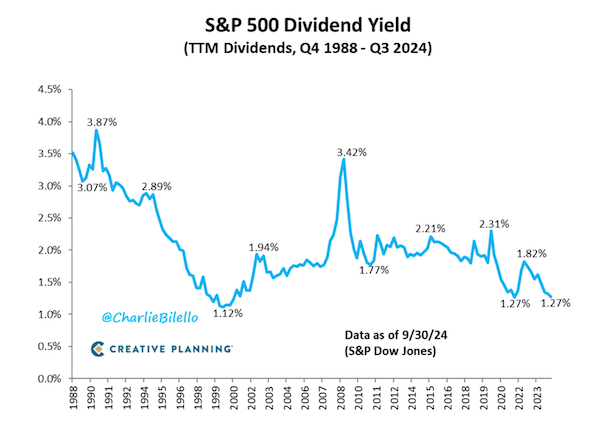

The current dividend yield of the S&P 500 is 1.27%. That's not much, but there are a few factors to consider. These days companies prefer to do a combination of dividends and share buybacks because it is more tax-efficient. Or they pay no dividends at all. Berkshire Hathaway, for example, doesn't pay a dividend but spends billions on buybacks. They could be a huge dividend payer if they wanted to, but Buffett believes the money has a better chance of growing under his watch. He is probably right.

The valuation of stocks is another influential factor. When stock prices go up, their yields come down. The market is currently at all-time highs, which naturally puts downward pressure on dividend yields.

Take a look at this graph showing dividend yields from 1988 to the present. You will see that they have been lower than the current meagre level in the past, especially during the dot-com rally in 1999.

The forward dividend yield of the average Vestact account is 0.57%. Many of our favourite companies pay very small amounts of their excess cash as dividends or none at all. We are fine with that, we prefer capital growth.

Michael's musings

There is a running joke in the office that our biggest competition at the moment isn't Allan Gray or Coronation, but rather Western Cape property. Before the South African elections, clients were getting as much money as possible out of the country. With zero economic growth and heightened political risk, it was a no-brainer to send your savings out of South Africa.

Since the election, we have had many requests to send money back, especially from clients who have made a small fortune from Nvidia's heroics. It feels like every second week a different client requests money for a new property, mostly in the Western Cape but also in Joburg and KwaZulu Natal.

It isn't an official data point, but I'm sure you can take the actions of Vestact clients as a leading economic indicator. Pouring many millions of Rands into a fixed asset like property strongly indicates how sentiment has shifted locally. Positive sentiment is the first step to renewed economic growth.

Bright's banter

LVMH, the world's largest luxury group, reported weaker-than-expected third-quarter revenues, signalling a continued slowdown in the global demand for high-end goods. The French conglomerate struggled across key markets, with a particular deterioration in China.

China, once a key growth engine for luxury brands like LVMH, is now becoming a challenge as the country faces a sluggish property market and economic uncertainty. These issues have dampened consumer confidence, with less affluent Chinese shoppers cutting back on luxury purchases.

LVMH reported a 3% drop in organic revenue to EUR 19 billion for the third quarter, with its key fashion and leather goods division - home to brands like Louis Vuitton and Dior - experiencing a 5% organic decline to EUR 9 billion. Notably, this division has remained strong and resilient since the pandemic, showing no signs of weakness until now.

The company's wines and spirits division saw the sharpest decline, down 7%, as the sector adjusts to post-pandemic consumption patterns and faces trade friction between China and the European Union.

Sales in the broader Asian market, excluding Japan, dropped 16%, underscoring the challenges in China. In contrast, LVMH's organic revenue was flat in the US, while Europe posted a modest 2% rise. Japan, a bright spot in previous quarters due to a weaker Yen and strong tourist spending, had organic revenue growth easing to 20% from 57% in the prior quarter.

Some investors are hopeful that China's economic stimulus might spark a rebound in demand, but it feels a bit early to bank on that just yet. The real issue is whether the worst is over, or if there's more pain ahead. Either way, don't rush to sell your LVMH shares - this dip could be an opportunity to pick up some more.

Linkfest, lap it up

It is that time of year when Jacaranda trees are in bloom. From our Rosebank office we can see rows of purple across the city - The history of Jacaranda trees in Pretoria.

NASA is sending a spacecraft to one of Jupiter's moons. It will use Earth and Mars' gravity fields to slingshot to Europa in 2030 - NASA's Europa Clipper sails toward ocean moon of Jupiter.

Signing off

Asian stocks climbed this morning with the MSCI Asia-Pacific index heading for its first daily rise in a week. Benchmarks in mainland China and Hong Kong continued their upward momentum after the People's Bank of China announced a re-lending mechanism to support share buybacks. Additionally, China's GDP, industrial production, and retail sales figures all came in above expectations.

In local company news, The Public Investment Corporation (PIC) announced that current CEO Abel Sithole will retire in July 2025. The asset manager with R3 trillion in assets under management will start its search for his successor, so dust off your CV. Elsewhere, PSG Financial Services reported strong half-year results, highlighting a 28% rise in recurring headline earnings. The company says they're benefiting from a good political outcome.

US equity futures are edging higher in early pre-market trade. The Rand is at R17.64 to the greenback.

The Proteas women are in the T20 World Cup Final on Sunday. They will be playing either West Indies or New Zealand. Good luck ladies, we are proud of you!

Have a happy Friday and a good weekend.